Superannuation for 65 years and over

As you are leading up to the ripe age of 65, you are either thinking of retirement or already in retirement. In this blog we can hopefully give you guidance and knowledge on what sort of things you can do with your super once you are in this age bracket to make sure you are utilising super to it’s fullest potential to boost your retirement savings. The information below should let you know how you can get your money into super and what types of things you should be considering before making a decision.

Superannuaton and what you should know when you’ve reached the age of 65

- At age 65, you have no restrictions with accessing your superannuation benefits via an income stream.

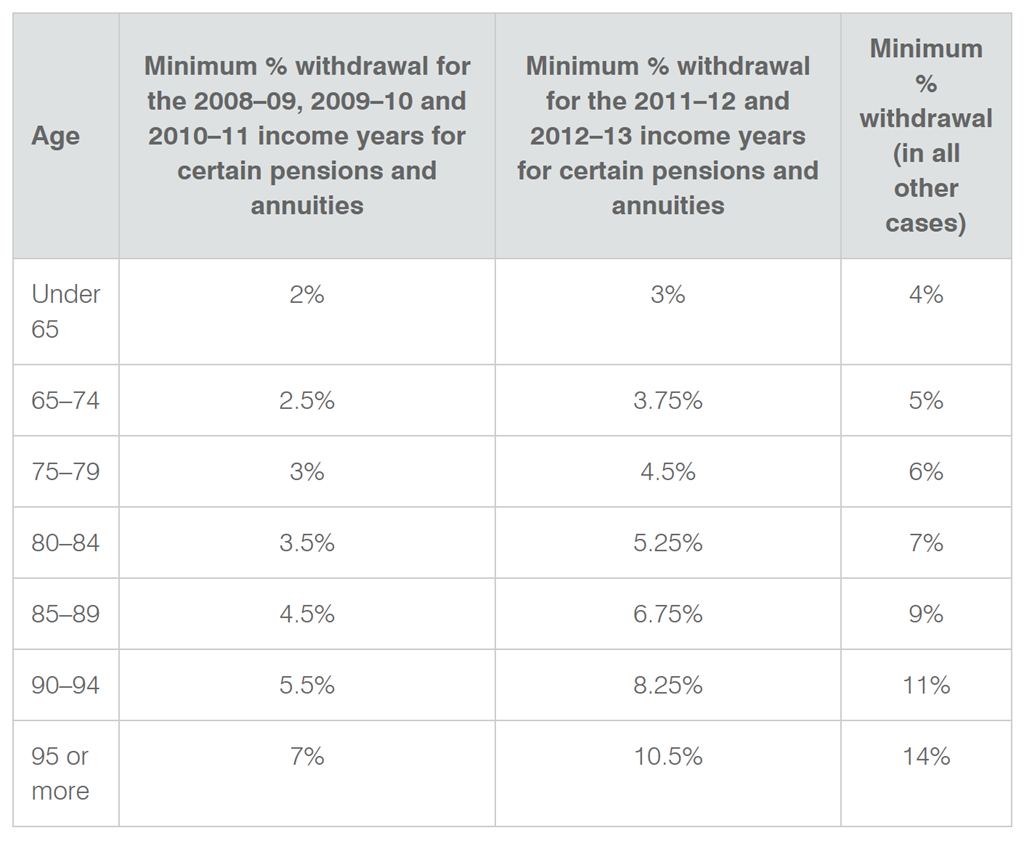

- When you have an income stream, you must ensure your payments meet the minimum pension requirements.

- If you are managing your own SMSF, this is your responsibility to take the minimum required amounts each year.

- If you are under an industry or SuperWrap type account, this will be the responsibility of the trustee product provider.

- Work test

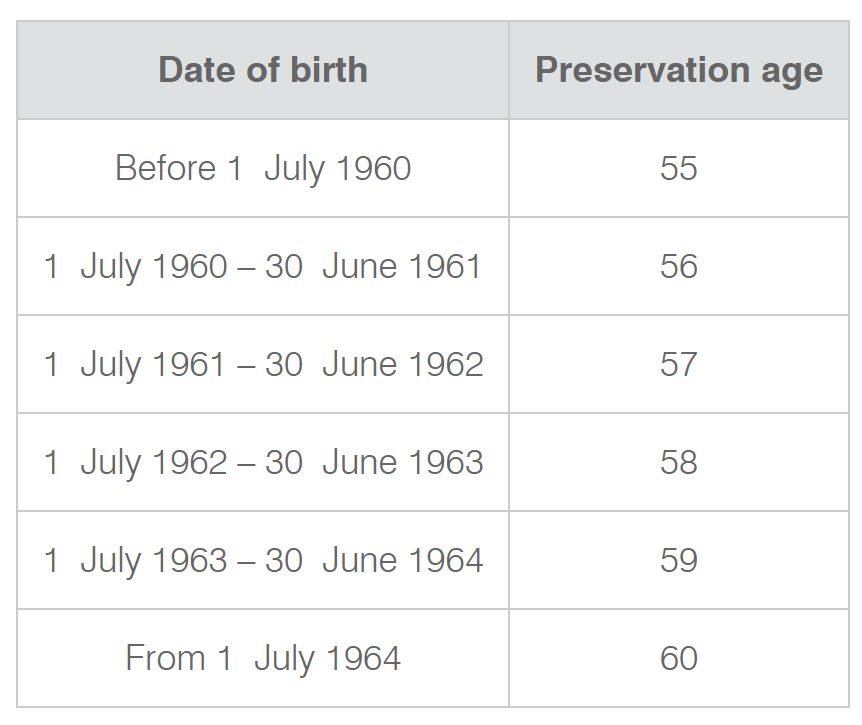

- Applicable once you turn 65 years old until you turn 75 years old, you must have worked at least 40 hours within 30 consecutive days in a financial year before your super fund can accept any non-concessional contributions for you (including, personal contributions, spouse contributions and government co-contributions).

- Work test exemption

- Allows an individual’s super contributions made by individuals ages 65 to 74 for an additional 12-month period from the end of the financial year in which they last met the work test, subject to their total super balance being less than $300,000.

Now what type of contributions is accessible to you? There are two types of contributions that you contribute into super, that is, Concessional Contributions and Non-Concessional Contributions. An easy way to think of this is, Concessional Contributions is anything you contribute into super with pre-tax monies (before your income gets taxed and is deposited into your bank account). On the other hand, Non-Concessional Contributions is anything you contribute into super with your after tax monies (money that has already been taxed and deposited into your bank account).

Concessional Contributions

General Rule:

- Maximum contribution cap of $25,000 per annum.

- More information.

- Contribution that your employer pays you on top of your regular income.

- Regardless of what age you are, as long as you are still working you will continue to receive SGC.

Salary sacrifice contributions:

- Contribution whereby you elect to sacrifice part of your income to contribute additional funds into super.

- Work test must be met or use the work test exemption.

- Must be under the age of 75.

Non-Concessional Contributions

General Rule:

- Maximum contribution cap of $100,000 per annum.

- Must be under the age of 75.

- Bring forward rule is not available.

- Work test must be met.

- Work test exemption can be used – if applicable.

- More information.

Member voluntary contribution:

- Contribution you make with money you have in your bank account.

- g. Partner A and Partner B has $250,000 in their bank account that they don’t require and want to invest this. Partner A and Partner B are able to make member voluntary contribution of $100,000 each in their respective super funds. The remaining $50,000 will need to be invested elsewhere or the following year if they meet the work test or use the work test exemption.

- Proceeds of downsizing your family home can be put towards superannuation as a downsizer contribution of a maximum $300,000.

- Certain requirements must be met.

- g. Partner A and Partner B sells their home worth $1,600,000 and uses proceeds to purchase a smaller home worth $1,000,000. With the $600,000 both of them can make a downsizer contribution of $300,000 each.

- Contributions whereby you make contributions into your spouse’s super account.

- You may be able to claim an 18% tax offset on super contributions up to $3,000 that you make on behalf of your non-working or low-income-earning partner. You can contribute more than $3,000, but you won’t receive the spouse contribution tax offset on anything above $3,000.

- Must be aged between 65 and 69 years of age.

- g. Partner A is a stay at home parent who works part time looking after the children. Partner B is the sole income earner in the family. Partner B decides to make a spouse contribution into Partner A’s super account in order for them to claim an 18% tax offset on super contributions. In total Partner B makes a contribution of $3,000 to make the most of the tax offset.

- A contribution which you make into superannuation whereby the government contributes a maximum of $300 given you make the requirements.

- Requirements:

- Under 71 years of age

- Total super balance less than $1.6 million for 2019-20 FY.

- Made eligible personal super contribution.

- 10% of total income must come from eligible source.

- Your income threshold must be surpass the higher income threshold.

- A lower threshold ($38,564 for 2019–20)

- A higher threshold ($53,564 for 2019–20).

As you can see above, there are a number of strategies you can take to get money into the superannuation environment. It is critical you understand the legislation and requirements behind each type of contribution you decide to make. I would suggest you seek a professional to discuss whether or not these contributions are relevant or suitable to your objectives, goals and situation.

As always if you have any questions, feel free to shoot as an email or give us a call!

Zac is a qualified financial planner at Pekada and host of the Wealth Collective Podcast. Living in Melbourne, Zac has six years of experience in advice and specialises in wealth accumulation and protection strategies. He loves to keep his finger on the pulse for the best strategies for wealth accumulators looking to build and protect their wealth tax effectively. Zac has been featured as an expert in Money Magazine.