May 2025 Economic & Market Review – Trade Progress, Earnings Strength, and Shifting Rates

Talking points

1. Markets moved higher: Improved trade talks and a major U.S. spending bill helped lift investor sentiment. Most markets finished the month stronger, including a 6% rise in the US S&P 500.

2. Tech back in the lead: Technology stocks bounced back with strong earnings, helping growth stocks outperform value. This was a key driver of the market’s gains in May.

3. The RBA cut rates again: Australia’s central bank lowered rates for the second time this year. Talk of a larger cut ahead gave local markets a boost, especially sectors like tech and consumer-related stocks.

4. Small caps and emerging markets recovered: Improved earnings and better trade sentiment helped smaller companies and emerging markets post solid returns after a shaky April.

5. Mixed signals from bond markets: Australian bonds performed well on dovish rate outlooks. However, globally, bond markets were more cautious as concerns about inflation and increased debt issuance prevailed.

6. Inflation is slowing—but questions remain: In the US and Australia, inflation has eased. However, weak retail sales and consumer sentiment in the US indicate that caution remains in the air.

7. Global central banks moving in different directions: Japan may raise interest rates soon due to rising food prices. Meanwhile, Europe appears poised to cut rates, underscoring the uneven global outlook.

Market commentary

After a tumultuous April, financial markets were relatively subdued in May, with most equity markets continuing to push higher. News of newly agreed US trade deals, revisions to the initial tariffs, and a ruling that the tariffs may not be legal dominated the headlines.

Late in the month, the release of the ‘One Big Beautiful Bill’ took the spotlight. The new spending bill will entrench previous tax cuts while also looking at a variety of spending cuts to pay for them. The net result is likely to see deficits in the US exceeding 5% for at least the next decade, an outcome that markets have cautiously accepted to this point, notably in the US bond markets, where bond yields have pushed higher.

This all contributed to investor sentiment continuing to improve and helped the US’s S&P 500 post its strongest May since 1990, rising just over 6%. A key driver of this move was the bellwether Technology names, which have seemingly returned to favour after a solid Q1 earning season. This also helped growth stocks to outperform their value-oriented peers.

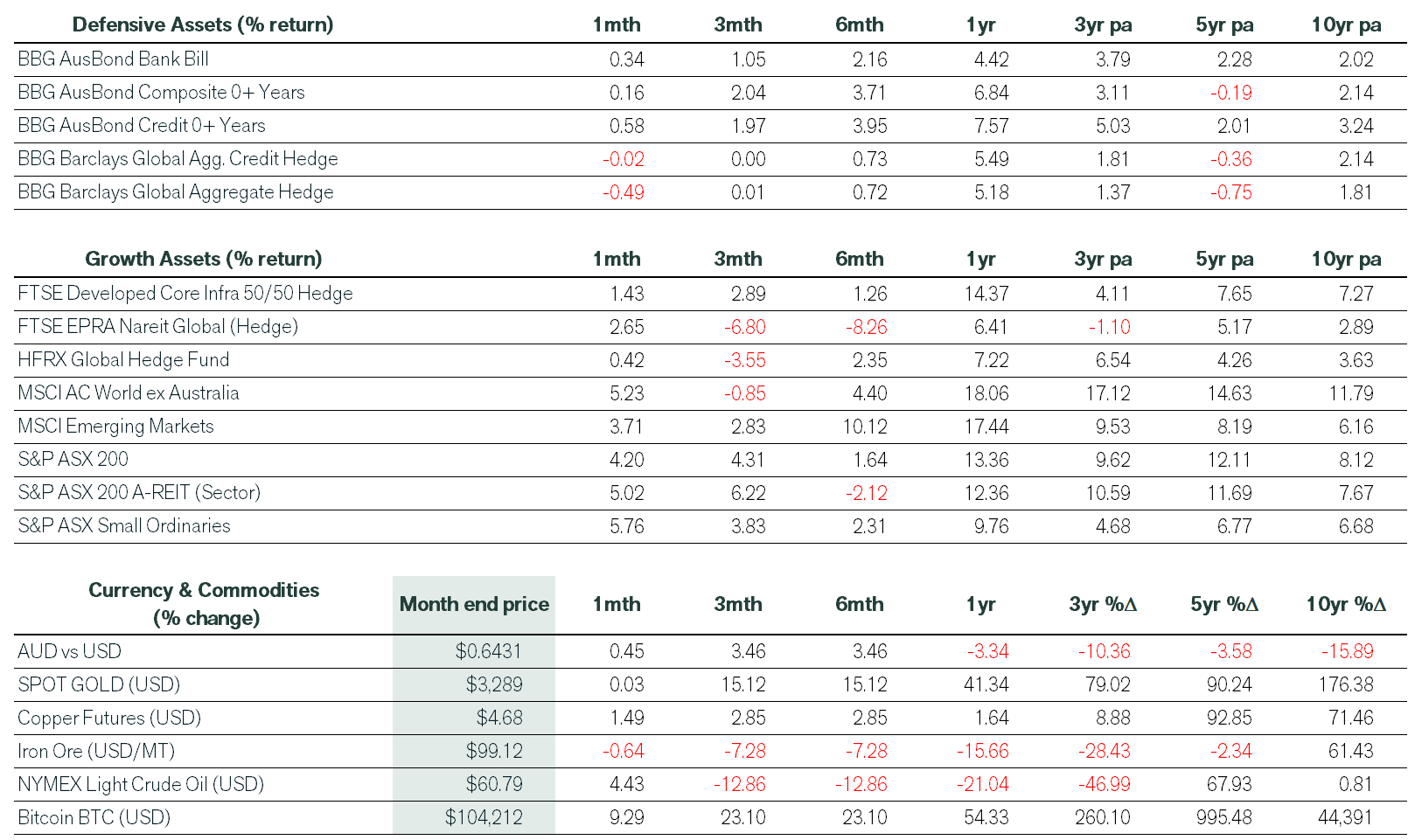

It also contributed to a similar, albeit slightly lower, rise in the Global indices, with the unhedged MSCI ACWI ex-Australian index up 5.41%. Hedged investors saw an even better outcome as that version of the same index rose 5.75% on the back of the rise in the Australian dollar. Emerging Markets also enjoyed a good month, with weakness in the USD and improved sentiment to tariff discussions helping them rise 3.7%.

Small Caps also enjoyed a strong month, with their performance fuelled by a positive Q1 earnings reporting season that helped retrace many of the sharp ‘Liberation Day’ declines. Closer to home, the local market continued its rise, as the ASX again tested its all-time highs. Finally, the Australian dollar enjoyed another solid month, ending just shy of 65 cents against the US dollar.

Domestically, the focus early in the month was on the federal election that saw Labor comfortably return with an increased majority. However, attention quickly turned to the RBA as it looked to cut rates for the second time in 2025, having commenced its easing cycle in February. Although the cut was widely expected, with inflation having returned to its targeted band of 2-3%, subsequent commentary from the RBA Governor that the board had discussed a 50bps cut gave markets another boost.

After a strong recovery in the back end of April, the ASX 200 continued to rise through May, seeing it ultimately end the month up 4.2%. The move higher was also led by the technology sector which was up 18.8%. Cyclicals also saw a strong month on the back of the RBA’s interest rate cut. The banks performed broadly in line with the index although this outcome was dominated by the continued strong performance of CBA. At the other of the spectrum were the traditional defensive sectors like Utilities and Consumer Staples which lagged the index but still delivered positive absolute returns.

Outcomes across the fixed income markets were more mixed, with longer date duration assets underperforming credit as credit spreads continued to tighten from their April highs. Domestic bonds outperformed their global peers, as the more dovish interest rate outlook from the RBA led to longer-dated yields continuing to fall. Offshore, concerns in the US about increasing issuance, rising inflation in Japan, and increased fiscal spending in Europe led to a decline in global bonds, although strong results in global corporate bonds offset this.

Elsewhere, gold saw a softer month as investor sentiment continued to improve, remaining broadly unchanged over the month.

Economic commentary

Australia

In domestic economic news, the continued fall in inflation to within the RBA’s band locked in the widely anticipated 25bps cut. Less expected however, was the RBA’s downward revisions to future inflation in the coming years. Across the rest of the economy, the recent trend of better-than-expected data continued, as consumer confidence rose, albeit to still suppressed levels, while employment remained robust and unemployment remained steady at 4.1%.

United States

The US kept interest rates unchanged at its May meeting as it sought to adopt a cautious approach to the current tariff situation and its potential impact on inflation. At this point, US inflation looks to remain under control with the April CPI print coming in slightly lower than expected at 2.3% and 2.8% on a core basis, to hit its lowest level in four years. Elsewhere across the US economy, data was mixed, with unemployment remaining steady at 4.1%. At the same time, weaker-than-expected retail sales and consumer sentiment signalled the uncertainty and caution that tariffs are creating.

Rest of the world

Elsewhere, Japanese inflation took the spotlight as it rose more than expected (to 3.5%, 3.4% on a core basis) on the back of surging rice prices. The result increased the likelihood of a near term interest rate hike, with BoJ governor, Ueda, signalling a desire to increase rates, although any shift would need to reflect the potential negative impact of tariffs. Conversely, the European Central Bank appears ready to cut rates at Its June meeting, as preliminary data suggests inflation is falling below the ECB’s 2% target. Meanwhile, weaker economic indicators throughout May indicate that growth remains under pressure across the Eurozone.

Want to chat about your personal investment strategy or have some questions?

If you want to discuss any of the above information or your personal investment strategy, then book a chat with your financial adviser here.

Pete is the Co-Founder, Principal Adviser and oversees the investment committee for Pekada. He has over 18 years of experience as a financial planner. Based in Melbourne, Pete is on a mission to help everyday Australians achieve financial independence and the lifestyle they dream of. Pete has been featured in Australian Financial Review, Money Magazine, Super Guide, Domain, American Express and Nest Egg. His qualifications include a Masters of Commerce (Financial Planning), SMSF Association SMSF Specialist Advisor™ (SSA) and Certified Investment Management Analyst® (CIMA®).