November 2023 Economic & Market Review – Global Markets Rally while Mixed Signals for Australia

Talking points

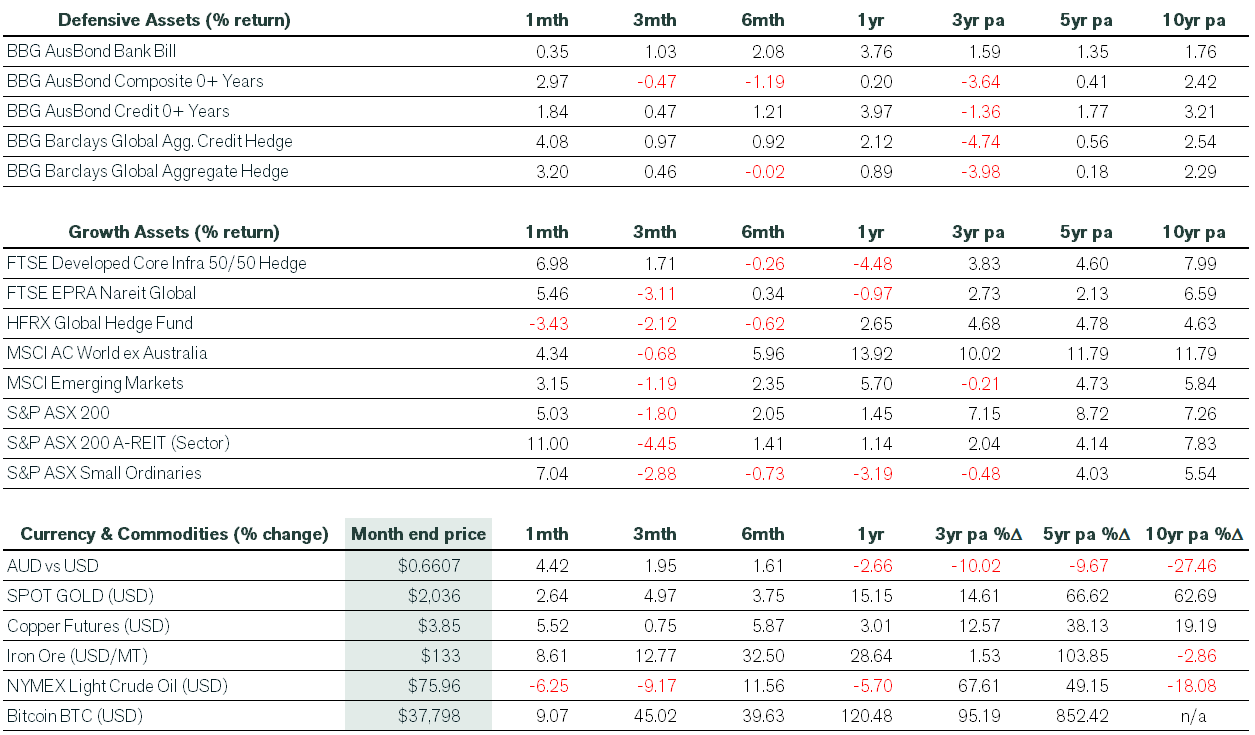

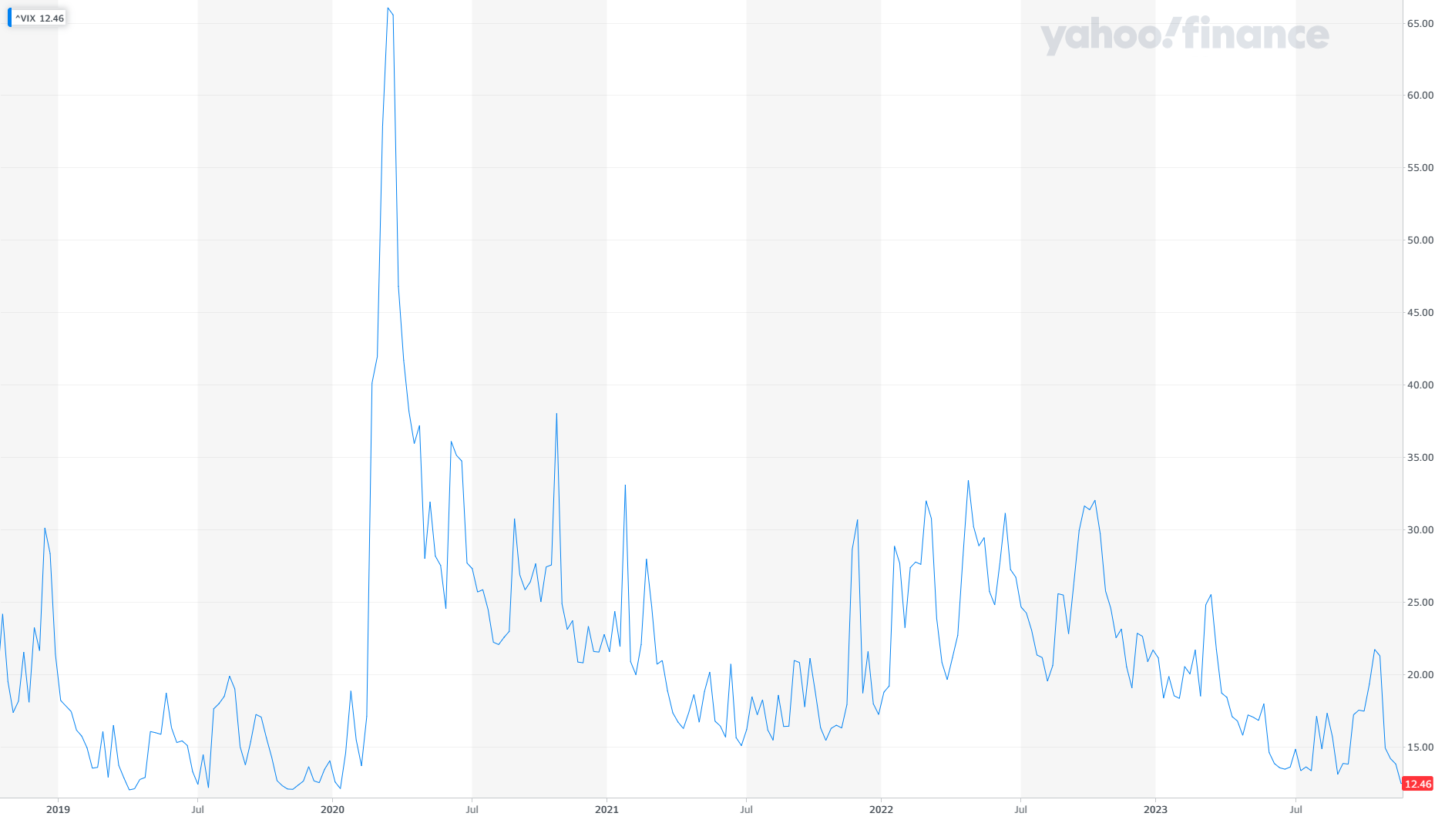

- Global Markets Rally Amidst Signs of Economic Moderation: November witnessed a strong rally in global markets as better-than-expected US inflation data fueled optimism that interest rates had peaked, leading to a surge in shares and bonds worldwide. The VIX volatility indicator reached its lowest levels since before the pandemic.

- Sector Performance Varied: Sectors previously hit hard this year, such as healthcare, property, small caps, and emerging markets, rebounded significantly. Tech stocks continued to soar, while energy and utilities lagged behind the broader market.

- Mixed Performance in Global Equity Indices: While the ASX 200 index delivered a solid 5% total return in November, global benchmark indices, particularly the US S&P 500 (+8.9%), Dow Jones (+8.8%), and Nasdaq (+10.8%) outperformed strongly. However, the rise in the Australian dollar negatively impacted unhedged domestic investors.

- Bond Markets Experience Historic Recovery: Fixed interest returns saw one of the strongest recoveries on record, with treasury curves shifting lower and long-term risk-free rates retreating. The bond market rally, especially in the US, resulted in the biggest monthly gain for the US aggregate bond index in over 35 years. Fed fund futures are now pricing in a 60% chance of a 25 basis points cut in March 2024

- Australian Economic Landscape Faces Mixed Signals: The Australian economy’s unemployment rate edged up to 3.7%, driven by stronger workforce participation. Despite this, the Reserve Bank of Australia (RBA) raised interest rates by 25 basis points to 4.35% at its November board meeting, in line with expectations. The RBA’s optimistic forecasts for GDP and inflation and a pushing out of projected jobless rate increases until the next year indicated a delicate balance in navigating economic challenges.

Market Commentary

Investors had reasons to rejoice in November as economic data showed that inflation was moderating and interest rates had likely peaked. As inflation rates slowed, the global financial landscape witnessed more moderate economic conditions, particularly in the US, where the labour market is softening. The outlook renewed confidence in the ‘soft landing’ narrative and buoyed equity markets.

Bond markets staged an incredible recovery in November as US long bond yields experienced the largest monthly decline since December 2008. The 10-yr US Treasury yield plummeted to 4.35% from a peak of 5% in October, boosting the US aggregate bond index by almost 5%, for its biggest monthly gain in over 35 years. In Australia, 10-year yields fell by over 50 basis points to help the Ausbond Composite All Maturities index return close to 3%.

The bond market rally pushed yields significantly lower in most regions, which gave a valuation boost to growth stocks and the technology sector. In terms of style, growth outperformed value during the month, and small caps outperformed their large cap peers.

The VIX volatility indicator fell to its lowest levels since before the pandemic, and equities posted their best month in over a year. November traditionally sees the beginning of the strongest six months of the year for US equities as share buybacks increase, while mutual fund tax-loss selling typically ends in October.

The S&P 500 Index is now up more than 20% year-to-date, including dividends. In contrast, the ASX 200 has returned 4.8%, including dividends, and just 0.7% in nominal price terms. On the continent, European indices moved higher despite the subdued economic environment. Japan continued its outperformance in 2023, posting a 5% increase in November.

In emerging markets, the MSCI Emerging Markets Index grew strongly over the month in local currency terms despite China continuing to underperform the broader index.

Economic Commentary

On the economic front, the disinflation narrative reigned supreme during the month. The US CPI for October was cooler than expected. Annual headline and core inflation dropped to 3.2% and 4%, respectively. The biggest driver of the decline in the headline data was a fall in energy and gasoline prices, along with lower travel and accommodation costs. In the labour market, the US economy added only half as many jobs in October, compared to September’s strong print. The below consensus data provided a much-needed sign that the labour market is slowly cooling.

In Australia, the October unemployment rate increased to 3.7%, driven by stronger workforce participation. Meanwhile, following a four-month pause, the RBA hiked official interest rates by 25 basis points to 4.35% at its November board meeting. This was in line with expectations and saw many economists predict that further hikes were to come. The quarterly Statement on Monetary Policy confirmed that the RBA had raised forecasts for GDP and inflation while deferring forecasts of a jobless rise until next year.

Elsewhere, the UK saw a larger-than-expected fall in inflation as the services sector cooled despite strong wage growth. The November services Purchasing Managers’ Index (PMI) posted a small expansion, surprising some analysts. In Europe, the CPI release for November also showed inflation is slowing, driven by lower energy prices. European manufacturing activity remains poor, mainly due to weak data from Germany and France. However, employment growth was robust over the previous quarter. Finally, macro data out of China exceeded consensus estimates, as retail sales jumped in October. However, new home sales continued to fall, seeing the People’s Bank of China (PBC) once again injecting liquidity into the banking system and further reducing the required reserve ratio.

Want to discuss the above information or your investments?

We hope you find the information useful, and if you want to discuss any details further or discuss your personal investment strategy, please book a chat here.

Pete is the Co-Founder, Principal Adviser and oversees the investment committee for Pekada. He has over 18 years of experience as a financial planner. Based in Melbourne, Pete is on a mission to help everyday Australians achieve financial independence and the lifestyle they dream of. Pete has been featured in Australian Financial Review, Money Magazine, Super Guide, Domain, American Express and Nest Egg. His qualifications include a Masters of Commerce (Financial Planning), SMSF Association SMSF Specialist Advisor™ (SSA) and Certified Investment Management Analyst® (CIMA®).