January 2021 Markets Review – A pause in the global sharemarket rally

January 2021 Markets Review – A pause in the global sharemarket rally

Talking points for January 2021

- Markets were subdued in January with th pandemic still looming large across the global economic landscape. It is reported that there are over 100 million confirmed Covid-19 cases worldwide at the start of February. Vaccine rollouts have not been without early logistical challenges.

- Following strong returns in the preceding quarter, it seems likely there was some profit-taking in January which contributed to a loss of momentum.

- One of the most talked about stories which will cause a rethink for aspects of investing (speculating) was the share price performance of US computer game retailer GameStop. A collective move spurred on by Reddit thread “WallStreetBets” created a price rise of 2,879% in the three months to the end of January (no I didn’t accidentally leave an extra digit in, that is 2879%). Media coverage of this was massive, as the story really captured the interest the mainstream. To this point, there hasn’t been a significant effect on markets overall.

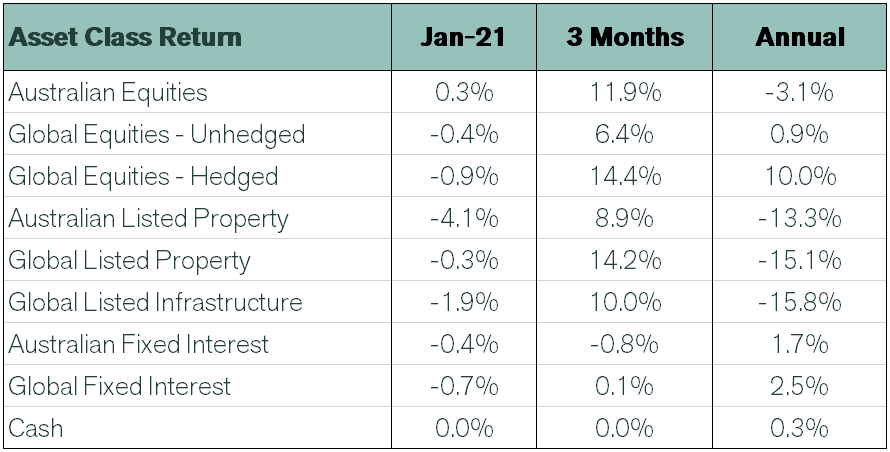

- Australian Equities were the only broad asset class to post a positive result and outperformed their global peers, with global equities slightly negative for the month.

- Australian listed property and infrastructure continued their trend of underperformance with a rough start to 2021, whilst rising bond yield generated small negative returns across fixed interest benchmarks.

International equities

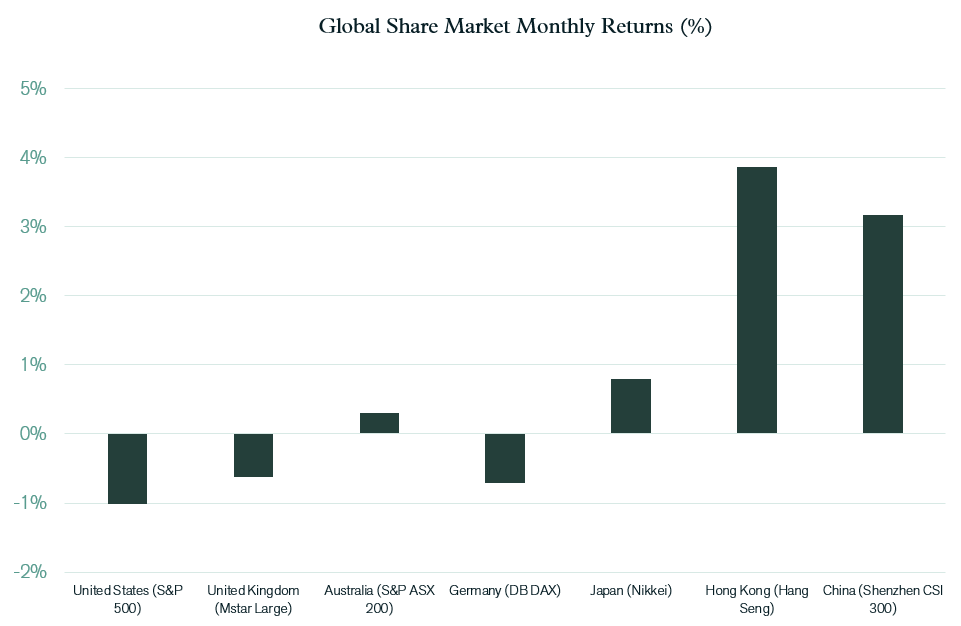

China remained the best performing market in January with both Hong Kong and Shanghai managing better than +3%. Economic indicators here continue to show increased activity due to government stimulus and rising international demand for Chinese exports. The other major markets were muted – focused on the more fraught outlook in Europe and the US due to the economic impact of COVID and changes in government support and restrictions.

In the US, the new economic stimulus package is being prepared and is expected to be approved in March, paving the way for increased consumer spending via an additional $1,400USD payment to individuals. The US company reporting season has been slightly better than expected, despite a 1% reported decline second-quarter earnings. The UK has been assessing the impact of finally executing the BREXIT deal, and there have been significant impediments to trade in food, goods, and services – as well as COVID related impacts on trade and activity. Despite these impacts, share market losses have been minimal.

Australian equities

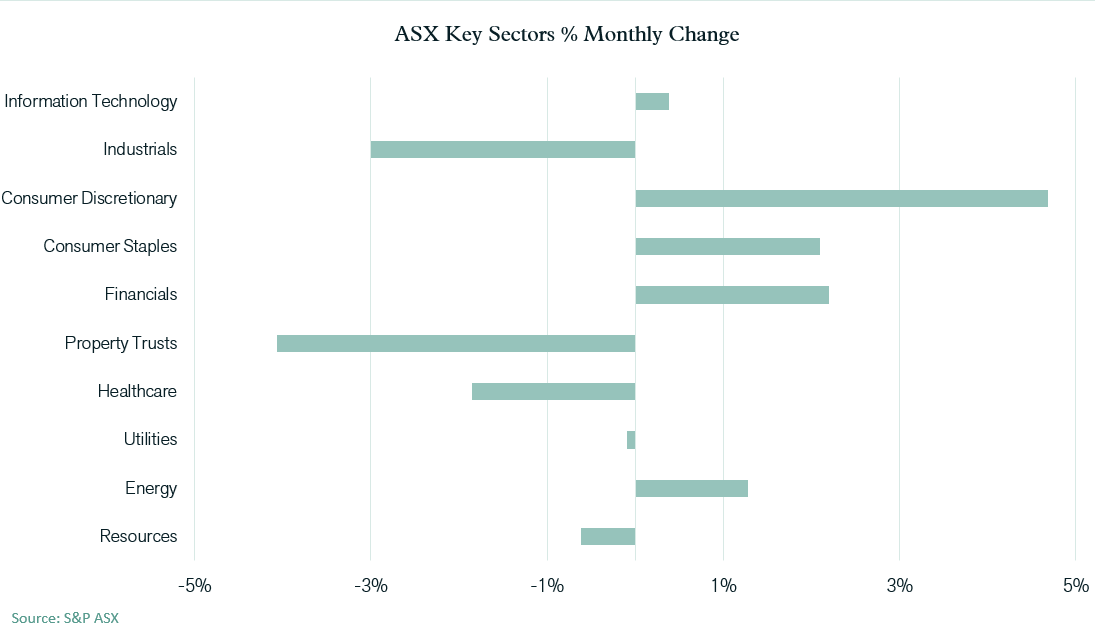

The Australian market rose 0.3% in January. Consumer Discretionary stocks – particularly retailers – delivered a 4.7% return in the month. Retailers benefited from strong consumer spending in the December Quarter, following government support payments and expenditure being redirected from travel. A large build-up of savings in the household sector implies further buoyant consumer spending may be possible. Banks performed well, as the proportion of poorly performing loans continued to drop, which should enable banks to restore some of the dividends that were cut last year.

However, Property Trusts were weak, as reports of new Covid-19 cases emerged and a drawn-out return to ‘normal’ appeared more likely. As the vaccine rollout progresses and lockdown restrictions ease, sold-off sectors such as retail may continue to strengthen and close the valuation gap with in-favour sectors such as industrial and specialised.

Fixed interest & Currencies

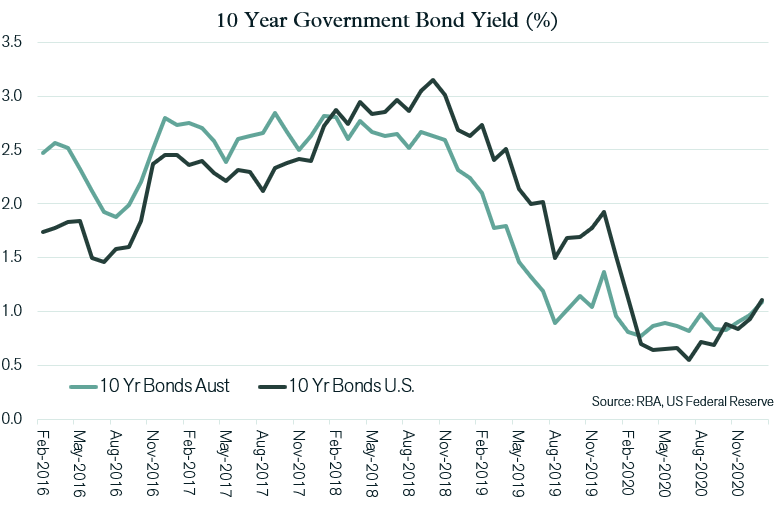

Longer term bond yields increased in both the US and Australia, with 10-year government bond yields now approximately 1.1% in both countries. Expectations of improved economic growth and inflation appear to be driving longer term bond yields higher. However, we do not yet see the evidence of consumer price inflation needed to justify a significant rise in interest rates. Nonetheless, inflationary expectations have increased over recent months as strong consumer spending and some areas of supply disruption provide two preconditions for inflation. Another potential source of inflationary pressure is higher energy and commodity prices. Prices for Iron Ore, in particular, have continued to push higher, as Chinese import demand remains buoyant and Brazilian supply weak. However, offsetting these factors is spare capacity in labour markets, where elevated unemployment continues to be a deflationary force.

The Australian dollar is showing signs of plateauing, following a period of strong growth. In January, the $A fell US 0.6 cents to close at US 76.5 cents. Australia’s currency remains underpinned by strong trade fundamentals. Higher commodity prices have supported the trade balance and neutralised the impact of lower export volumes and stronger spending on imports by Australian consumers. As a result, the trade balance has remained in a strong surplus position over recent months.

Outlook

Whilst there were pockets of volatility, share markets have been relatively steady over the past few months up to the end of January. This follows a significant rally to end the 2020 calendar year. It isn’t a majot surprise that a period of consolidation was overdue. Markets are seeking more certainty to continue pushing higher in the short term, but there is still much to play out in terms of the success of the vaccine program in allowing ‘normalisation’ of economic activity to return.

Although the vaccine rollout is demonstrating inevitable challenges, the path to normalisation remains visible and this forms the basis of the market consensus assumption that 2021 will display a strong cyclical economic recovery. Hence, there remains a material risk that any evidence emerging to the contrary of this consensus assumption will produce negative impacts on share markets as forecasts for improvements in company earnings will need to be reassessed.

A second risk that has emerged as being slightly more significant over recent months is that of higher inflation and higher longer term interest rates. The rise in bond yields that has occurred to date has not had any noticeable impact on equity market sentiment. However, with valuations at such elevated levels when compared with historic norms, a change in the longer term market assumption around interest rates could start to challenge some of the basis for current valuations.

Pete is the Co-Founder, Principal Adviser and oversees the investment committee for Pekada. He has over 18 years of experience as a financial planner. Based in Melbourne, Pete is on a mission to help everyday Australians achieve financial independence and the lifestyle they dream of. Pete has been featured in Australian Financial Review, Money Magazine, Super Guide, Domain, American Express and Nest Egg. His qualifications include a Masters of Commerce (Financial Planning), SMSF Association SMSF Specialist Advisor™ (SSA) and Certified Investment Management Analyst® (CIMA®).