February 2024 Economic & Market Review – Global Markets Surge, Interest Rate Shifts, and ASX Reporting Season Insights

Talking points

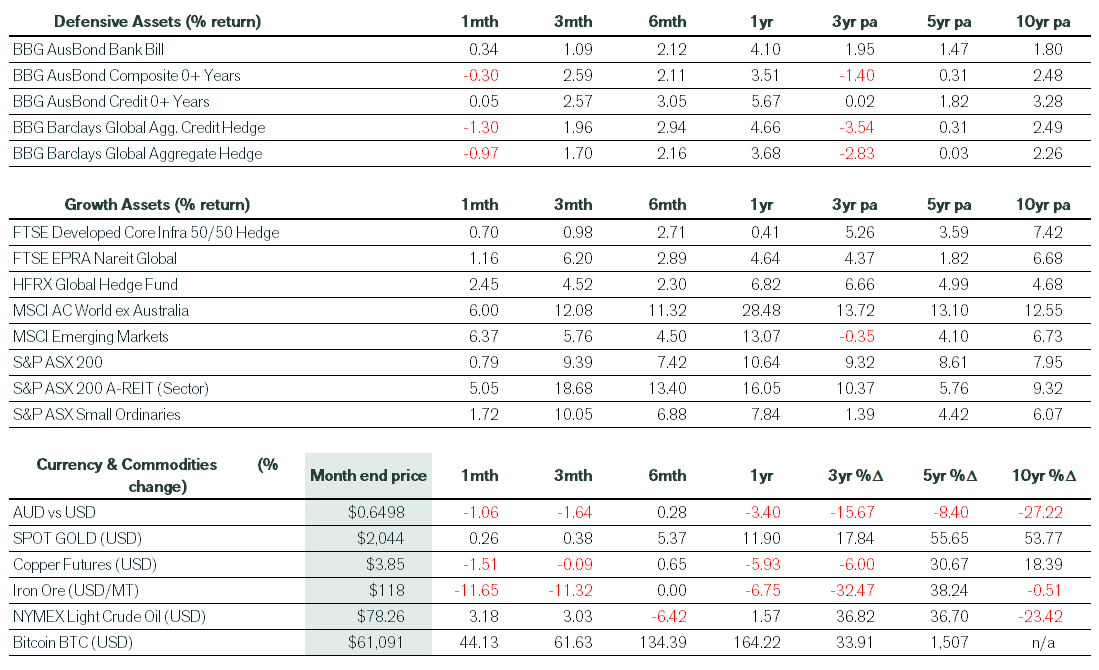

- Strong Global Market Performance: In February, global markets experienced a surge in performance, fueled by the standout performance of select mega tech giants. Notably, the S&P 500, Dow Jones, and Nasdaq 100 all showcased notable gains, underlining the dominance of risk assets on the international stage.

- Interest Rate Dynamics: Throughout the month, there was a notable shift in interest rate dynamics, with traders recalibrating their expectations for a significant reduction in the US Fed Funds Rate. Surprising inflation and labour market data prompted a reevaluation, leading to higher yields and pressure on fixed interest returns.

- Emerging Markets Strength: The MSCI All Country World index, inclusive of dividends, delivered a strong 6% return in February. Moreover, the MSCI Emerging Markets index slightly outperformed expectations, benefitting from a late-stage resurgence, particularly notable in China.

- ASX Performance Lags Global Markets: Despite a solid interim reporting season, the ASX faced headwinds, failing to keep pace with its global counterparts. Weaker commodity prices exerted downward pressure, notably impacting the Resources sector, with the ASX Metals and Mining sub-index witnessing a decline of nearly 6%.

- Key Themes Evident in ASX Reporting Season: During the February reporting season, significant themes emerged within the ASX landscape. Notably, a heightened focus on cost control yielded favourable earnings results, with ASX 200 companies allocating a higher proportion of their free cash flow towards capital expenditure than the previous year.

Market Commentary

February saw global markets deliver much stronger returns in risk assets than domestically, thanks to positive economic data and stronger-than-expected earnings reports, particularly select mega tech names linked to the generative AI revolution. A prime example was Nvidia, which delivered another strong profit result, beating consensus expectations for earnings and sales, which resulted in another round of upgrades.

In Australian dollar terms, the MSCI All Country World Index returned 6%, including dividends, in February, while the MSCI Emerging Markets index performed slightly better, gaining 6.4%, including dividends, helped by a late rebound in China. In developed markets, Japan continued to outperform, with the Nikkei 225 Index forging a new all-time high for the first time in over three decades. Meanwhile, European stock markets underperformed on disappointing economic data releases.

On the domestic front, despite a solid interim reporting season, the ASX had a weaker month, underperforming global peers. While the Tech sector followed its global peers upwards, weaker commodity prices weighed on the Resources sector. The ASX Metals and Mining sub-index declined by almost 6%. The Energy sector was also weaker.

Key themes during the ASX February reporting season included a greater focus on cost control helping drive more earnings beats than misses (Health Care and Resource firms the main exceptions where cost increases were more problematic). ASX 200 companies spent 55% of their free cash flow on capital expenditure (capex), up from 40% a year ago. Meanwhile, the domestic market’s cash conversion cycle continues to improve, thanks to lower inventory and receivables. Finally, older and wealthier cohorts benefiting from higher rates are spending and saving more, while younger and more indebted cohorts have pulled back on spending, having exhausted most of their savings.

On the interest rate front, traders pared back interest rate bets for a sharp reduction in the US Fed Funds Rate, as inflation and labour market data continued to surprise to the upside. At the beginning of the month, as many as six 0.25% cuts were being positioned for by Christmas 2024, but this was halved by month end. As yields rose, fixed interest returns again came under pressure, with most key benchmarks finishing February in the red. Meanwhile, the average rate on a US 30-year fixed mortgage rose to 6.94% at month end, its highest level in over two months. Elsewhere, oil prices continued to creep higher, while gold was virtually unchanged. The rally in crypto accelerated as Bitcoin spiked by 44% during the month, with speculation in numerous ‘coins’ reaching a fever pitch.

Economic Commentary

On the economic front, the Reserve Bank of Australia (RBA) maintained a hawkish tone in its February board meeting. The RBA held the official cash rate steady at 4.35%, in line with expectations. While inflation continues to show signs of slowing due to weaker goods and energy prices, it remains well above the target 2-3% range. January labour market data was again relatively weak, with employment growth and hours worked trending downward. Elsewhere, preliminary retail sales data for January increased by 1.1% versus December, missing the market consensus of a 1.5% rise. Manufacturing data was also below expectations, as the industry contracted at the beginning of the year.

In the US, the economy added 353k jobs in January, well ahead of expectations. Wage growth was also unexpectedly firmer. Average hourly earnings growth has now picked up steadily since October, reaching 4.5% over the prior year. The GDP figures for the December quarter were also strong, growing by 3.2% annualised, while productivity growth was up 2.7% over the twelve-month period. However, January inflation data came in hotter than market consensus. Core CPI (which excludes food and energy) rose by 1% over the quarter, and producer prices were also stronger than investors were hoping for. Services inflation has remained sticky, and so-called ‘super core services’ inflation, which strips out rental costs, jumped 0.9% in January, the largest monthly increase since April 2022.

Euro Area inflation inched lower to 2.8% in the year to January, and annual core inflation continued to ease to 3.3%. The result was above consensus but still reached its lowest level since March 2022. Finally, official UK data revealed its economy entered a shallow technical recession at the end of 2023 amid a broad-based decline in output. Despite consecutive quarters of negative growth, UK mortgage approvals and house prices are now rising strongly, while the unemployment rate fell to 3.8% at the end of 2023, led by progress in full-time employment.

Got some questions or want to chat ?

Thanks for reading. If you have any questions or want to discuss your investment strategy, please book a chat here.

Pete is the Co-Founder, Principal Adviser and oversees the investment committee for Pekada. He has over 18 years of experience as a financial planner. Based in Melbourne, Pete is on a mission to help everyday Australians achieve financial independence and the lifestyle they dream of. Pete has been featured in Australian Financial Review, Money Magazine, Super Guide, Domain, American Express and Nest Egg. His qualifications include a Masters of Commerce (Financial Planning), SMSF Association SMSF Specialist Advisor™ (SSA) and Certified Investment Management Analyst® (CIMA®).