September 2023 Economic & market review - Fed Higher for Longer and Economic Contrasts

September 2023 Economic & market review – Fed Higher for Longer and Economic Contrasts

Talking Points

- Global shares decline amid fed’s ‘higher for longer’ stance: Global stock markets saw a downturn in September as the Federal Reserve’s commitment to holding interest rates higher disappointed investors.

- Market malaise and increased volatility: Market sentiment soured, leading to widespread declines in major indices and increased market volatility. This trend was marked by a decline in trading volumes and prominent short positioning across financial markets.

- Challenges in key sectors: Several sectors, including listed property, global REITs, and infrastructure stocks, faced challenges and underperformance due to changing market conditions, with energy and value sectors offering limited respite.

- Fixed-interest markets and concerns over bond bear market: The sell-off in US Treasuries and rising yields had a ripple effect on other sovereign bonds, including Australian bonds. This situation raised concerns about a potential bond bear market, causing losses in composite bond indices and affecting the gold sector.

- Global economic contrasts: The US experienced robust growth on the economic front despite challenges such as rising unemployment rates and inflation. In contrast, Europe grappled with higher oil prices and unexpected interest rate hikes. Key economic indicators from China also showed signs of improvement, indicating a potential shift in the manufacturing sector.

Summary

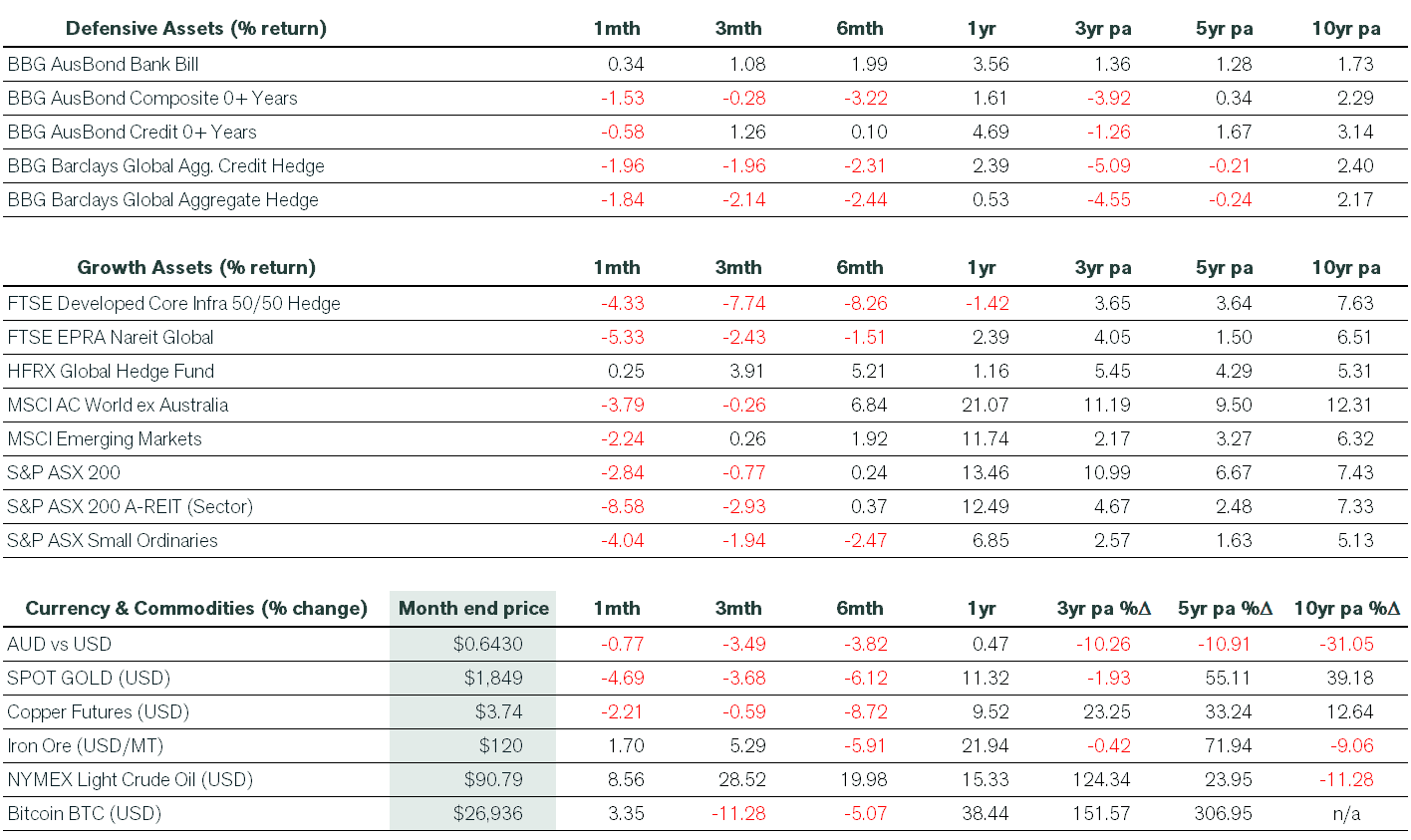

Financial markets took another leg down in September as investors came to grips with the narrative that the US Federal Reserve (the Fed) would need to keep interest rates higher for longer. Excluding dividends and share buybacks, the benchmark S&P 500 was down 4.9% in September, the Dow Jones Industrial Average decreased 3.5%, while the tech-heavy Nasdaq slumped 5.8%. This weakness was not limited to the US, as global indices across developed and emerging markets fell. However, a silver lining for unhedged Australian investors was the Australian dollar trading lower throughout September, partly insulating them from the losses.

In local shares, the ASX could not maintain its momentum from a rally in late August, with the S&P/ASX 200 index falling 2.8% after accounting for dividends. Small caps fared comparatively worse, posting a 4% decline. However, these moves paled compared to the 8.6% drop in listed property stocks, where rising risk-free rates revived valuation concerns and detracted from the impressive rally in A-REITs at the beginning of the financial year.

Fixed interest returns disappointed defensive investors, where exposures to safe-haven cash and high-grade credit continue outperforming government bonds. The ongoing large quantum of debt issuance by the US Treasury is proving to be an overhang. Finally, an extension of cuts in oil production by Saudi Arabia and Russia reignited inflation concerns and drove the price of crude above US$90/bbl.

Market Commentary

Global shares accelerated their downward trend in September as the Fed’s ‘higher for longer’ theme rang more loudly in the aftermath of the September FOMC meeting. Upwardly revised economic projections by Fed officials were a case of ‘good news is bad news’, with investors disappointed a further rate hike could occur in 2023 before making way for potentially just two rate cuts in 2024. The Fed’s ongoing resolve to tame inflation was not well received by investors, with matters exacerbated by another lift in oil prices as Russia and Saudi Arabia coordinated their efforts to extend restrictions on output. As a result, transport-related costs were higher during the month.

The malaise in sentiment saw broad declines across major indices, often characterised by poor market breadth as decliners easily outnumbered gainers, culminating in most sectors finishing in the red. Trading volumes decreased significantly, while increased volatility and short positioning became prominent features across financial markets.

Our domestic sharemarket was not spared, as a jump in real yields put listed property to the sword, completely wiping the momentum seen in the sector since mid-July. Global REITs and infrastructure stocks similarly underperformed, with minimal respite to be found outside of energy and value plays.

In fixed-interest markets, the sell-off in US Treasurys continued in earnest, dragging other sovereigns along for the ride, including Australian bonds. Yields at the longer end of the maturity spectrum were particularly hard hit, imposing losses on composite bond indices and stoking anxiety that the bond bear market, which commenced in late 2021 had further to play out. Furthermore, the increase in yields and accompanying strength in the US dollar ensured that the gold sector underperformed.

Economic Commentary

On the economic front, data releases provided support that the US economy was experiencing a period of robust growth in the September quarter. In contrast, Europe was struggling with higher oil prices and an unexpected lift in official interest rates.

In the US, jobs market data remained strong despite a rise in the unemployment rate from 3.8%. Nonfarm payrolls exceeded expectations, and wage growth remained firm while job openings continued to outpace the available workers. Underlying inflation showed further signs of stickiness, and there was a reversal in the favourable base effects seen earlier this year. Notably, the US national debt reached US$33 trillion for the first time in September, while “excess” savings by households from the pandemic had now been depleted. This resulted in growing credit card balances, especially among poorer cohorts.

On the domestic front, the RBA again paused the official cash rate at 4.10% at its September meeting, with the minutes revealing that the central bank was concerned with the impact strong population growth was having on rents and house prices. The monthly CPI indicator for August jumped to 5.2%, as rising fuel and utility prices led to a rebound in inflation from a 4.9% gain in July. It was the first increase in annual inflation since April.

In China, the manufacturing sector finally stopped contracting in September, with key indicators pointing to a slight expansion. Another positive sign was that August retail sales exceeded expectations and accelerated from the previous month, posting the largest increase since May.

How can we help

We hope you find the information useful, and if you want to discuss any details further or discuss your personal investment strategy, then please book a chat here.

Pete is the Co-Founder, Principal Adviser and oversees the investment committee for Pekada. He has over 18 years of experience as a financial planner. Based in Melbourne, Pete is on a mission to help everyday Australians achieve financial independence and the lifestyle they dream of. Pete has been featured in Australian Financial Review, Money Magazine, Super Guide, Domain, American Express and Nest Egg. His qualifications include a Masters of Commerce (Financial Planning), SMSF Association SMSF Specialist Advisor™ (SSA) and Certified Investment Management Analyst® (CIMA®).