January 2024 Economic & Market Review – Market rally takes a breath and waits on rate cuts

Talking points

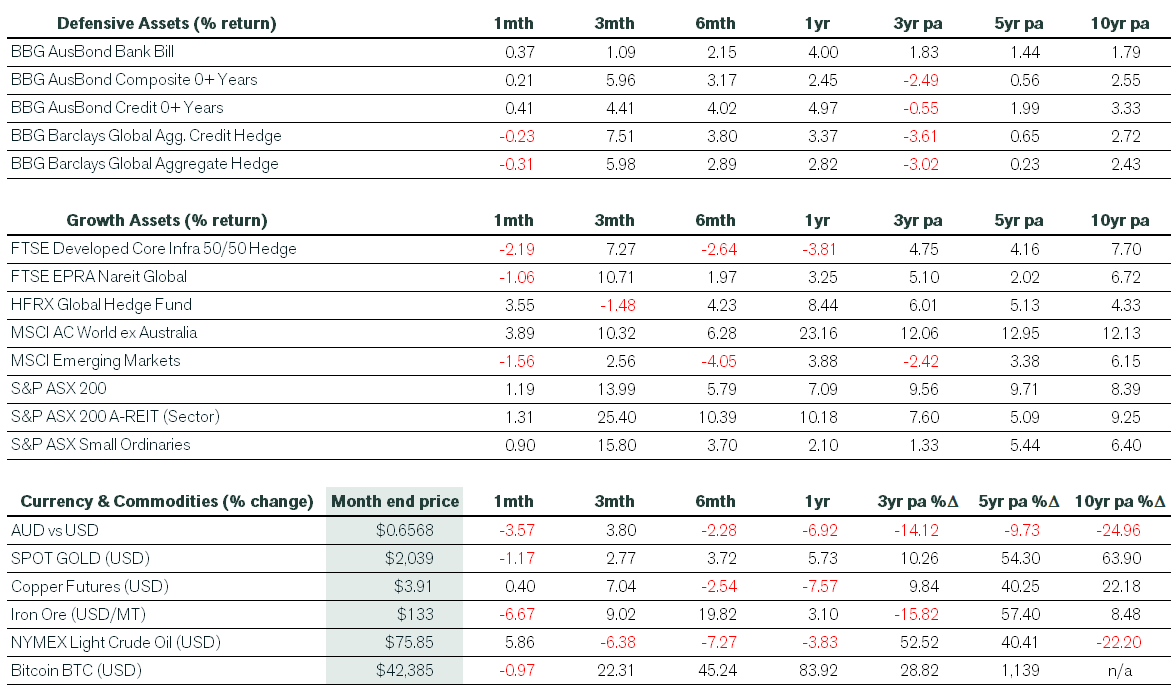

- Market Momentum Slows: January was another positive month for developed market equities, although returns moderated following a strong December rally. Driving forces were shifts in bond yields and currency movements, weighing particularly on infrastructure and bond proxies.

- Waiting on Interest Rate Cuts: On the interest rate front, domestic bond traders were buoyed by weaker-than-expected December quarter CPI figures and ramped up their rate cut expectations, with the market now fully priced for two reductions by the end of the year. Meanwhile, the US Federal Reserve (the Fed) kept interest rates steady at its January meeting but signalled that rate cuts are not imminent.

- Domestic Equity Highlights: Energy and Financial sectors emerged as strong performers, buoyed by geopolitical tensions and robust returns in banking and insurance. Healthcare also rebounded after a period of underperformance.

- Economic Realities in Australia and the US: Contrasting trends in Australia’s disinflationary environment with the US’s strong economic indicators offer a nuanced understanding of two major economies and their potential implications for investment strategies.

- China’s Economic Puzzle: Despite stimulus efforts, China continues to grapple with economic challenges, including manufacturing contractions and low confidence in the property market. The government’s urbanisation projects aim to address these issues, but their effectiveness remains uncertain.

Market Commentary

Following a searing December quarter rally, returns moderated in January. Ongoing economic data strength led to bond yields retracing recent falls. These moves muted fixed interest returns and impacted bond proxies, including infrastructure, where returns turned negative. Global government bonds were also down over the month, led by UK Gilts, as sticky services inflation and elevated wage growth made the prospect of imminent rate cuts from the Bank of England more unlikely. Meanwhile, the US Fed’s commentary at its January meeting was less dovish than markets had anticipated, and this led to reduced expectations of a US rate cut in March. Despite removing references to further rate rises, the Fed noted that it was prepared to adjust monetary policy if risks emerged that could impede the attainment of its employment and inflation goals.

The Australian dollar weakened in January on weaker-than-expected domestic data, which boosted global returns for unhedged investors. For example, the MSCI ACWI ex Australia index delivered a 3.9% return during the month. In Emerging Market equities, returns finished in the red following a further sell-off in China. In US dollar terms, the MSCI China Index has lost about 1%, including dividends, since the end of 2013. During the same period, the US and Indian sharemarkets have returned more than 200%.

In domestic equities, the Energy and financial sectors performed strongly in January. Returns in Energy were boosted by a rise in oil prices on the back of heightened geopolitical tensions in the Middle East. The bank and insurance sub-sectors drove higher returns in Financials, while the Healthcare sector rallied following a period of underperformance. Overall, the ASX 200 finished January at 7680 and reached an all-time high of 7682 (which was eclipsed in early February when the market rallied to 7703).

Economic Commentary

Australia

On the economic front, the disinflation narrative gained further momentum in Australia, after inflation cooled at a faster-than-expected rate in the December quarter. The consumer price index (CPI) data showed inflation had slowed to 0.6% in the three months through December, lower than the consensus estimate of 0.8%. Over 12 months, the CPI fell to 4.1% from 5.4% in the September quarter. It is the fourth consecutive quarter of lower annual inflation and down from the peak of 7.8% in the December 2022 quarter. An underlying inflation measure, known as the trimmed mean, also slowed to 4.2% in 2023. In other news, retail sales declined 2.7% in December and rose by just 0.8% in 2023, failing to keep up with inflation. It was the biggest monthly decline in retail sales since pandemic lockdowns in mid-2020 and, before that, the introduction of the GST in July 2000. Elsewhere, a volatile labour market shed 65,100 jobs in December from previous record levels, and the unemployment rate held steady at 3.9% as the workforce participation rate slumped.

United States

In the US, a host of data releases pointed to the ongoing strength of the US economy. The December jobs report exceeded expectations and wage growth remained firm, with the unemployment rate steady at 3.7%. Despite stronger wage growth in late 2023, inflation continues to moderate, with some data suggesting that a productivity boom may be underway in the US. Also of note was the strong December quarter GDP print of 3.3% annualised, smashing market expectations for 2% annual growth. Consumer spending on goods slowed, while consumption of services rose faster. Non-residential investment accelerated, led by a rebound in equipment spending.

China

Finally, in China, manufacturing contracted in December, against consensus expectations of a slight expansion. More broadly, China’s economy has seemingly failed to regain sustainable momentum, even after the government introduced some stimulus measures throughout 2023. A lack of confidence is behind the weakness, with poor property sentiment (consumer and corporate) a key driver. To help address the issue, in late 2023, the government proposed to expand some major urbanisation projects, including the redevelopment of so-called ‘urban villages’, which are clusters of self-built residential constructs in its major cities.

Want to chat about what this means for your investments?

Thanks for reading. If you want to discuss your investment strategy, please book a chat here.

Pete is the Co-Founder, Principal Adviser and oversees the investment committee for Pekada. He has over 18 years of experience as a financial planner. Based in Melbourne, Pete is on a mission to help everyday Australians achieve financial independence and the lifestyle they dream of. Pete has been featured in Australian Financial Review, Money Magazine, Super Guide, Domain, American Express and Nest Egg. His qualifications include a Masters of Commerce (Financial Planning), SMSF Association SMSF Specialist Advisor™ (SSA) and Certified Investment Management Analyst® (CIMA®).