Stage 3 tax cuts for 2025FY and what they mean for you

The Labor tax package passed through the upper house on Tuesday night with bipartisan support. The quick passage of the bill means the cuts will start applying to people’s incomes from July 1.

What does this mean for you?

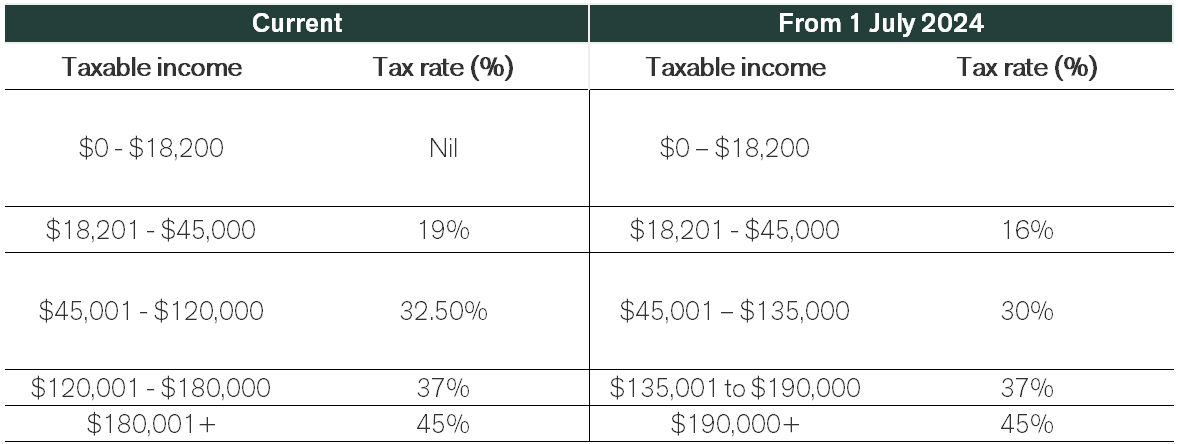

The stage 3 tax cuts will make the following changes to tax rates and thresholds in 2024/25 compared to the current financial year (2023/24):

- reduce the current 19% tax rate to 16%

- reduce the current 32.5% tax rate to 30%

- increase the current threshold above which the 37% tax rate applies from $120,000 to $135,000

- increase the current threshold above which the 45% tax rate applies from $180,000 to $190,000

The table below compares the resident tax rates in 2023/24 to the proposed tax rates from 2024/25 onwards:

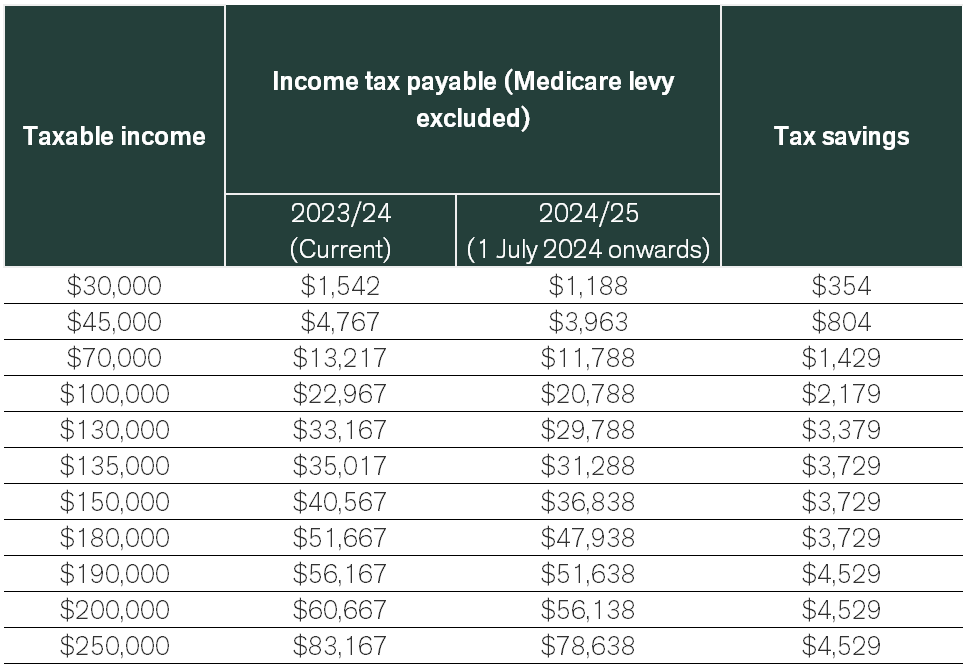

How much are the tax savings under the proposed changes?

As a guide, the below table shows the tax savings a resident taxpayer will receive from 2024/25 under the stage 3 tax cuts, based on different levels of taxable income in comparison to the current tax rates.

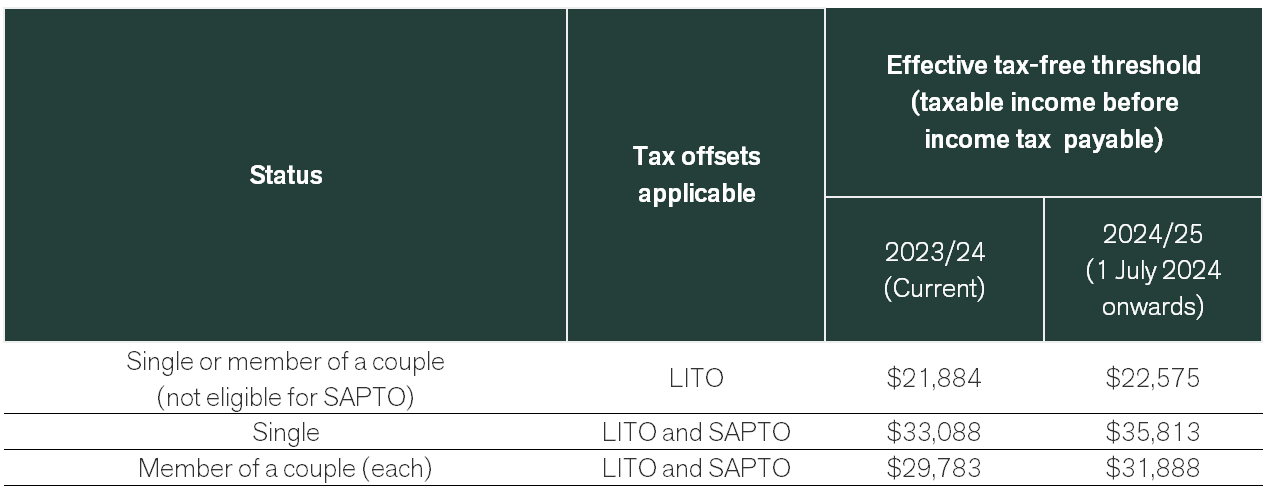

Effective tax-free thresholds changes

The reduction in the lowest marginal tax rate will also impact the effective tax-free threshold, which is the level of taxable income you can receive before income tax becomes payable. The good news is that these thresholds will increase.

The below table compares the effective tax-free income thresholds between the current year and from 1 July 2024.

Link to the Government fact sheet here.

What strategy considerations are worth thinking about?

- Is a strategy to bring-forward next year’s (2024/25) tax deduction into the current year (2023/24) tax effective?

- Should you delay an event to increase taxable income in 2024/25 or later, if your marginal tax rate (MTR) is lower in a future year?

- What’s the impact of a reduction in the lowest marginal tax rate (from 19% to 16%) on salary sacrifice or personal deductible contribution strategies?

Want to discuss your personal circumstances and strategy?

If you want to discuss what this means for your personal strategy or any of the details above, please book a chat with one of our financial planners.

Pete is the Co-Founder, Principal Adviser and oversees the investment committee for Pekada. He has over 18 years of experience as a financial planner. Based in Melbourne, Pete is on a mission to help everyday Australians achieve financial independence and the lifestyle they dream of. Pete has been featured in Australian Financial Review, Money Magazine, Super Guide, Domain, American Express and Nest Egg. His qualifications include a Masters of Commerce (Financial Planning), SMSF Association SMSF Specialist Advisor™ (SSA) and Certified Investment Management Analyst® (CIMA®).