Federal Budget 2021: what individuals need to know

The 2021 Federal Budget was announced on 11 May 2021 and Pekada will provide you with the resources to determine the potential impact to you, the opportunities and how to manage them effectively.

After the economic turmoil of 2020, the 2021-22 Federal Budget focused on measures to promote economic growth and recovery with big spending and very few surprises.

The biggest winners aged care, women, health, and childcare. Perhaps laying the foundations for an Election announcement?

There were also some wins for superannuation, although the rate of superannuation guarantee or changes to minimum pension requirements didn’t see any proposed changes. As a result, superannuation guarantee will increase to 10%, and minimum pension drawdown requirements will revert to their standard levels from 1 July 2021.

On a positive note it was good to see the data confirming the economy is recovering rapidly, but the Treasurer did temper the excitement on this, noting that we cannot take the gains we have made for granted. Probably a fair point, as a fair chunk of the heavy lifting has come as a result of tax receipts off the back of an iron ore spot price that is 4 times higher than forecast. The deficit is still significant, however it is hard to argue that something of this magnitude isn’t required.

NOTE: It’s important to remember that the Budget announcements are still only proposals at this stage. Each of the proposals must be passed by Parliament before they’re legislated – and could change.

Superannuation

Repealing the work test for non-concessional contributions and salary sacrifice contributions for people aged 67 to 74

Expected to be 1 July 2022

The Government has announced it will allow individuals aged 67 to 74 to make or receive non-concessional (including under the bring-forward rule) or salary sacrifice superannuation contributions without meeting the work test, subject to existing contribution caps.

However, individuals aged 67 to 74 years wanting to make personal deductible contributions will still have to meet the existing work test. This measure is proposed to have effect from the start of the first financial year after the enabling legislation receives Royal Assent. The Government stated it expects this to occur prior to 1 July 2022.

Reducing the eligibility age for downsizer contributions to 60

Expected to be 1 July 2022

The Government has announced it intends to reduce the eligibility age to make a downsizer contribution from 65 to 60 years of age.

The downsizer contribution rules allow people to make a one-off after-tax contribution to super of up to $300,000 from the proceeds of selling their home they have held for at least 10 years. Under the rules, both members of a couple can make downsizer contributions for the same home and the contributions do not count towards a member’s non-concessional contribution cap.

This measure is proposed to have effect from the start of the first financial year after the enabling legislation receives Royal Assent. The Government has stated that it expects this to occur prior to 1 July 2022.

First Home Super Saver Scheme – increasing the maximum releasable amount to $50,000

Expected to be 1 July 2022

The Government has announced it will increase the maximum releasable amount for the First Home Super Saver Scheme (FHSSS) from $30,000 to $50,000.

Under the existing FHSSS rules, an eligible person can only apply to have up to $30,000 of their eligible (voluntary) contributions, plus a deemed earnings amount, released from super to purchase their first home.

This measure is proposed to have effect from the start of the first financial year after the enabling legislation receives Royal Assent. The Government has stated that it expects this to occur prior to 1

July 2022.

Removing the $450 per month minimum superannuation guarantee threshold

Expected to be 1 July 2022

The Government has announced it intends to remove the $450 per month minimum superannuation guarantee (SG) income threshold.

Under the current rules, an employer is not required to pay superannuation guarantee contributions for an employee who earns less than $450 per month.

This measure is proposed to have effect from the start of the first financial year after the enabling legislation receives Royal Assent. The Government has stated that it expects this to occur prior to 1 July 2022.

Complying pension and annuity conversions

Effective first financial year following Royal Assent The Government has announced people with certain complying income stream products will be given a two-year window to commute and transfer the capital supporting their income stream (including any reserves) back into a superannuation account in the accumulation phase. The member can then decide whether to commence a new account based pension, take a lump sum benefit or retain the balance in the accumulation account.

The income streams affected by this measure include:

- market-linked income streams (otherwise known as Term Allocated Pensions),

- complying life expectancy income streams and

- complying lifetime income streams,

that were first commenced prior to 20 September 2007 from any provider, including self-managed superannuation funds (SMSFs).

Under the measure, any commuted reserves will not be counted towards an individual’s concessional contributions cap but they will be taxed as an assessable contribution of the fund. When commuted, any social security treatment the product carries such as 100% or 50% asset test exemption and/or grandfathering for income test purposes will cease.

However, the Government has confirmed there will be no re-assessment of the social security treatment the product received prior to the commutation. Therefore, the member would not be required to pay back any overpaid entitlements.

The Government has also confirmed the existing transfer balance cap rules will continue to apply. Therefore, on commutation the member will receive a debit in their transfer balance account based on the debit value method that applies.

Income streams not included in this measure include flexi-pensions offered by any provider and lifetime products offered by a large APRA-regulated defined benefit scheme (eg some older corporate funds) or public sector defined benefit scheme (eg CSS, PSS).

Relaxing residency requirements for SMSFs and Small APRA Funds (SAFs)

Expected date 1 July 2022

The Government plans to relax the residency requirements for SMSFs by extending the central management and control test from 2 to 5 years and removing the active member test.

Under current rules, SMSF trustees living overseas who intend to return to Australia at some point can be away for a period of up to two years and the fund will still meet the central management and control test. Under the proposal, the trustee will be able to be away for up to five years and still meet the test.

Further, the active member test will be abolished. Under this test, if the fund had members that were ‘active’ by making contributions or rollovers into the fund, the residency status of the fund could be jeopardised. This means that members who are overseas for a period of time often cannot make contributions to their SMSF or SAF. In contrast, a non-resident can contribute to large APRA and industry funds without putting the fund’s residency status at risk.

Abolishing the active member test simplifies the rules and ensures that members and trustees who are temporarily overseas can continue to make contributions to their SMSF or SAF without jeopardising the fund’s complying status.

If you would like to discuss how this may impact your retirement planning, then please book a chat.

Taxation

Retaining LMITO in the 2021-22 income year

Effective 1 July 2020

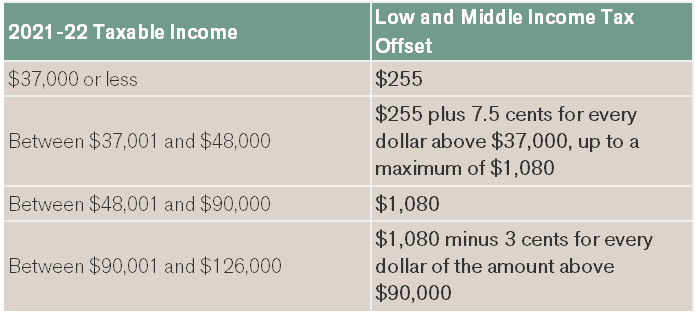

The Government will retain the low and middle income tax offset (LMITO) for the 2021-22 income year, providing further targeted tax relief for low- and middle-income earners. The LMITO provides a reduction in tax of up to $1,080. The table below shows the amount of offset an individual client is entitled to depending on their taxable income:

This announcement means that an individual’s effective tax-free income threshold for 2021-22 financial year remains the same compared with the current financial year. An individual who is not eligible for seniors and pensioners tax offset can effectively have taxable income of up to $23,226 without having to pay income tax.

Modernising the individual tax residency rules

Effective 1 July following Royal Assent

The Government will replace the individual tax residency rules with a new, modernised framework. The primary test will be a simple ‘bright line’ test — a person who is physically present in Australia for 183 days or more in any income year will be an Australian tax resident. Individuals who do not meet the primary test will be subject to secondary tests that depend on a combination of physical presence and measurable, objective criteria. The measure will have effect from the first income year after the date of Royal Assent of the enabling legislation.

Simplifying self-education tax deductions

Effective from the income year after Royal Assent Currently, tax deductions for Category-A self-education expenses must generally be reduced by $250.

The Government has proposed removing this $250 reduction amount to effectively allow individuals to claim a tax deduction for all Category-A self-education expenses.

Category-A expenses include tuition fees, textbooks, stationary, student union fees, student services and amenities fees, public transport fares, car expenses worked out using the ‘logbook’ method (other than the decline in value of a car), running expenses for a room set aside specifically for study.

Social Security

Increasing the flexibility of the Pension Loans Scheme

Effective 1 July 2022

The Pension Loans Scheme (PLS), a voluntary, reverse mortgage type loan available through Services Australia, currently allows a fortnightly loan of up to 150% of the maximum rate of Age Pension. From 1 July 2022, the Government will implement two changes to the scheme – a No Negative Equity Guarantee and lump sum advances.

No Negative Equity Guarantee

A No Negative Equity Guarantee will be introduced so borrowers, or their estate, will not have to repay more than the market value of their property, in the rare circumstance where their accrued PLS debt exceeds their property value.

Lump sum advances

Eligible people will be able to receive one or two lump sum advance payments totalling up to 50% of the maximum Age Pension each year. Based on current Age Pension rates, this is around $12,385 per year for singles and around $18,670 for couples combined. Note, the total amount eligible people are able to receive under the pension loans scheme, including

any lump sum advance payments, has not changed. The total amount cannot exceed 150% of the maximum Age Pension which is around $37,155 per year for singles and around $56,011 per year for couples.

Child Care

Increase in child care subsidy

Effective 1 July 2022

The Government announced it will:

- increase the Child Care Subsidy (CCS) rate by 30 percentage points for the second child and

subsequent children aged five years and under in care, up to a maximum CCS rate of 95% for

these children, commencing on 11 July 2022, and - remove the CCS annual cap of $10,560 per child per year commencing on 1 July 2022.

This will provide greater choice to parents who want to work an extra day or two a week. Removing

the annual cap helps support the choices of parents to work the hours they want to work and, in

particular, reduces barriers that secondary income earners face when seeking to work more.

The current hourly fee caps will continue to apply.

Aged Care

Increased funding for Home Care

Effective 1 July 2021

To support senior Australians to remain at home, the Government is funding an additional 80,000 Home Care packages:

- 40,000 released in 2021-22

- 40,000 released in 2022-23

Additional respite care services will be provided to assist carers and enhanced support services will

be provided to assist senior Australians to navigate the aged care system

Increased funding for residential aged care

Effective over 3 phases: 2021, 2022-23, 2024-25

To improve and simplify residential aged care services, the Government is implementing a range of measures To improve residential aged care quality and safety, including a new star rating system to provide senior Australians, their families and carers with information to make comparisons on quality and safety performance of aged care providers.

Reforms to residential aged care services and sustainability, including a new Government-funded Basic Daily Fee supplement of $10 per resident per day, funding to implement the new funding model, the Australian National Aged Care Classification (AN-ACC), and implementation of a new Refundable Accommodation Deposit (RAD) Support Loan Program; and

a range of measures to grow and upskill the aged care workforce.

We are here to help

For our ongoing service package clients, your financial adviser will be in touch with any specific actions or impacts to your situation.

If after reading this you want to chat, get some clarification in regards to any of the above measures outlined in the 2021-22 Federal Budget, please contact us so that we can discuss your particular requirements in more detail.

Pete is the Co-Founder, Principal Adviser and oversees the investment committee for Pekada. He has over 18 years of experience as a financial planner. Based in Melbourne, Pete is on a mission to help everyday Australians achieve financial independence and the lifestyle they dream of. Pete has been featured in Australian Financial Review, Money Magazine, Super Guide, Domain, American Express and Nest Egg. His qualifications include a Masters of Commerce (Financial Planning), SMSF Association SMSF Specialist Advisor™ (SSA) and Certified Investment Management Analyst® (CIMA®).