January Market Update

We run through what happened in the market in January

January 2020 Investment Update

• Australian asset classes rebounded strongly in January after a weak December. Listed property and equities were supported by a reversal of fears of higher interest rates.

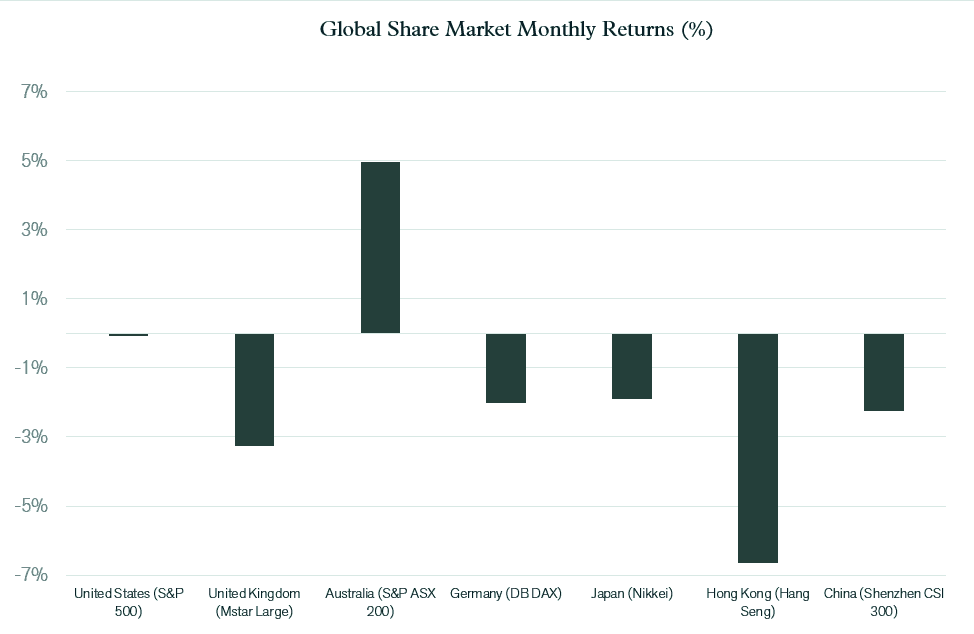

• Global equity markets were subdued as the implications of the US-China trade deal sank in, along with rising fear regarding the impact of the coronavirus on Chinese and global activity levels.

• The Australian Dollar fell from US$0.70 to US$0.67, enhancing returns for international assets held on an unhedged basis.

International Equities

January saw equity markets weaken sharply at the end of the month, as the implications of the spread of the coronavirus and the efforts to contain it, started to impact on confidence. China’s equity markets were closed for an extended New Year holiday from 23rd January to the 3rd February. Globally, market volatility rose from low levels. Economic indicators continued to give mixed signals regarding levels of economic activity, which also caused investors to reward more stable asset classes and sectors including infrastructure, while also pushing bond yields lower.

Australian Equities

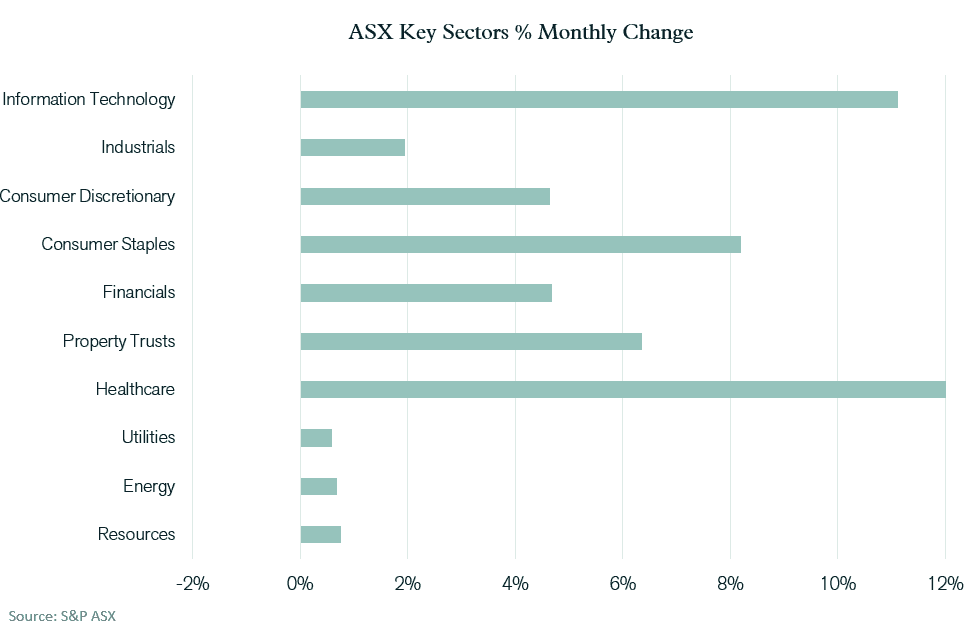

The Australian market rose 5% (S&P/ASX 200 Index), strongly out-performing other equity markets, thereby reversing the trend of the previous month. The improvement came with falling bond yields. Notwithstanding the strong market performance overall, some 17 companies recently issued downgrades, with an average share price fall on the day of the announcement of 16.5% . These companies reporting earnings weakness had exposure to insurance, consumer spending, travel and commodities. Half-year reporting season has commenced in February and recent price movements suggest any profit or outlook disappointments will be treated even more harshly than normal.

In January, the market was supported by a 5.2% rebound from the banking sector, but resources were flat (+0.8%) as investors moved away from cyclically exposed businesses. The stand-out returns were from Healthcare where CSL’s share price rose 13.2%, ResMed jumped 14.4% and Ansell also rose 10.4%. Information Technology jumped 11.1%, driven by strong moves in the prices of companies such as Altium +14.7%, Appen +12.9%, Wisetech +7.1% and Xero +7%.

Market strength came without a significant positive change in earnings expectations and was perhaps more in response to lower bond yields. This month’s company reporting season performance will be crucial in establishing the basis for further price gains.

Fixed Interest & Currencies

Interest rates fell across the yield curve in January. However, the largest falls domestically were in 10-year bonds as investors sought safe havens.

The Australian 10-year government bond yield fell 0.40% from 1.35% to 0.95%. The US equivalent bond yield fell 0.35% to finish at 1.56%.

Lower domestic bond yields helped drive the Australian dollar lower, as Australian interest rates became less attractive for international investors. Lower commodity prices may also explain the weaker $A last month, with Copper falling 9.5%, Oil down 15.5%, Iron Ore weaker and, unsurprisingly, Gold stronger by 4.7%. Concerns over Chinese growth, and the coronavirus more generally, contributed to the commodity price weakness and the greater attraction of gold, which can act as a safe haven asset.

Outlook and Portfolio Positioning

Despite the heightened concerns over the outlook for Chinese and global growth stemming from the coronavirus, equity markets refused to fall significantly in January as positive sentiment remained broadly intact. This is despite the reaction on commodity, gold and bond markets, which implied a more material change in the risk appetite of investors. This contrast was even more stark in Australia, where the outperformance of the share market here belied the strong relationship between the Australian and Chinese economies. As such, the rationale to take a more cautious view around Australian equities has increased. Global equities, being somewhat more insulated from the coronavirus impact on average, have become more attractive on a relative basis. The potential “cushioning” impact of a weaker Australian dollar on global investments, should the broader economic risks continue to rise, adds to the attraction of global equities over the local market.

Notwithstanding the decline in bond yields in January, we retain our view that yields bottomed late in 2019 and are not well positioned to provide either a source of positive real return or a “sanctuary” from volatility in the period ahead. Other defensive investments, such as higher grade corporate credit and selected Alternatives, that offer greater return compensation without the prospect of capital loss should interest rates rise continue to be preferred.

Important Information

The following indexes are used to report asset class performance: ASX S&P 200 Index, MSCI World Index ex Australia net AUD TR (composite of 50% hedged and 50% unhedged), FTSE EPRA/NAREIT Developed REITs Index Net TRI AUD Hedged, Bloomberg AusBond Composite 0 Yr Index, Barclays Global Aggregate ($A Hedged), Bloomberg AusBond Bank Bill Index, S&P ASX 300 A-REIT (Sector) TR Index AUD, S&P Global Infrastructure NR Index (AUD Hedged).

Our experienced financial planners provide tailored strategies and guidance to suit your unique needs and financial goals. If you’re seeking expert investment advice and management, reach out to a Pekada financial planner today.

Pete is the Co-Founder, Principal Adviser and oversees the investment committee for Pekada. He has over 18 years of experience as a financial planner. Based in Melbourne, Pete is on a mission to help everyday Australians achieve financial independence and the lifestyle they dream of. Pete has been featured in Australian Financial Review, Money Magazine, Super Guide, Domain, American Express and Nest Egg. His qualifications include a Masters of Commerce (Financial Planning), SMSF Association SMSF Specialist Advisor™ (SSA) and Certified Investment Management Analyst® (CIMA®).