November 2025 Economic & Market Review – Fed Expectations Swing, AI Stocks Slip, and Australia Feels the Inflation Hit

Talking points

- Volatility returned as rate expectations shifted: Changing views on the Fed’s December decision and uncertainty created by missing US data pushed markets into choppy trading throughout November.

- Inflation surprises reshaped Australia’s outlook: A higher-than-expected CPI print lifted bond yields and derailed equity returns, leading some economists to forecast an RBA rate hike in 2026 rather than a cut.

- US equities wobbled, then recovered late: The S&P 500 fell as much as 5.7% mid-month before dovish Fed commentary sparked a rebound, ending November slightly positive.

- Market leadership broadened beyond mega-cap tech: While the Nasdaq slipped and several Magnificent 7 stocks declined, mid- and small-cap US indices outperformed, showing a wider base of market support.

- Australian markets underperformed sharply: Local shares fell 2.7% as rising inflation and the expiry of electricity subsidies hit sentiment, while listed property dropped nearly 4% on weakness in major names.

- Bond markets split between global strength and domestic weakness: Global fixed income posted positive returns, but Australian bonds sold off as traders priced out 2026 rate cuts and pushed long-term yields well above US equivalents.

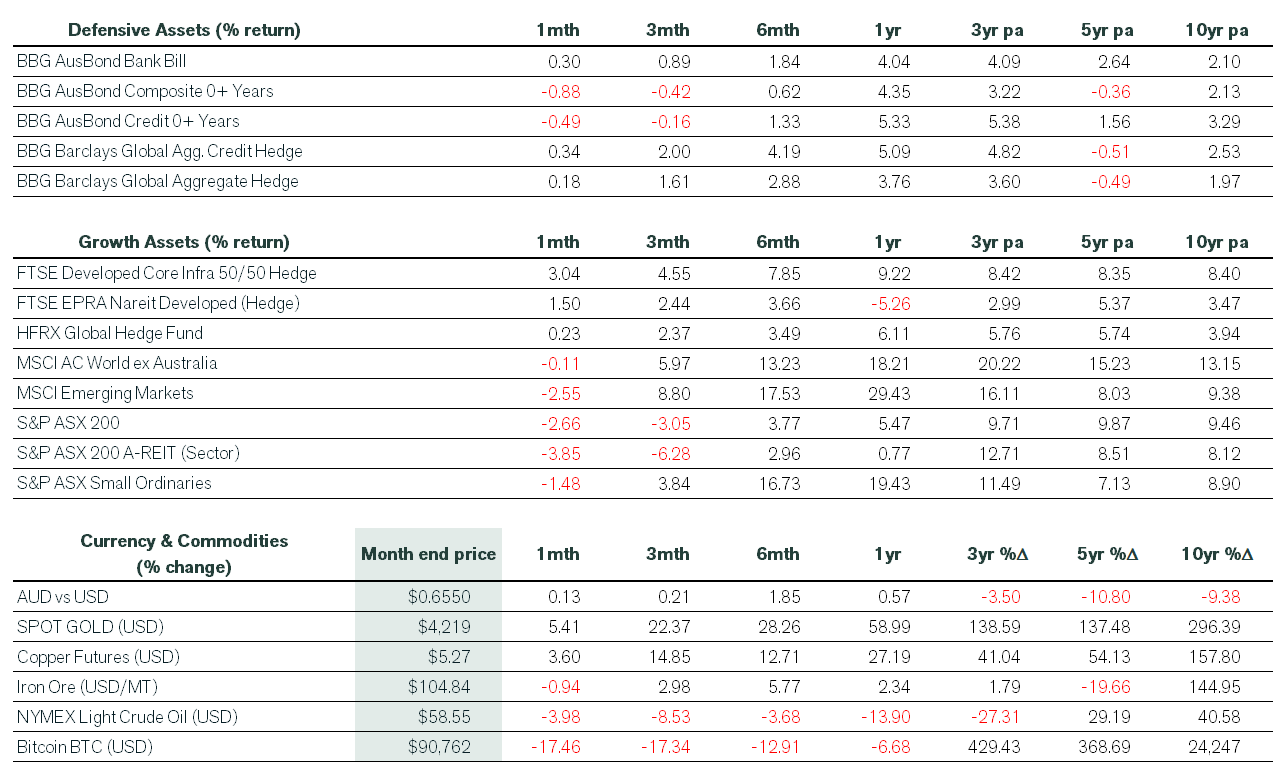

- Commodity and crypto performance diverged: Oil fell on rising supply, precious metals strengthened toward their best year since 1979, and Bitcoin slid as momentum and sentiment turned negative.

Market commentary

Volatility returned to financial markets in November as investors battled with changing interest rate expectations and questioned lofty stock valuations. In a month that saw the temporary end to the record-breaking US government shutdown, markets were none the wiser as to the current state of the US economy, with important jobs and inflation data postponed until mid-December. Meanwhile, higher-than-expected domestic inflation data derailed returns across Australian shares and bonds, with some analysts now expecting an increase to the RBA cash rate in 2026.

A late rally on growing optimism that the US Federal Reserve (the Fed) will cut interest rates at its December meeting saw developed market global shares finish the month about even.

Global equities

As sentiment soured, the S&P 500 at one point declined 5.7% from its October high, its largest retracement since the tariff-related slump in early April. Subsequent dovish remarks by key Fed officials placed a December rate cut back on the agenda, driving a strong recovery into month-end.

Including dividends and in US dollar terms, the S&P 500 posted its seventh consecutive monthly gain, up 0.3%, and the Dow Jones Industrial Average returned 0.5%. Meanwhile, the tech-laden Nasdaq fell 1.6% (ex-dividends), as cracks started to appear in the AI narrative. The Magnificent 7 stocks were mixed, with four of the group falling nearly 5% in November. Emerging markets also struggled, losing -2.6%.

While the S&P 500 was unable to post a new closing high for the month for the first time since May, its return drivers broadened, with the S&P MidCap 400 and S&P 500 equal weighted indices delivering total returns of around 2%. The S&P SmallCap 600 outperformed its larger cap peers, producing a total return of 2.7% in November.

As an aside, in the month of December, the S&P 500 has historically posted gains 72% of the time—the best rate of any month.

Australian equities

On the domestic front, the ASX 200 underperformed peers—and by some margin—finishing the month down -2.7%. Returns were dented by an unwelcome rise in consumer inflation that coincided with the cessation of temporary electricity subsidies. Listed property trusts also underperformed, losing -3.9%, driven by a -10% decline in sector-giant Goodman Group.

Fixed interest, currencies, commodities, crypto

Global fixed interest returns finished November in positive territory, easily outperforming the domestic bond sector after its inflation shock. Australian 10yr government bond yields ended the month above 4.5%, as futures traders abandoned expectations for an RBA rate cut in 2026.

Amid these cross-currents in sentiment, global bond markets eked out small positive returns in November. Yield curves steepened, but expectations around longer-term US inflation remained in check.

The same could not be said for domestic fixed interest, which was broadly weaker over the month. Money markets reacted to disappointing Australian CPI data that pushed long term yields higher, and well above equivalent maturities in US bond markets.

Elsewhere, crude oil posted another monthly decline on increased supply, while precious metals were stronger and remained on target to deliver their best annual return since 1979. Bitcoin, on the other hand, fell victim to a sharp negative shift in sentiment and momentum, seeing its price fall sharply over the course of the month.

Economic commentary

Australia

In domestic economic news, the RBA kept interest rates on hold at its November policy meeting and said it now expects consumer prices to peak at 3.7% in June 2026. This prompted traders to remove positions for a rate cut next year, while some economists warned that the cash rate would need to be lifted to bring inflation under control.

Complicating matters, the annual CPI for October jumped to 3.8%, well ahead of expectations and above the RBA’s recently revised peak estimate. This was the first release of a complete monthly CPI report, however, the RBA said it would still focus on the quarterly inflation report for now.

United States

The resolution (for now) of the US government shutdown allowed for the release of long-awaited employment statistics for September. Jobs growth was well ahead of consensus, but seen as outdated.

Adding to the data void, the Bureau of Labor Statistics announced that it will not publish an October employment report, instead incorporating those payrolls figures into its November report and delay its release until after the Fed’s final meeting of the year.

Key inflation data met a similar fate, while calls for the Fed to push back its policy meeting fell on deaf ears. Notably, private data releases relating to job cuts and consumer sentiment were disappointing, and highlighted that risks of stagflation in 2026 could not be ruled out.

Rest of the world

Finally, the European Commission upgraded its 2025 growth forecast for the Eurozone economy to 1.3%, up from its 0.9% projection in its spring forecast. Growth is then expected to slow slightly to 1.2% in 2026, before rising to 1.4% in 2027. They noted that economic activity exceeded expectations in the first nine months of the year, supported by a surge in US exports as companies stocked up ahead of Trump’s tariffs, and stronger-than-expected investment in equipment and intangible assets.

How can we help?

Want to understand what this mean for your portfolio? Get in touch with our team here.

Pete is the Co-Founder, Principal Adviser and oversees the investment committee for Pekada. He has over 18 years of experience as a financial planner. Based in Melbourne, Pete is on a mission to help everyday Australians achieve financial independence and the lifestyle they dream of. Pete has been featured in Australian Financial Review, Money Magazine, Super Guide, Domain, American Express and Nest Egg. His qualifications include a Masters of Commerce (Financial Planning), SMSF Association SMSF Specialist Advisor™ (SSA) and Certified Investment Management Analyst® (CIMA®).