My thoughts on Pocket Money

Just like any other parenting choice, the topic of pocket money is one that chocks up the online forums, and everyone has an opinion.

Our kids are now at the age where pocket money has entered the chat, and the extra pressure to get it right as we are both financial advisers always weighs heavy! I thought it would be worth sharing my thinking about this, and maybe you can take some ideas away for your own family.

It is essential to first form your family philosophy—the actual mechanics can be very simple, but as we know, the emotional and psychological underpinnings of money are far from it. Some questions to think of as a family:

- Does pocket money need to be earned, or is it a UBI style set amount per week?

- If earned, how is it earned?

- How much is appropriate?

- How will your children know the value of money once received?

- Will your children be required to purchase some of the ‘extras’ normally purchased by parents?

- Will you set incentives for the use of money, e.g. extra dollars if it is saved, invested or donated rather than spent straight away?

- Are there lessons you want to impart on trading time for money, or producing something of value for money? For example, you may say, ‘Do X job for the household for X dollars’, or something like ‘Can you figure out a way to save X in electricity/groceries? And if you do, then you can have half the difference per month’.

On the topic of kids starting an income producing business, I would put it outside the realm of “pocket money”, but it is also worth discussing.

I know personally, I would like my kids to learn they need to put in work to be able to earn money, but I also don’t want them asking for each basic household task, ‘Will I get money for this?’ (This actually happened, and it horrified me).

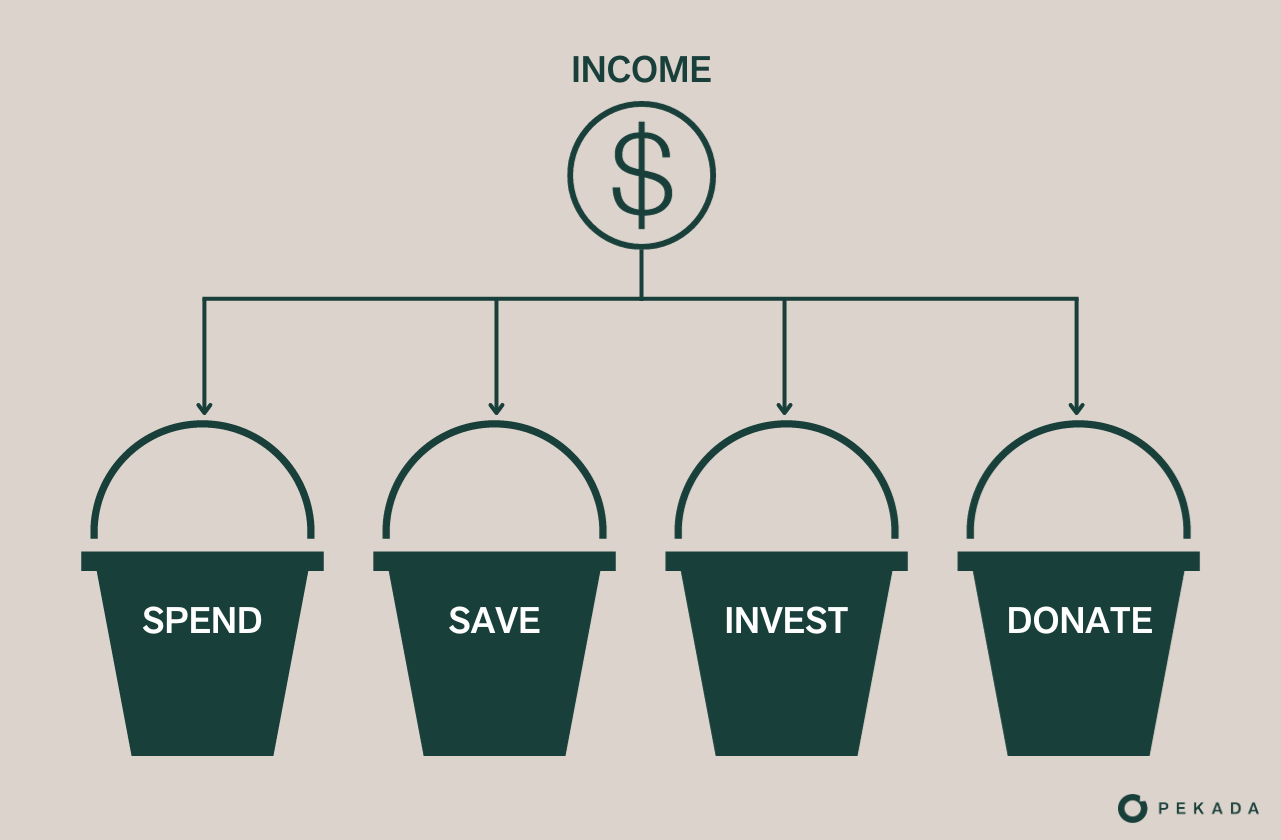

I love the bucket strategy of spend, save, invest, donate – as this mindset can carry them right through to adulthood and spawns many subsequent lessons along the way. I will also try to mimic the different real life implications of saving, investing and donating—the earnings and tax deductions—that the dopamine hit of extra money or helping people can be just as strong as the instant gratification of spending immediately.

Another concept I love is getting older kids involved in your household budget to help look for savings that they can get a piece of/benefit out of. I have heard a great story about a teen shopping around the internet and utilities and creating a family meal plan that saved enough for them in bills and groceries to take a family holiday. Great lessons in budgeting, but also saving money on commodity-style items to direct to things that bring you joy.

Would love to hear any tips from readers as to things you felt work with your kids or grandkids or something maybe your parents did that sticks with you, and please email them through to rhiannon@pekada.com.au!

Rhiannon is the co-founder and leads the strategy & compliance board of Pekada. She is a qualified financial adviser based in Melbourne, and has been advising since 2006. Rhiannon is passionate about helping everyday people benefit from the opportunities which come from a great financial plan. She has been featured as an expert in the Australian Financial Review, Super Guide and Professional Planner.