What is the government super co-contribution?

If you’re making less than $58,445 in the 2023/24 financial year, and at least 10% of that comes from your job or a business, consider putting extra money into your super after taxes.

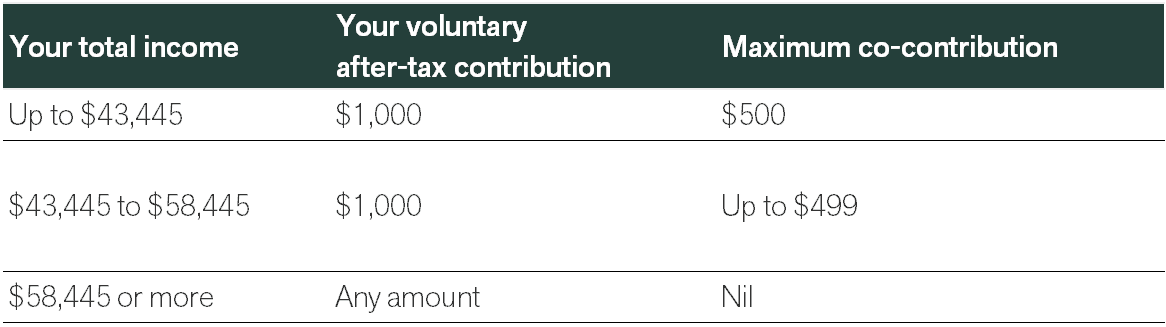

If you do and meet specific criteria, the Government might chip in with up to $500 into your super account—which is a fantastic percentage return on investment!

How the super co-contribution works

You get the full co-contribution if you make a voluntary non-concessional (after-tax) super contribution of $1,000 and earn $43,445 a year or less. If you put in less than $1,000 or earn between $43,445 and $58,445 a year, you might still get something, but only part of the amount.

Just remember that what you earn, including regular income, certain benefits, and employer super contributions, counts here.

Things to consider

- Remember, once you put money into your super fund, you can’t take it out until you reach a certain age or meet specific conditions.

- If you claim a tax deduction for your contributions, you won’t get the government co-contribution, so confirm which is a better outcome for for you.

- For more details, check out the ATO website at ato.gov.au.

How can we help

If you’re considering putting more money into your super, let’s chat. Our experienced advisers can help you figure out which superannuation strategies make sense for you.

Pete is the Co-Founder, Principal Adviser and oversees the investment committee for Pekada. He has over 18 years of experience as a financial planner. Based in Melbourne, Pete is on a mission to help everyday Australians achieve financial independence and the lifestyle they dream of. Pete has been featured in Australian Financial Review, Money Magazine, Super Guide, Domain, American Express and Nest Egg. His qualifications include a Masters of Commerce (Financial Planning), SMSF Association SMSF Specialist Advisor™ (SSA) and Certified Investment Management Analyst® (CIMA®).