Why it pays to stay invested

Investing isn’t always smooth sailing. For some, investing can make them nervous, and you can say that volatility is the price of admission when it comes to investing. However, over time, those that have stayed calm and remained invested during volatile times have been rewarded with growth and compounding returns. Conversely, those that got nervous and potentially sold after the market had dropped were often left missing some of the best days of returns.

Why is it hard to time the market?

If you have a crystal ball, timing the market is easy. However, timing the market can be dangerous for the average investor without the crystal ball. The pain of an investment going down can be real, but in these times, it’s essential not to make any irrational decisions. Charlie Munger, the vice-chairman of Berkshire Hathaway, points out that selling for market-timing purposes gives investors two ways to be wrong: the decline may or may not occur, and if it does, you’ll have to figure out when the time is right to go back in.

That second point he raises can often be the most challenging part. As an adviser, I have had clients come to me who have sold out when market events have happened and converted to cash. The Global Financial Crisis is an excellent example of this. When the market dropped a considerable amount, investors may have gotten nervous, and some may have sold out. For those that sold out, if they were fortunate, they may have saved a further drop of 5%, for example, but when the market started to rebound, were they able to put the money back into their growth assets at the exact right time? Often, the answer is no. I have seen firsthand some cases where people remained in cash long after the market had returned to its previous highs, therefore meaning they missed making not only their money back but all the future gains as well.

We as humans often act irrationally when it comes to investing, which is another reason timing the market can be so hard. For example, if you sell out at a certain point and the market rises, you may experience price anchoring. This means that you feel, despite potentially no objective evidence, that it will drop back to the level it was before, and that is when you will buy back in, but what if the market never gets back to that level? Often investors would have stayed in cash and missed out on several high days, months or even years of returns.

Why is this so important?

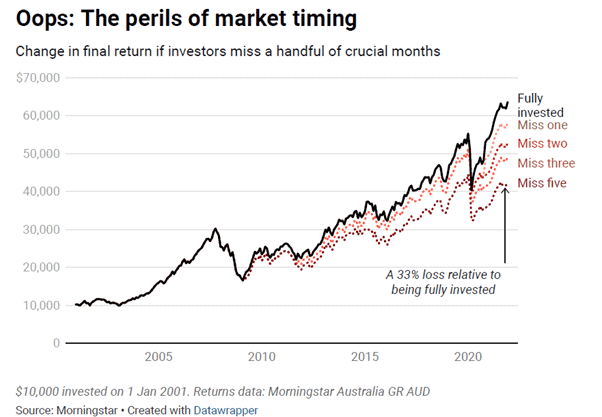

With the market experiencing a slight drop in January, Morningstar researched the perils of market timing. Their research showed that if you missed the best five months since 2001, you would be 33% worse off than someone who had remained fully invested throughout. Only five months contributed to 33% of the total gains for the portfolio since 2001.

Their research found that US stocks outperformed cash between 1926 and 2018, thanks to just 51 months of performance. If you missed those 51 months or even some of those months, then your overall return can be significantly affected to the point where it may have been better not to invest at all.

A more recent example is March 2020. Covid hits, and your portfolio drops 20%. You get nervous, and you sell, thinking that things will get worse. Then, with markets rising again, you look to reinvest the funds by May. Have you made the right decision? No. You would have missed the stock market’s best month in two decades. Morningstar showed that someone who invested $10,000 in January 2001 would have $63,500 last December. Missing just April 2020 cuts $6,000 off that final balance, which is a significant amount.

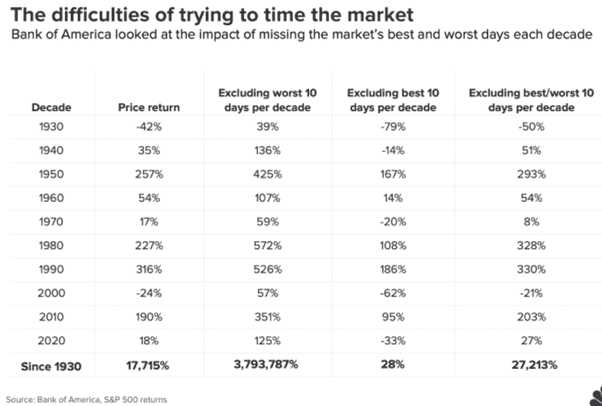

Overseas Bank of America looked at the S&P 500 returns since 1930 and the impact of missing the best and worst days since that time. The data showed that if an investor missed the ten best days each decade, the total return would be 28%. However, had they stayed the course and remained invested throughout that time, the return would have been 17,715%. Sure, if you managed to miss the worst days, then your return is a lot higher, but I would argue this would be nearly impossible to do for the average investor.

This shows the importance of remaining calm and invested. Usually, when we invest, we invest for a purpose. We have a goal in the future that investing is helping us work towards. We should always come back to this, the why. Sometimes good investing can be boring. However, staying the course and remaining invested will often result in good returns over a long period. These returns can be the difference between retiring early for many people, and therefore it becomes vital to not blow this away by making an irrational decision.

As always, if you have any questions regarding investments and strategies, feel free to email me at zac@pekada.com.au

Zac is a qualified financial planner at Pekada and host of the Wealth Collective Podcast. Living in Melbourne, Zac has six years of experience in advice and specialises in wealth accumulation and protection strategies. He loves to keep his finger on the pulse for the best strategies for wealth accumulators looking to build and protect their wealth tax effectively. Zac has been featured as an expert in Money Magazine.