October 2025 Economic & Market Review – Markets Climb, Fed Cuts Again, and Rare Earths Rattle Trade

Talking points

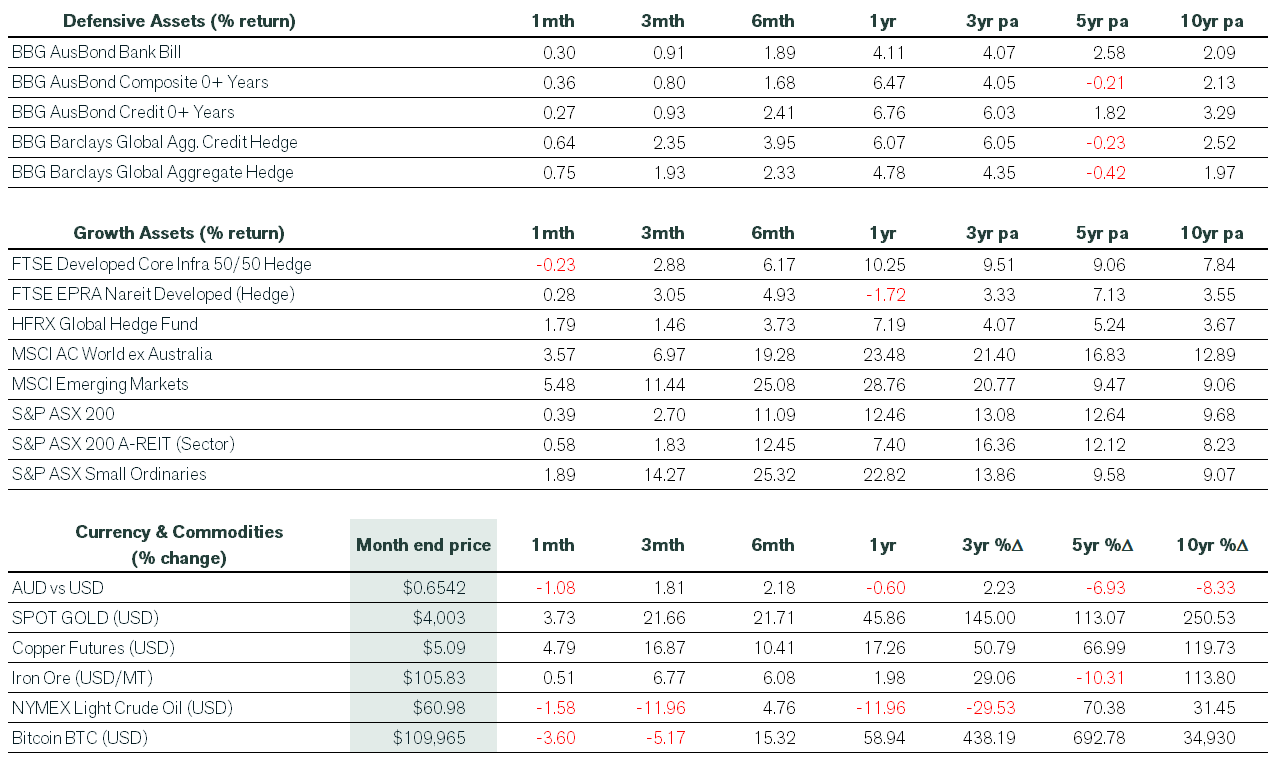

- Markets extended their winning streak: Nearly all major asset classes posted gains in October, despite heightened volatility from trade news and US political gridlock.

- The Fed cut rates again – but sent a hawkish signal: The second straight 0.25% cut to 3.75%–4% kept policy supportive, yet comments about “no guarantee of December relief” sparked a market rethink.

- Equities rallied on earnings strength: The S&P 500 rose 2.3%, marking six months of gains as Q3 earnings grew 10.7% year on year. The “Magnificent 7” accounted for over 80% of returns.

- Trade tensions spiked then eased: China’s rare earth export controls and US tariff hikes shook markets early in the month. A Trump–Xi meeting later calmed sentiment and lifted emerging markets.

- Regional winners emerged: Japan rallied after Sanae Takaichi became the country’s first female PM, signalling fiscal expansion. Latin American markets rose on political clarity in Argentina.

- Australia lagged global peers: The ASX 200 added just 0.4%, as strong resource stocks were offset by an 8.4% drop in technology. Small caps again outperformed large caps.

- Inflation stayed sticky across regions: Australia’s CPI surprised on the upside at 3.2%, US prices rose 3%, and Europe posted modest growth while China cooled. Markets dialled back expectations for further rate cuts.

Market commentary

Financial markets continued their upward trend in October, with almost every major asset class delivering positive returns. The global rally continued despite alarming trade news about China’s export controls on rare earth minerals. Later in the month, the Fed reduced its funds rate by a further 0.25% to a range of 3.75%-4%. Although the US government shutdown remained ongoing, growing inflation risks meant that further rate relief in December was “not a foregone conclusion”. This forced traders to recalibrate their interest rate forecasts, leading to a spike in volatility.

Global equities

Global equity markets successfully navigated the increased volatility seen in October to reach new highs, led by large-cap growth stocks, notably the ‘Magnificent 7’. The month began with the US government shutting down as political opponents failed to agree on key budget initiatives. This resulted in a void of official data and heightened speculation that the labour market could moderate.

Investors were shocked when China expanded its export controls on rare earths and related refining technologies. Trump responded with the imposition of an additional 100% tariff on Chinese imports and export controls on critical software from the US targeting technology/software with strategic significance. A subsequent meeting between Presidents Trump and Xi eased trade tensions and resulted in a reduction in US tariffs on fentanyl and a one-year delay in rare earth export controls.

The unhedged MSCI ACWI ex-Australian index was up 3.6% in Australian dollar terms.

The move was led by US markets, which rallied on robust Q3 earnings (+10.7% y/y for the S&P 500) and mostly positive guidance. Including dividends and in US dollar terms, the benchmark US S&P 500 posted its sixth consecutive gain in October (+2.3%), with the Magnificent 7 contributing more than 80% of the return. The S&P MidCap 400 had a tougher time, delivering investors a loss of 0.5%, while total returns for the SmallCap 600 fell 0.9% over the month. The Dow Jones Industrial Average returned 2.6% in October, while the Nasdaq 100 jumped 4.8%, as robust Q3 earnings saw growth stocks easily outperform their value peers.

Japan was also strong, with the TOPIX rising after Sanae Takaichi became Japan’s first female PM and President of the Liberal Democratic Party. Takaichi aims to pursue expansionary fiscal policies, which the equity market is viewing as broadly positive. The easing of trade tensions later in the month boosted emerging markets, particularly in Korea and Taiwan. In Latin America, a decisive victory by President Javier Milei’s party led to strong performance across its equity markets.

Australian equities

On the domestic front, the ASX 200 underperformed global peers—returning just 0.4% in the month—as investors increased their focus on inflation risks and its ramifications for interest rates. The local market benefited from a rally in the Resources sector (+4.0% including dividends). Energy and Banks were also stronger, but Info Tech slumped 8.4% in October.

Listed property fared slightly better, delivering 0.6%. Meanwhile, the Small Ordinaries again easily outperformed their large cap peers, returning 1.9% in October.

Fixed interest, currencies and commodities

Elsewhere, fixed interest returns were broadly stronger. In credit markets, global high yield modestly outperformed investment-grade. Meanwhile, it was a month of two distinct halves for government bonds. Yields fell sharply in the first half of October amid heightened trade fears and uncertainty about the state of the labour market in key economies. Later in the month, a rebound in yields was driven by disappointing inflation data and concerns over high levels of public sector borrowing.

Economic commentary

Australia

In domestic economic news, the headline unemployment rate for September rose unexpectedly to 4.5% as more workers entered the jobs market. Later in the month, the September quarter CPI figures came in higher than expected, with trimmed mean inflation of 1.0% q/q and 3.0% y/y. Headline inflation rose to 1.3% q/q and 3.2% y/y, driven by fast-rising housing construction costs.

Overall, price rises were broadly based across the CPI basket; however, the removal or reduction of electricity bill subsidies exacerbated pressures. Following the inflation print, many economists walked back their expectations of another rate cut in 2025 (including this one).

United States

The Fed cut interest rates for the second consecutive month by 0.25% (to 3.75% ̶ 4%) by a 10-2 vote, with 1 vote for no change and 1 vote for a 0.50% rate cut. Markets characterised the move as a ‘hawkish cut’ and pared back expectations for another move at the December meeting.

The US CPI increased 0.3% in September and by 3% over the last twelve months. Meanwhile, the Beige Book for October revealed opportunistic price hikes were occurring due to the reduced competition triggered by higher import tariffs.

Rest of the world

Elsewhere, China’s official Non-Manufacturing PMI was virtually unchanged in October. The data highlighted weakening economic momentum since July, weighed down by the property sector and global trade headwinds. There were contractions in new orders, employment and foreign sales. On the Continent, the Euro Zone economy expanded by 0.2% in the September quarter and by 1.3% over the year, which was slightly above expectations. Spain (+2.8%) led the major economies over the twelve-month period, followed by France (+0.9%), Italy (+0.4%) and Germany (+0.3%). Finally, annual inflation in the UK remained steady at 3.8% in September, while GDP growth in August inched higher by 0.1% m/m.

Pete is the Co-Founder, Principal Adviser and oversees the investment committee for Pekada. He has over 18 years of experience as a financial planner. Based in Melbourne, Pete is on a mission to help everyday Australians achieve financial independence and the lifestyle they dream of. Pete has been featured in Australian Financial Review, Money Magazine, Super Guide, Domain, American Express and Nest Egg. His qualifications include a Masters of Commerce (Financial Planning), SMSF Association SMSF Specialist Advisor™ (SSA) and Certified Investment Management Analyst® (CIMA®).