September 2025 Economic & Market Review – Tech Leads, Fed Cuts, and Global Equities Advance

Talking points

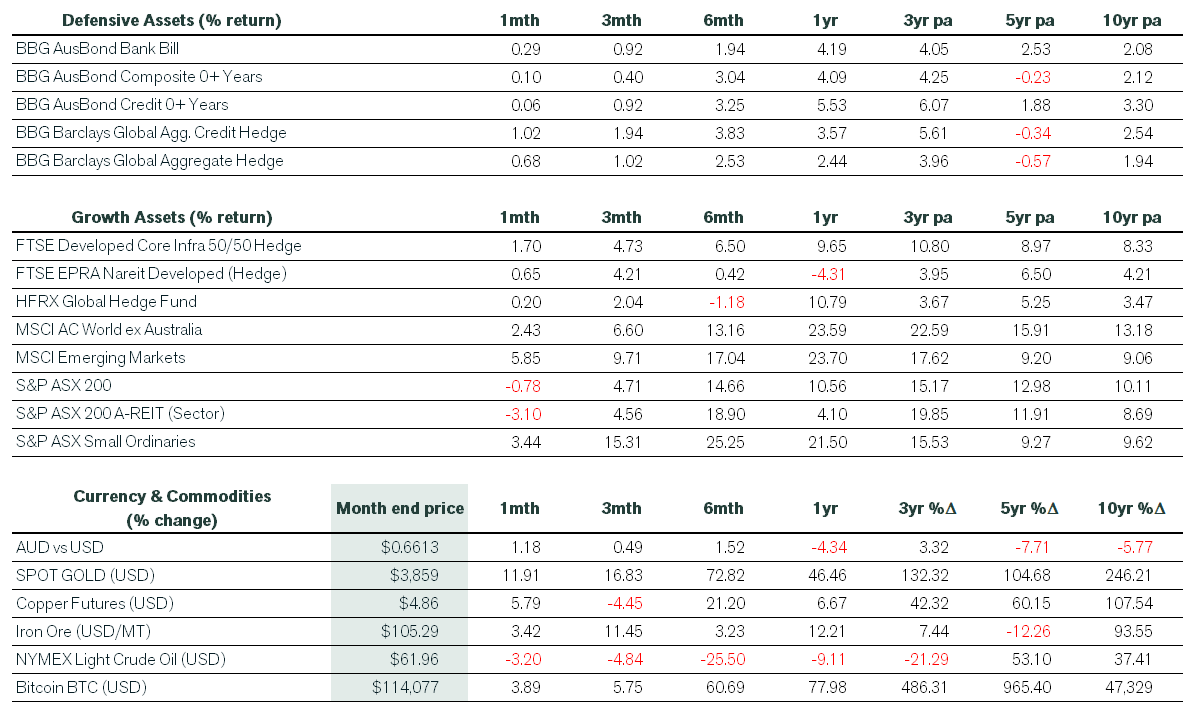

- Markets climbed, even with geopolitical tension: Global equities advanced in September, with the unhedged MSCI ACWI ex‑Australia up 2.4% (AUD). Optimism around AI, firm tech earnings, and the Fed’s first 25 bps cut of 2025 (policy rates reduced to 4.00%–4.25%) supported risk appetite even as US consumer confidence softened.

- Tech leadership—and concentration—stood out: Info Tech rose 7.2% and the Nasdaq 100 jumped 5.6% (its best September since 2010). The “Magnificent 7” delivered nearly two‑thirds of S&P 500 returns as the broader S&P 500 gained 3.7% (incl. dividends) while mid‑ and small‑caps lagged (+0.5% and +1.0%).

- Earnings beat, guidance lifted: US companies frequently printed above expectations. Several retailers raised 2025 outlooks as Q2 sales tracked well ahead of prior guidance—keeping the growth narrative intact.

- Australia diverged from the US: The ASX 200 fell 0.8% for the month (‑1.4% price‑only) even as the Small Ordinaries rallied 3.4%. Materials rose 6.1% on a 25% surge in gold, while Energy slid 9.7% and listed property gave back 3.1%.

- Bonds firmed as yields eased: The US 10‑year ended at 4.16% (‑7 bps) and the 30‑year at 4.74% (‑2 bps). Tighter credit spreads lifted global credit to a gain of just over 1% in September, though domestic fixed income underperformed.

- Policy paths are diverging: The Fed cut to 4.00%–4.25% amid a cooling jobs market—officials remain split, and Stephen Miran dissented in favour of a 50 bps move. The RBA held at 3.60% as hotter‑than‑expected monthly CPI trimmed the implied odds of a November cut, with markets leaning toward only one cut in early 2026.

- Inflation, growth and commodities sent mixed signals: In Australia, headline CPI ticked up to 3.0% in August (ex‑volatiles 3.4%) while trimmed‑mean eased to 2.6%; employment fell by 5,400 and unemployment held at 4.2% on lower participation. Gold jumped 10%+, the AUD edged higher, oil fell 3.2% to finish below US$62, and UK growth cooled to 0.3% in Q2.

Market commentary

September proved to be a positive month for most investors as financial markets continued to navigate the tense geopolitical landscape. The global rally has been supported by optimism around AI, strong corporate earnings from key technology companies and the resumption of the Federal Reserve’s rate-cutting cycle. The Fed reduced its funds rate by 0.25% to a range of 4%-4.25% in its first move this year, citing risks to the labour market. While consumer confidence has dipped in the US as the labour market has softened, consumer spending, income growth and industrial output have remained robust.

US company earnings often dominated the financial news headlines during the month, typically printing above expectations. Investors were pleased that some retailers increased their 2025 guidance, with Q2 sales tracking well above previous management guidance.

Global equities

Global equity markets continued to rally in September, with the unhedged MSCI ACWI ex-Australian index up 2.4% in Australian dollar terms. Most of the market’s focus remained on the US, where, including dividends and in US dollar terms, the benchmark US S&P 500 was up 3.7% in September, while the S&P MidCap 400 increased just 0.5% and the S&P SmallCap 600 gained 1% for the month. The Dow Jones Industrial Average returned 2% in September. The tech-laden Nasdaq 100 jumped 5.6%, including dividends, marking its best September since 2010.

Among GICS sectors, Info Tech did the best for the month, adding 7.2%, whilst Materials performed the worst, falling 2.3%. Of note, ‘Magnificent 7’ stocks accounted for almost two-thirds of the S&P 500’s total returns in September.

Australian equities

On the domestic front, the ASX 200 lost 0.8% in the month as investors became more concerned about the inflation outlook. Excluding dividends, the ASX 200 dropped 1.4%. Listed property gave back 3.1% following a period of gains. Meanwhile, the Small Ordinaries easily outperformed large cap peers, returning 3.4% in September inclusive of dividends.

In contrast to US markets, the Materials sector experienced a strong rally (+6.1% including dividends), as the gold sub-industry surged 25%, driven by a booming US dollar gold price. Utilities added 0.7%, while the remaining sectors posted losses. The more defensive GICS sectors struggled (namely, Telcos, A-REITs, Health Care and Staples). But, the worst was saved for Energy (-9.7% including dividends), which plummeted on the back of falling crude oil prices and a collapse in a foreign takeover bid for Santos.

Fixed interest, currencies and commodities

In bond markets, investors were more bullish as 10-year US Treasurys closed at 4.16%, down 7 basis points from the previous month, while 30-year bonds nudged 2 basis points lower to 4.74%. Credit spreads narrowed further, helping the global credit benchmark to return over 1% in September. However, domestic fixed interest underperformed global peers. While the Reserve Bank of Australia (RBA) kept interest rates on hold at 3.60% in September, as expected, the monthly CPI data was above consensus. This suggested September’s quarterly inflation data might exceed the RBA’s forecast, resulting in money market traders repositioning towards just one rate cut in early 2026.

Finally, the Australian dollar was modestly higher, while gold soared more than 10% on rising geopolitical and tariff-related inflation risks. Oil closed 3.2% lower for the month, finishing below US$62.

Economic commentary

Australia

In domestic economic news, employment unexpectedly fell by 5,400 jobs in August, following a gain of 24,500 in July. Consensus was for 21,000 jobs to be created. The unemployment rate remained at 4.2%, as workforce participation stepped lower. Meanwhile, headline monthly inflation data for August revealed a 3% annual increase, up from 2.8% in July. The move was driven by increases in housing, food and alcohol & tobacco prices. Excluding volatile items such as fruit, vegetables, fuel and holiday travel, annual inflation was 3.4% higher. However, annual trimmed mean inflation, which measures core or underlying inflation, fell to 2.6% from 2.7% in July.

At the end of September, the RBA left interest rates on hold at 3.6%, as was widely expected. Money market traders scaled back bets that another rate cut would be delivered by November. Ahead of the decision, the implied probability of a rate reduction to 3.35% had declined to 50%, from a near certainty at the beginning of the month. Those odds have since fallen below 40%. In contrast, many economists were still predicting that a November rate cut was the more likely outcome.

United States

In the US, the Fed cut rates (-25 basis points) for the first time since December 2024. Chair Jerome Powell again intonated that the US central bank is increasingly concerned about balancing inflation risks against a cooling jobs market. Interestingly, only the recent Trump appointee, Stephen Miran, dissented the decision in support of a 50 basis point cut.

However, Fed officials appear highly divided on this outlook. The quarterly Summary of Economic Projections noted nine out of the 19 Fed members are in favour of 50 basis points of additional cuts this year, while six think they should keep rates unchanged. The Fed’s inflation target of 2% remains elusive, with Powell effectively conceding they won’t hit this goal “anytime soon.”

Rest of the world

The UK economy slowed in the second quarter of 2025 to just 0.3% growth, from 0.7% in the first three months of the year. Adjusting for a rising population, largely driven by high levels of immigration, GDP per capita was up 0.9% in the year to June, after being stagnant in 2024.

Pete is the Co-Founder, Principal Adviser and oversees the investment committee for Pekada. He has over 18 years of experience as a financial planner. Based in Melbourne, Pete is on a mission to help everyday Australians achieve financial independence and the lifestyle they dream of. Pete has been featured in Australian Financial Review, Money Magazine, Super Guide, Domain, American Express and Nest Egg. His qualifications include a Masters of Commerce (Financial Planning), SMSF Association SMSF Specialist Advisor™ (SSA) and Certified Investment Management Analyst® (CIMA®).