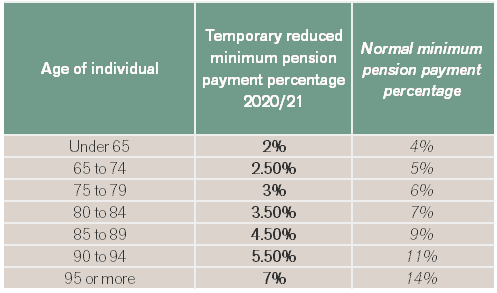

Reduced minimum annual pension payments by 50% for 2020/21

Recent investment market volatility has resulted in the Government implementing reduced minimum annual pension payments with Legislation being passed on 25th March 2020. The thinking behind the change is to give retirees the option to reduce what they are drawing from their superannuation. In doing so, retirees may avoid being forced to sell down depreciated asset holdings and realise capital losses to fund pension payments. The Government has reduced the minimum annual payment by 50% for both this financial year (2019/20) and the upcoming financial year (2020/21).

It is important to note that this is a temporary measure, and at this stage, we will revert to the standard minimum pension requirements in the 2022 financial year.

What are your options?

- Reduce your pension payments

- Do nothing and maintain your current pension arrangements

If you have already drawn the reduced minimum in the current income year you will not be required to take any additional payments. However, from a practical perspective, you may need to contact your fund to confirm you wish to reduce your pension payments accordingly.

Also where you have already received more than the reduced minimum, you cannot get any pension payments you have received over the reduced minimum back into superannuation – (unless you are otherwise eligible to contribute). Important to note that while this legislation allows people to reduce their pension payments to preserve capital, whether you are in a position to reduce pension payments will depend on your individual circumstances and ability to meet ongoing living and lifestyle costs.

Things to note

- It’s important to check with the relevant superannuation fund as to their procedures for nominating a change in pension payment due to the reduced minimums.

- If you have originally nominated to receive the minimum annual payment, you may still need to notify the fund that you wish to reduce their payments to the reduced minimums.

- Many super funds are applying the reduced minimum annual payments in 2020/21 where you have nominated to receive the minimum annual payment last financial year.

- Transfer balance cap implications are of particular interest for those at or close to the $1.6m balance transfer cap. The reduction in the minimums has meant that where a

client with an account based pension (or transition to retirement pension in retirement phase) wants to draw more than the reduced minimums, they can choose to take the additional amount as either a pension payment or a lump sum. Taking the additional amounts as a lump sum can be beneficial for transfer balance cap purposes as lump sum

withdrawals are debits for transfer balance cap purposes.

What action should you be taking?

There is no catch-all answer to this and it really depends on your individual circumstances and financial position. In many cases, you may not want to receive the reduced minimums as you may need the higher payments to meet your living expenses. In this case, you should nominate to receive a higher level of pension payments at the level you require. However, if you are in a position where you do not require the higher level of pension payments due to other savings accounts or reduced spending then by reducing your pension payments warrants consideration. Any reduction will assist in preserving your pension portfolio balance and avoiding drawing down on depreciated asset holdings to fund pension payments.

If you would like to make any changes or need to discuss your options more accurately, please contact your financial adviser and they can assist you as to the best course of action.

Pete is the Co-Founder, Principal Adviser and oversees the investment committee for Pekada. He has over 18 years of experience as a financial planner. Based in Melbourne, Pete is on a mission to help everyday Australians achieve financial independence and the lifestyle they dream of. Pete has been featured in Australian Financial Review, Money Magazine, Super Guide, Domain, American Express and Nest Egg. His qualifications include a Masters of Commerce (Financial Planning), SMSF Association SMSF Specialist Advisor™ (SSA) and Certified Investment Management Analyst® (CIMA®).