February 2022 Investment Review: Volatility spikes in response to invasion of Ukraine

February 2022 Investment Review: Volatility spikes in response to invasion of Ukraine

Talking points:

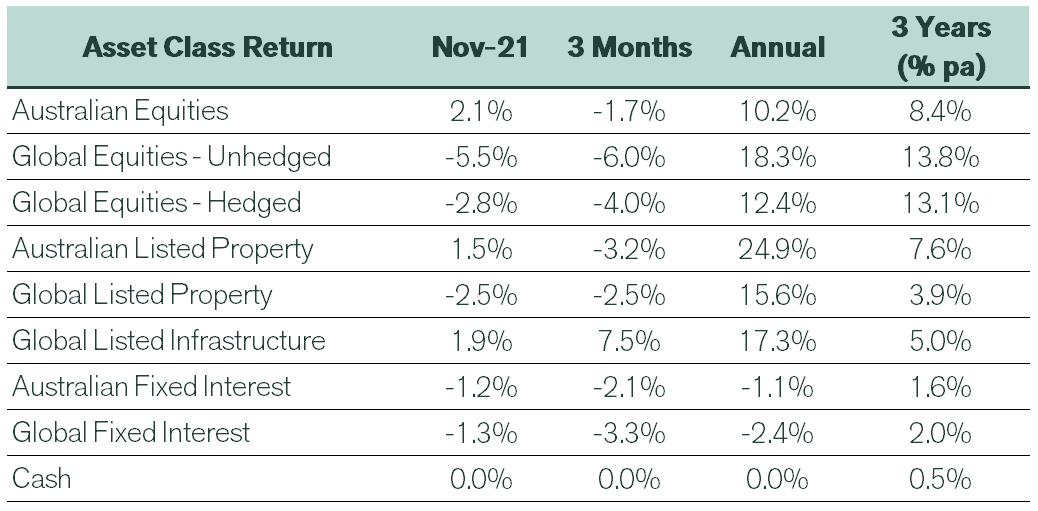

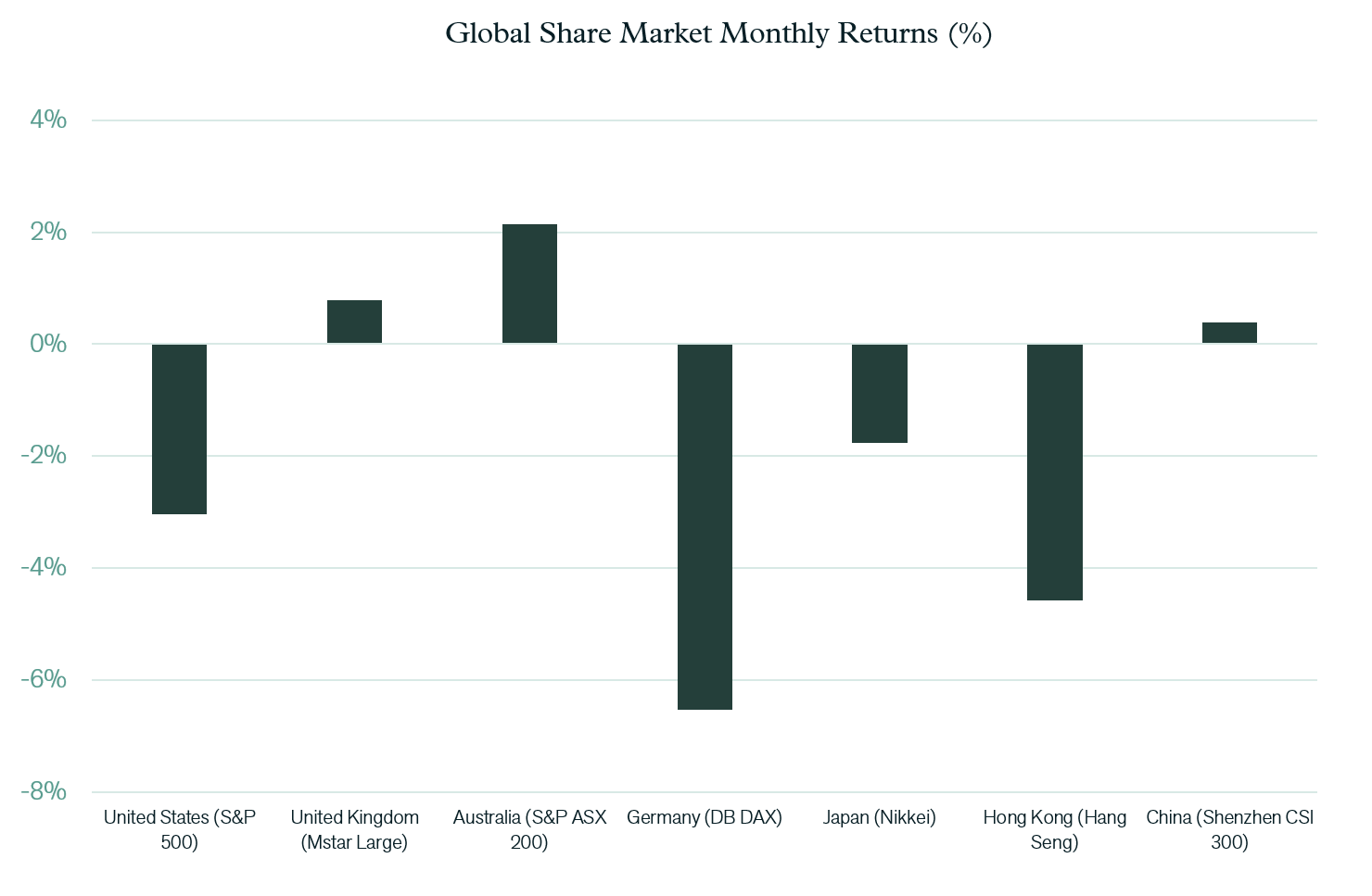

- In a month of high day to day volatility, global equities moved lower in response to the invasion of Ukraine by Russia.

- Australian equities moved against the worldwide trend, finishing the month higher.

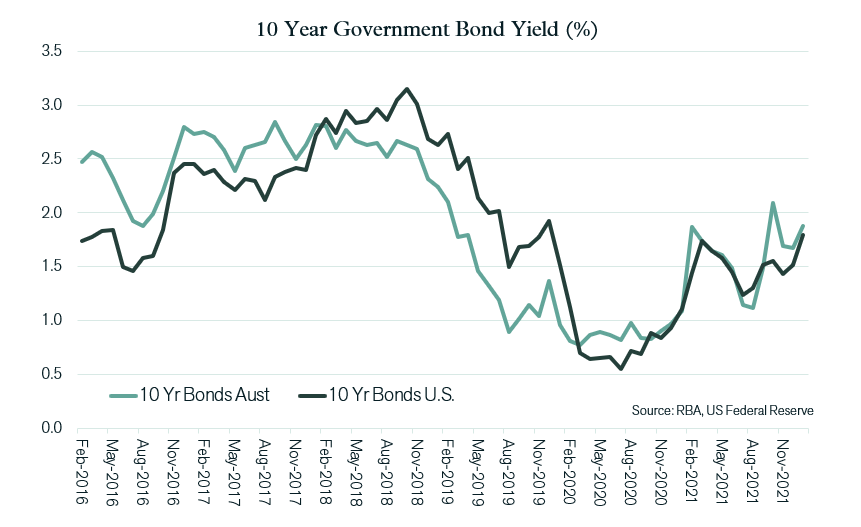

- Bond yields continued to rise as the military conflict heightened inflationary pressures.

International Equities

Unsurprisingly, the Russia-Ukraine conflict over February heavily impacted European share markets. Germany (down 6.5%) and France (down 4.7%) both performed below the global market average decline of 2.8%. The United States also experienced a significant 3.0% fall, with ongoing weakness in the higher growth sectors (particularly Information Technology) adding to the market decline.

In contrast, markets with substantial commodity exposure outperformed. Supplies of oil, gas, wheat and various other base metals and rare earths are expected to be heavily impacted by the Russian invasion of Ukraine. Commodity prices jumped significantly as a result. Oil prices were nearly 9% higher over the month and have now risen 27% so far this calendar year.

New Zealand, Canada, Norway and the United Kingdom were all examples of markets that benefited from the higher commodity prices and avoided equity market decline. The Japanese market was another to outperform, with the fall in the Nikkei Index restricted to 1.8%. In periods of heightened uncertainty, the Japanese market and currency are often viewed as “safe haven” assets and can outperform as a result.

Emerging markets also had mixed results over the month. Prior to the market being closed in late February, the Russian market had dropped 36% during the month. With MSCI and other index providers announcing that Russian listed stocks will be excluded from global and regional indexes, further selling pressure is expected should the Russian market re-open.

Other Eastern European markets also performed poorly over February, with an average decline of 11.7% (excluding Russia). However, elsewhere the jump in commodity prices supported emerging equity markets, with the Middle East and Latin America particular beneficiaries.

After a large decline in January, the Chinese share market stabilised somewhat in February with a flat result, although Hong Kong reversed its January increase with the Heng Seng Index falling 4.6%.

Australian Equities

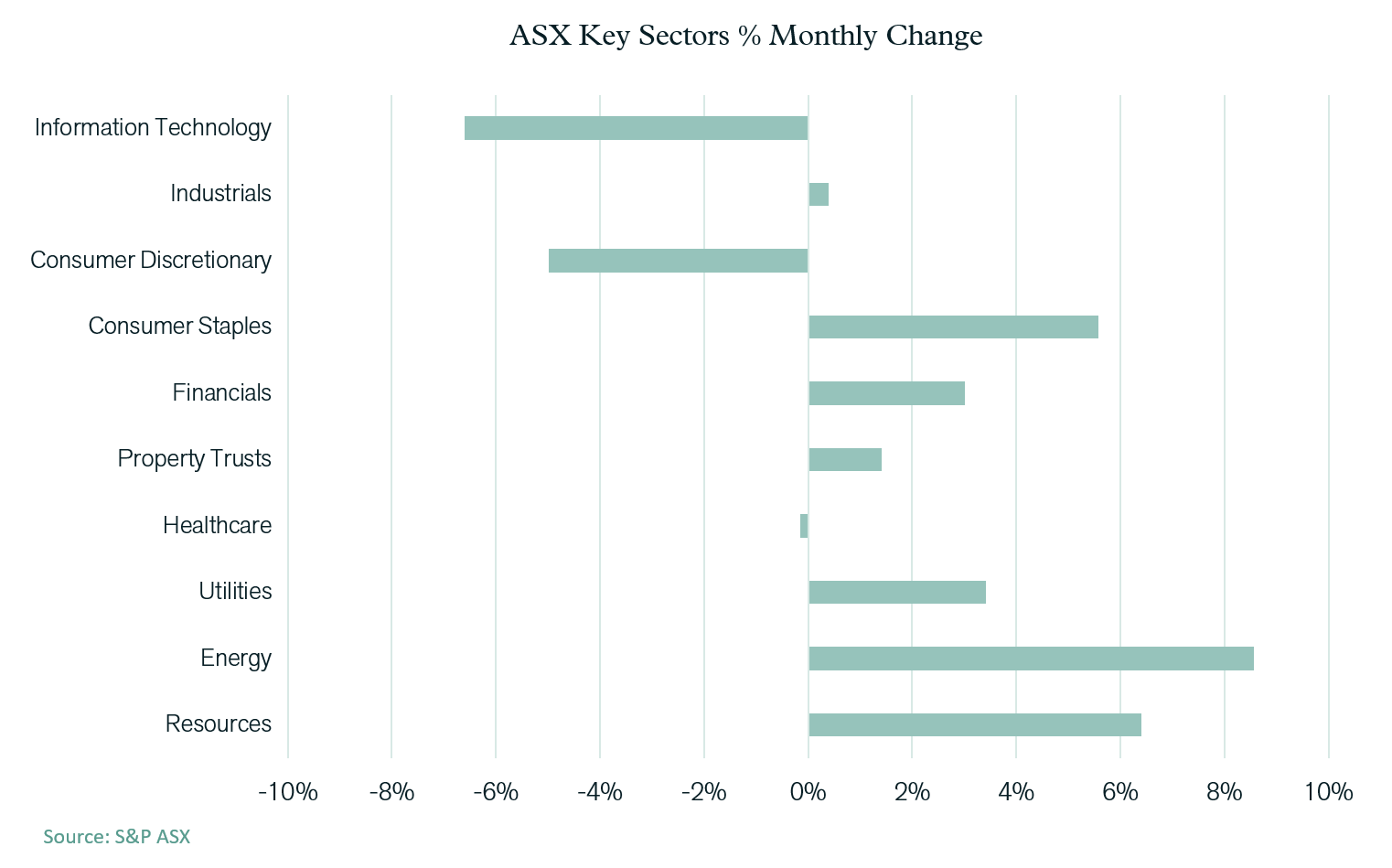

The Australian equity market outperformed global averages significantly, with higher commodity prices being the key driver. The energy sector jumped 8.6%, with resources more broadly being 6.4% higher. Iron ore prices consolidated their gains from January, which supported the larger resource stocks of BHP (up 5.4%) and Rio Tinto (up 5.9%). However, larger price gains in other commodities saw some smaller mining companies, such as South 32 (up 24.9%), perform particularly well.

In addition to the resource rally, there was also a continuation of the dominant trend in January that saw more defensive “Value” stocks outperform higher “Growth” orientated stocks. One of the explanations for this trend was the ongoing rise in inflationary pressure (stemming from higher commodity prices) and the related increase in bond yields. These higher yields reduce the attractiveness of stocks reliant on earnings growth in future years. As a result, the Information Technology sector was once again the weakest performer with a decline of 6.6%.

More cyclical consumer stocks were impacted by concerns over the potential impact of the military conflict on global growth and consumer sentiment. The Consumer Discretionary sector dropped 5.0%. In contrast, more defensive sectors including Property Trusts (up 1.4%), Utilities (up 3.4%), Consumer Staples (up 5.6%) and Financials (up 3.0%) all performed well.

Despite the strong gains from some small resource companies, smaller companies continued to lag larger companies over February. The ASX Small Ordinaries Index was flat over the month. With an annual gain of 5%, smaller companies have lagged the broader market by 5% over the past year.

Fixed Interest & Currencies

With the jump in commodity prices adding further inflationary pressure across the global economy, there was additional upward pressure on interest rates last month. Some of the rise in global bond yields was, however, tempered later in the month due to the possibility that an extended conflict in Ukraine would reduce the magnitude of policy tightening by central banks. As a result, the rise in the U.S. 10 year Treasury Bond yield was limited to just 0.04%, with the yield finishing the month at 1.83%.

Australian yields increased by more, however, possibility due to expectations that Australia would be less negatively impacted by the military conflict. Australian 10-year government bond yields jumped from 1.88% to 2.13%.

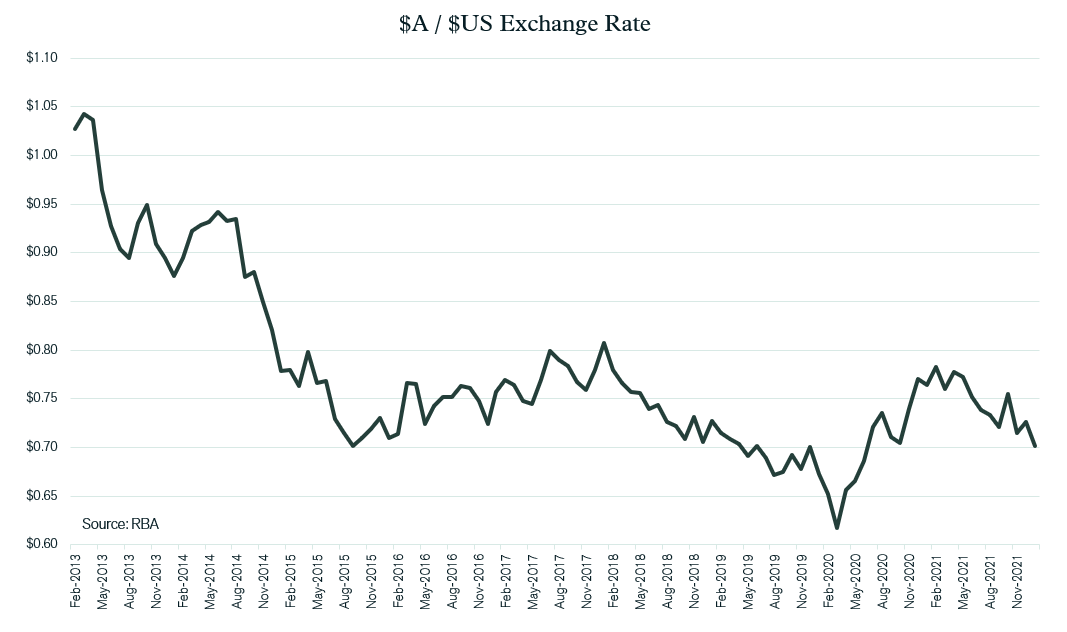

Stronger commodity prices and higher bond yields contributed to a rise in the $A last month. Partially reversing the depreciation in January, the $A rose from US 70.1 cents to US 71.8 cents.

Outlook

The outbreak of war in Ukraine has both tragic human outcomes as well as significant global economic impacts. For those specific countries, companies and commodities directly impacted, the effects are clear and potentially long lasting. However, from an overall macro-economic and global share market perspective, the consequences are less apparent. Clearly uncertainties and risks have been heightened and the fall in global share market values over recent weeks is an appropriate response to that heightening of risks. Past experience, however, does suggest there is a tendency for equity markets to recover post an initial sell-off, well before any underlying geopolitical event has been resolved. This may reflect the reality that military conflicts don’t necessarily have negative implications for longer term company earnings at the aggregate level.

For Australian investors, the geographical isolation from the military conflict, together with the high resource and energy exposure of our economy, creates the potential for at least relative outperformance from the local market.

Concurrent with the risks stemming from the war in Ukraine, investors also need to consider the ongoing implications of rising inflation and interest rates – with inflation risks ballooning further as a result of the conflict. Although central banks may be more cautious around lifting interest rates in an environment of heightened uncertainty, any relaxation of a tightening regime could further entrench inflation and then ingrain higher interest rates into the medium term.

Despite the significance of events of recent weeks, our portfolio positioning preferences have changed little. Within the fixed interest asset class, the ongoing prospect of higher interest rates remains, and duration positions should be held relatively short to avoid the prospect of capital loss on bonds.

Although risks have increased, equity exposures should be maintained near neutral levels for investors who have the tolerance to hold exposure to these risks. On balance, risks and return prospects within Australian equities have improved relative to broader global equities given events of recent weeks. As such, a slight bias towards Australian equities may be warranted. Consistent with this improved relative positioning of Australia, high commodity prices and potentially increased latitude for interest rates to rise could add support for the $A. Although high commodity prices (and high iron ore prices in particular) could correct downwards at any time, short term recent upward momentum in the $A may have further to run, and some additional currency hedging could be considered over this period.

Should you have any questions or want to discuss your investment strategy then please book at chat with me.

Pete is the Co-Founder, Principal Adviser and oversees the investment committee for Pekada. He has over 18 years of experience as a financial planner. Based in Melbourne, Pete is on a mission to help everyday Australians achieve financial independence and the lifestyle they dream of. Pete has been featured in Australian Financial Review, Money Magazine, Super Guide, Domain, American Express and Nest Egg. His qualifications include a Masters of Commerce (Financial Planning), SMSF Association SMSF Specialist Advisor™ (SSA) and Certified Investment Management Analyst® (CIMA®).