Beating the "investment stall"

Among other things, the rolling lockdowns in Melbourne have sent me searching for new hobbies to assist with staving off cabin fever. One that I am most excited and challenged by currently is “low & slow” barbeque.

Why am I mentioning this on our financial planning blog? Good question, and I think the answer lies in the fact that a cook takes ages (8-14 hours from my limited experience) and gives you plenty of time to let your mind run free.

Stay with me here.

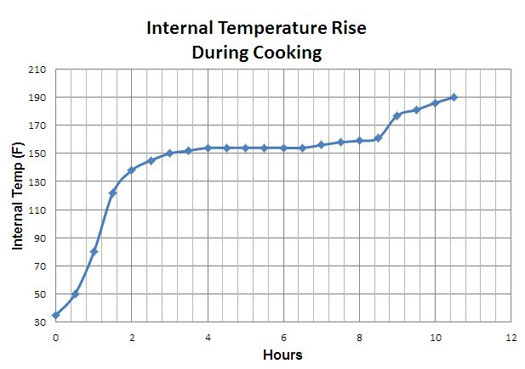

The challenge of the “brisket stall” for novice barbecuers like me is in some ways similar to the challenge retail investors face when their investments stall. You worry and panic because nothing is happening for what ‘feels’ like an eternity, and therefore something is wrong. So you do divert from your plan, do too much and unintentionally reduce your chances of success.

In contrast, the best pitmasters much like their investing professional counterparts are seasoned and experienced. They have seen this before and know what to do. Monitoring and being patient in most cases is the winning formula.

It isn’t something you start with and we need to train ourselves to act like the pitmaster and not the novice.

What do I mean by “investment stall”?

I’m referring to a phase, stage or period of an investments journey where it plateaus. The price seems to be not doing a lot, and this pressure compounds when the perception/reality is that the “rest of the market” is going up.

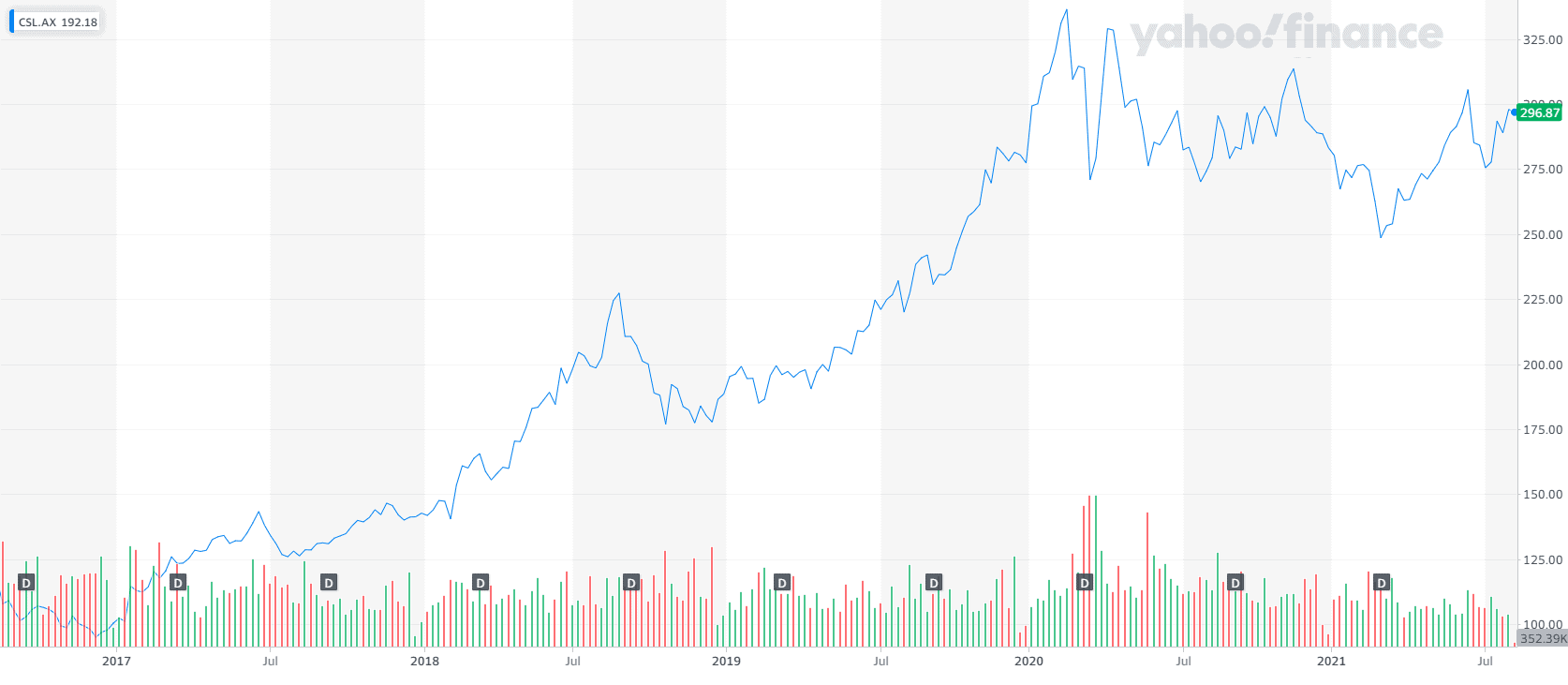

A current example of this could be a CSL. I use this as most people are familiar with this, and if you have been a long term investor, it has likely rewarded you handsomely – but not of late.

As you can see in the above chart, the last 12 months have basically been flat. For some, this causes a panic that it needs to be sold and replaced with something new, something that is doing something.

Now, does CSL still deserve its place in your portfolio? It depends on many factors and warrants research, but I am confident that the price chart alone cannot tell you the whole story.

Why is it so vital to acknowledge and seek to beat investment stall?

I’m a firm believer in long term investing and not day trading or speculating on short term price movements.

If you prescribe to this thinking, then having the clarity and patience to ride through flat spots in your investment journey will assist you in successfully compounding your returns over time with less stress.

In particular, be aware of the urge to trade that recency bias gives you. It is common to focus disproportionately on recent events and using them to judge the future. Eg. Thinking that the last 12 months performance (good, bad or indifferent) is indicative of its prospects.

I am not saying you shouldn’t monitor your investments; do so with an unemotional and analytical lens. Go back to your investment strategy, thesis for why you invested initially. Have these things changed? If not, then be patient.

What can you do to manage investment stall?

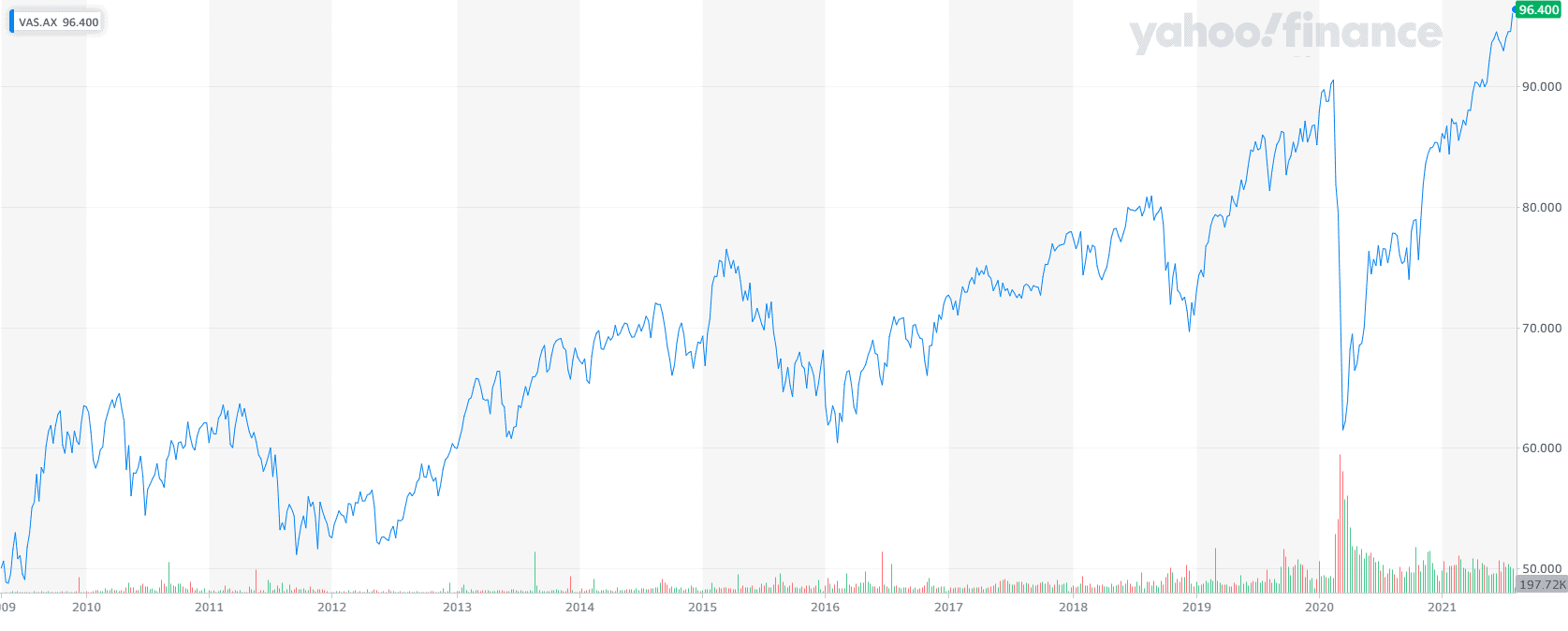

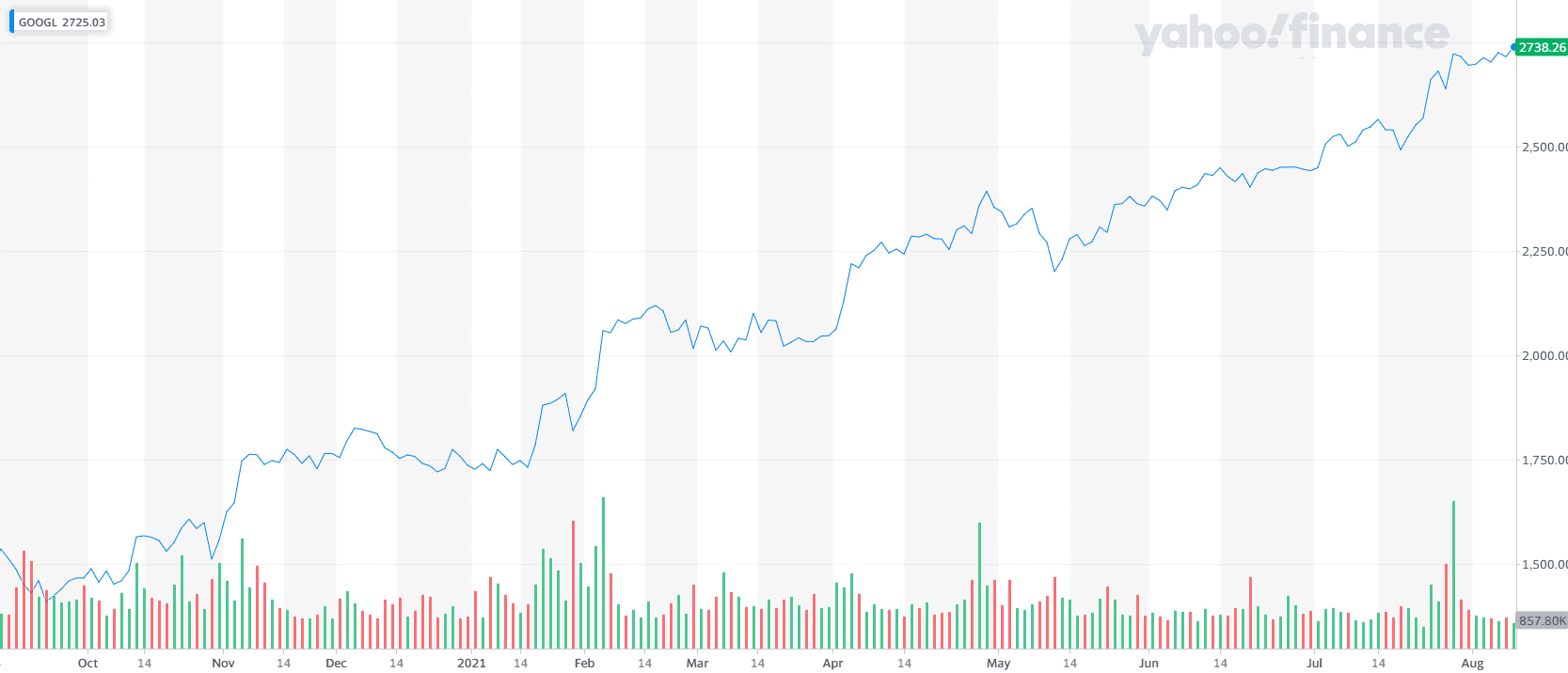

Our research using data from the last few decades shows that buy and hold could yield greater value over the long term.

Plenty of great long term performing businesses and indexes have all gone through periods of investment stall and managed to compound significant returns. Do your research and use some real-life examples to give you the confidence to remain patient. See below for some charts of the Vanguard Australian Shares Index ETF and Alphabet (Google) shares which I think highlight the point well.

However, this is easier said than done, which is why putting effort into developing a clear investment strategy and constructing your portfolio accordingly is critical. Having this documented will help you counter the behavioural bias to tinker with your investment when it really should be left alone to compound over the long term.

If you are not feeling confident then some tools to consider would be to:

- Use diversified managed investments or ETFs instead of direct investments: the diversification will most likely result in lower volatility and keep you focused on the long term returns.

- Engage the services of a financial planner (obviously biased here): The advice process will be useful in clarifying your goals, risk tolerance, investment preferences and develop a strategy that aligns with this. Going through the process of developing and documenting this will better prepare you to navigate the challenges of investment stall (and others).

Takeaways

Confession time. So many hours and a few poorly cooked briskets have contributed to these lessons! I panicked and didn’t have the patience I should have in hindsight. So I hope it has provided some value for your investing success.

Similarly, you may have succumbed to the urge to trade too frequently and chase the latest hot investment or trend.

It is normal, and I can tell you that it gets easier to manage these urges as you become a more seasoned investor. Going through various investment cycles or surrounding yourself with the right people and tools will improve your investing and long term returns.

Pete is the Co-Founder, Principal Adviser and oversees the investment committee for Pekada. He has over 18 years of experience as a financial planner. Based in Melbourne, Pete is on a mission to help everyday Australians achieve financial independence and the lifestyle they dream of. Pete has been featured in Australian Financial Review, Money Magazine, Super Guide, Domain, American Express and Nest Egg. His qualifications include a Masters of Commerce (Financial Planning), SMSF Association SMSF Specialist Advisor™ (SSA) and Certified Investment Management Analyst® (CIMA®).