The October 2022-23 Federal Budget and what it means for you

Last night the Treasurer, Jim Chalmers, released the Government’s October 2022-23 Budget.

The Budget featured a range of proposed measures including superannuation, tax, Social Security and Aged Care changes.

Our summary of the key changes which may impact your financial planning are outlined below. As always if you have any questions please email me or book a chat.

Superannuation

Expanding the eligibility age for downsizer contributions to 55 and over

Downsizer contributions allow eligible individuals to contribute up to $300,000 to superannuation upon selling an eligible main residence. From 1 July 2018 until 30 June 2022, the minimum qualifying age to be eligible to make a downsizer contribution was age 65. From 1 July 2022, the minimum qualifying age was reduced to age 60.

On 3 August 2022, the Government introduced Treasury Laws Amendment (2022 Measures No. 2) Bill 2022 into Parliament, which if legislated, will ensure that the minimum qualifying age for downsizer contributions will be reduced to age 55.

Notes:

- This measure is currently before the Senate.

- The Government reaffirmed its commitment to this proposal in the Federal Budget. It is expected that if legislated, this measure will be effective from 1 January, 1 April, 1 July or 1 October following the day the enabling legislation receives Royal Assent.

- Contributions may be preserved until after age 65.

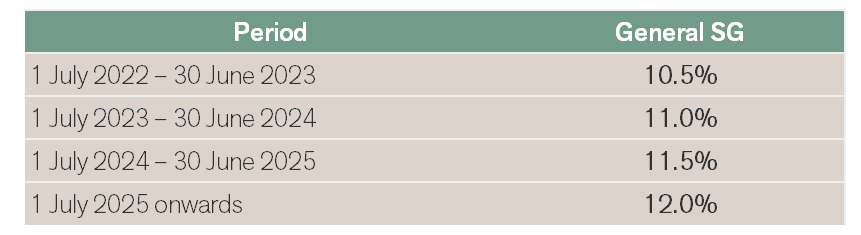

Superannuation Guarantee legislated increases to continue in accordance with the original timetable

Currently, Superannuation Guarantee (SG) is 10.5%. It is legislated to increase by 0.5% at the start of each financial year from here on in until it reaches 12% on 1 July 2025.

There is no change to the legislated increase of SG.

No extension to the halving of SIS minimums beyond the 2022-23 financial year

There was no announcement concerning extending the halving of the SIS minimums beyond the 2022-23 financial year in relation to eligible income streams such as account-based pensions and market linked pensions.

Self-managed Superannuation (SMSF)

In recent Federal Budgets, there have been a number of announcements relating to superannuation. The Government took the opportunity in the to provide clarity on the progress of specific unlegislated proposals.

SMSF audit requirement from annual to three-yearly no longer going ahead

In the 2018-19 Federal Budget, the previous Government had proposed that from 1 July 2019, the annual audit requirement will be changed to a three-yearly requirement for SMSFs with a history of good record-keeping and compliance. This measure was proposed at the time to reduce red tape for SMSF trustees that have a history of three consecutive years of clear audit reports and that have lodged the fund’s annual returns in a timely manner.

The Government has confirmed that this measure will not go ahead.

Delay to the commencement date for SMSF residency changes

In the 2021-22 Federal Budget, the previous Government had proposed to allow the relaxation of residency requirements for SMSFs and Small APRA Funds (SAFs) by extending the central management and control test safe harbour rule from two to five years for SMSFs and removing the active member test for both SMSFs and SAFs. It was expected for this measure to take effect from 1 July 2022.

The Government has reaffirmed its support for this measure with the effective date to be delayed to the income year commencing on or after the date of Royal Assent of the enabling legislation.

Tax

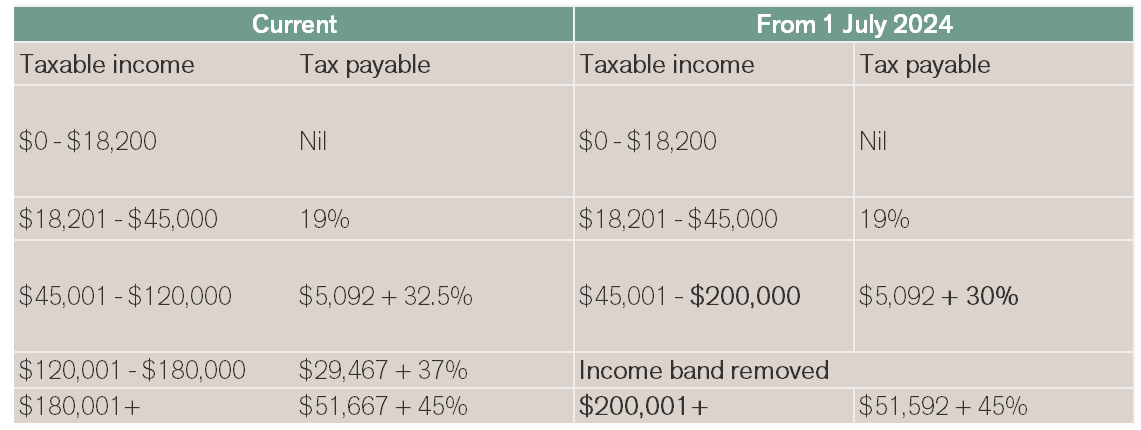

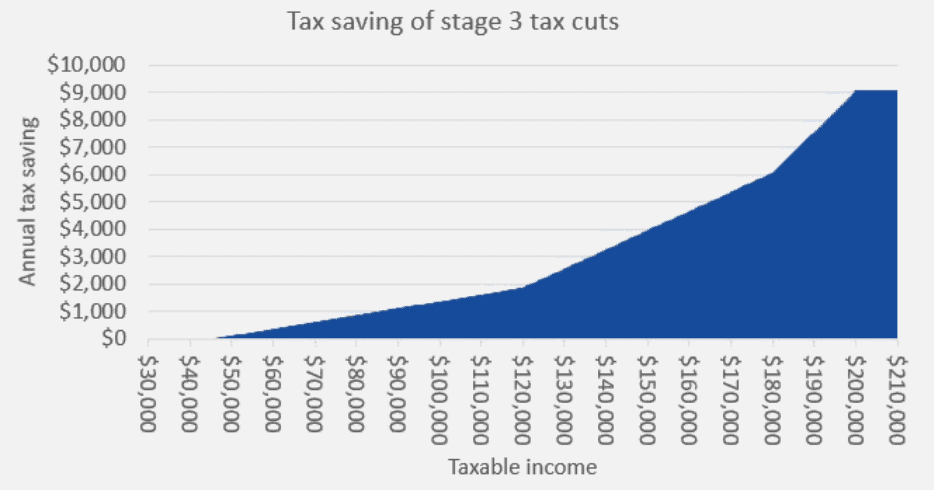

Stage 3 tax cuts to proceed

Despite the ongoing debate about deferring or cancelling the stage 3 tax cuts, the measure will go ahead in accordance with the legislated timetable from 1 July 2024. The stage 3 tax cuts that were introduced as part of the previous Government’s personal income tax reform, will remove the 37% income band and increase the higher threshold in the 45% income band from $180,000 to $200,000. The applicable rate on the 32.5% income band will also reduce to 30%.

Source: Colonial First State

Improving the integrity of off-market share buy-backs

The Government will improve the integrity of the tax system by aligning the tax treatment of off-market share buy-backs undertaken by listed public companies with the treatment of on-market share buy-backs.

Note:

This measure will apply from the announcement on Budget night (7:30 pm AEDT, 25 October 2022).

Electric Car Discount

The Government will cut taxes on electric cars so that they will be affordable for more Australians.

From 1 July 2022, the measure will exempt battery, hydrogen fuel cell and plug-in hybrid electric cars from fringe benefits tax and import tariffs if they have a first retail price below the luxury car tax threshold for fuel-efficient cars ($84,916 in 2022‑23).

Note:

- The car must not have been held or used before 1 July 2022.

Social Security

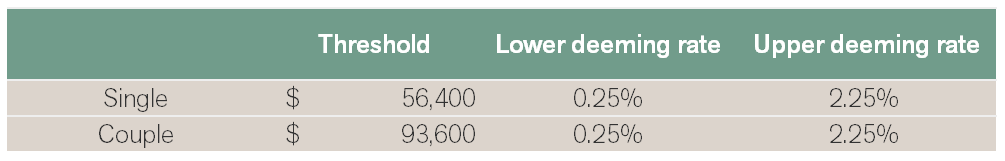

Freezing deeming rates until 2024

The Government recommitted to freezing the current deeming rates until 30 June 2024. The deeming thresholds will continue to be indexed on 1 July each year.

Principal home sale proceeds all at lower rate for exemption period. This rate would also not impact deeming threshold for other financial assets.

The current deeming rates and thresholds are as follows:

Changes to Commonwealth Seniors Health Card income thresholds

The Government recommitted to increasing the income thresholds for the Commonwealth Seniors Health Card from $61,284 to $90,000 for singles, from $98,054 to $144,000 for couples and from $122,568 to $180,000 for couples separated by illness, respite care, or prison.

Notes:

- This measure will start 7 days after the legislation is passed and receives Royal Assent.

- The Social Services and Other Legislation Amendment (Lifting the Income Limit for the Commonwealth Seniors Health Card) Bill 2022 was introduced into Parliament on 27 July 2022 and is currently before the House of Representatives.

Home sale proceeds exemption

The Government recommitted to extending the exemption period for proceeds from selling the principal home to purchase or build another home. Specifically:

- The assets test exemption for principal home sale proceeds will be extended from 12 months to 24 months. In certain circumstances, such as experiencing delays beyond a person’s control, the exemption can be extended to 36 months, and

- The income test will be amended to treat the principal home sale proceeds as a separate pool to the individual’s or couple’s other financial assets for the purpose of calculating deemed income. Only the lower deeming rate (currently 0.25%) will be applied to these proceeds for the duration of the assets test exemption.

Notes:

- The changes are scheduled to commence from the later of 1 January 2023, or one month after the enabling legislation receives Royal Assent.

- Enabling legislation (Social Services and Other Legislation Amendment (Incentivising Pensioners to Downsize) Bill 2022) was introduced on the 7 September 2022 and is currently before the Senate.

Temporary increase to pensioner Work Bonus income bank

The Government is providing an immediate one-off increase to an eligible pensioner’s Work Bonus income bank of $4,000 during 2022-23. This will increase the maximum unused income bank to $11,800 from $7,800 and allow pensioners to work more hours without affecting their pension.

These changes will not affect the existing application of the $300 fortnightly Work Bonus. Instead, the changes will provide an immediate $4,000 increase to the income bank of all eligible pensioners. This will allow eligible pensioners to have an extra $4,000 of income from work immediately disregarded from the income test rather than having to accumulate a balance over time.

Notes:

- Enabling legislation (Social Services and Other Legislation Amendment (Workforce Incentive) Bill 2022) was introduced on 28 September 2022 and is currently before the House of Representatives.

- The above Bill also contains provisions to enable Age Pensioners and certain DVA pensioners to have their pension suspended for up to two years instead of being cancelled under the income test, where the pensioner’s assessable income includes income from work. These pensioners will be able to retain their Pensioner Concession Card for up to two years and only be required to update their details, including their income and assets information, to have their payment reinstated instead of lodging a new claim.

- Max concession balance reduces to $7,800 on 1 July 2023.

A plan for cheaper medicines

The Government will provide funding to decrease the general patient co-payment for treatments on the Pharmaceutical Benefits Scheme (PBS) from $42.50 to $30.00 from 1 January 2023. The existing Medicare Safety Net provisions and all prescriptions that currently count towards a patient’s Safety Net will continue to do so.

Changes are also being made to ensure Closing the Gap patients will not need to pay any more to reach their Safety Net. A script with a Commonwealth price at or above the co-payment amount will have the script count toward the PBS Safety Net at a fixed value of $42.50, rather than at the reduced $30.00 co-payment. This will remain until the general patient co-payment is more than $42.50 in the future through indexation.

Plan to deliver Cheaper Child Care

The Government will provide $4.7 billion over 4 years from 2022–23 (and $1.7 billion per year ongoing) to deliver cheaper child care, easing the cost of living for families and reducing barriers to greater workforce participation. This includes $4.6 billion over 4 years from 2022–23 to:

- increase the maximum Child Care Subsidy (CCS) rate from 85 per cent to 90 per cent for families for the first child in care and increase the CCS rate for all families earning less than $530,000 in household income.

- maintain current higher CCS rates for families with multiple children aged 5 or under in child care, with higher CCS rates to cease 26 weeks after the older child’s last session of care, or when the child turns 6 years old.

- improve the transparency of the child care sector by requiring large providers to publicly report CCS-related revenue and profits.

Boosting Parental Leave to Enhance Economic Security, Support and Flexibility for Australia’s Families

The Government will introduce reforms from 1 July 2023 to make the Paid Parental Leave Scheme flexible for families so that either parent is able to claim the payment and both birth parents and non-birth parents are allowed to receive the payment if they meet the eligibility criteria. Parents will also be able to claim weeks of the payment concurrently so they can take leave at the same time.

Both parents will be able to share the leave entitlement, with a proportion maintained on a “use it or lose it” basis, to encourage and facilitate both parents to access the scheme and to share the caring responsibilities more equally. Sole parents will be able to access the full 26 weeks.

Pete is the Co-Founder, Principal Adviser and oversees the investment committee for Pekada. He has over 18 years of experience as a financial planner. Based in Melbourne, Pete is on a mission to help everyday Australians achieve financial independence and the lifestyle they dream of. Pete has been featured in Australian Financial Review, Money Magazine, Super Guide, Domain, American Express and Nest Egg. His qualifications include a Masters of Commerce (Financial Planning), SMSF Association SMSF Specialist Advisor™ (SSA) and Certified Investment Management Analyst® (CIMA®).