Retirement Villages explained

Whether you or a loved one is considering a move into a retirement village, it can be a lot of information to process. Below, I run through some of the main things to know and consider when transitioning to a retirement village, including:

- Occupancy and ownership structures,

- Fees and charges payable,

- Homeownership rules for Centrelink,

- Moving from the retirement village into residential aged care.

What is a retirement village?

Retirement villages are communities that generally provide accommodation, facilities and services to people over 55 and retired from full-time employment. Accommodation varies from independent living in self-contained units to assisted living in serviced units.

The occupancy and ownership structures

There are a variety of occupancy and ownership structures. Still, it is important to know that the most common form of occupancy and ownership structures are:

Leasehold and loan and licence arrangement (84%):

- Leasehold where the resident leases a unit from the village operator, is usually via a lease for 99 years or more. It is registered with the Land Titles Office.

- Loan and licence arrangement where the resident provides the village operator with an interest-free loan in exchange for a license to occupy a unit (mainly offered by not-for-profit organisations). The licence is not registered with the Land Titles Office.

Strata title (11%)

- Strata title where the resident purchases a unit from the village operator or previous resident (mainly offered by for-profit organisations). The resident is the registered owner with the Land Titles Office.

Company title and unit trust (3%).

- Company title structure is where the resident purchases shares in a company that owns the retirement village. These shares give the resident the right to occupy a unit in the retirement village.

Other structures

- A unit trust where the resident purchases units in a trust, and the trustee owns the retirement village.

- Rental arrangements where the resident rents a unit from the village operator under a residential tenancy agreement.

What are the costs, fees and charges?

What you have to pay and when varies based on the structure and agreement you choose, so always be sure to fully understand these before making a decision.

It can be confusing with different names/labels for all of the costs, but in a nutshell, they can be categorised as:

- Entry price/Contribution,

- Ongoing costs,

- Departure/Exit fee.

Entry price/contribution

- Simply the initial entry price paid when the resident moves in.

- It is a one-off payment negotiated between the resident and the village operator or previous resident.

- A common entry contribution is under a loan-lease arrangement where a zero-interest loan is paid to the retirement village on entry.

- Another type of entry contribution that non-profit organisations may charge is a donation payable on entry.

Ongoing cost/fees

- Residents will pay fees to contribute towards ongoing maintenance and management of the retirement village. This amount varies and is usually based on a budget for the entire village and spread across the residents.

- Ongoing fees may also include contributions to a ‘works fund’ for major improvements to the retirement village.

- Depending on the structure, residents may also pay for the cost of separately metered utilities or a shared cost divided among the residents.

- Additional services, which are usually charged on a user-pays basis, can include things such as cleaning, meals, laundry and other personal services. These additional costs are a variable where a resident would only pay for what they use.

- Note that residents may have to continue paying for ongoing maintenance costs after they move out of the retirement village until a new resident moves in. There are limits that apply to these amounts.

Departure/exit fees

- These can be referred to as departure fee, departure refund, deferred entry fees or deferred management fees.

- The exit fee is usually calculated as a percentage per year of either the entry price or resale price up to a maximum percentage. The fee is then often deducted from the money the resident is to receive back.

- The refund of the resident’s capital is determined by the type of legal and financial arrangement.

Homeownership rules for Centrelink purposes

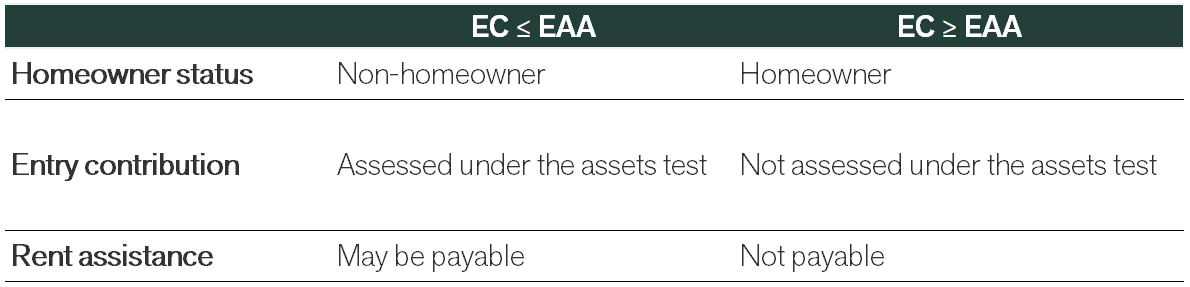

This table sets out the homeownership status, asset test assessment and eligibility for rent assistance which is determined by whether the amount paid as an entry contribution exceeds the extra-allowable amount

To determine whether a resident is considered a homeowner for Centrelink purposes, the entry contribution (EC) is compared with the Extra Allowable Amount (EAA). The EAA is the difference between the homeowner and non-homeowner lower assets test thresholds (currently $242,000).

How can we help?

If you want to discuss your planning strategy to transition to a retirement village, then please get in touch and book a chat with one of our advisers.

Note: The information in this article is current as at 2 October 2023 unless otherwise specified.

Pete is the Co-Founder, Principal Adviser and oversees the investment committee for Pekada. He has over 18 years of experience as a financial planner. Based in Melbourne, Pete is on a mission to help everyday Australians achieve financial independence and the lifestyle they dream of. Pete has been featured in Australian Financial Review, Money Magazine, Super Guide, Domain, American Express and Nest Egg. His qualifications include a Masters of Commerce (Financial Planning), SMSF Association SMSF Specialist Advisor™ (SSA) and Certified Investment Management Analyst® (CIMA®).