Magellan’s Global Equity Retail Funds Restructure explained

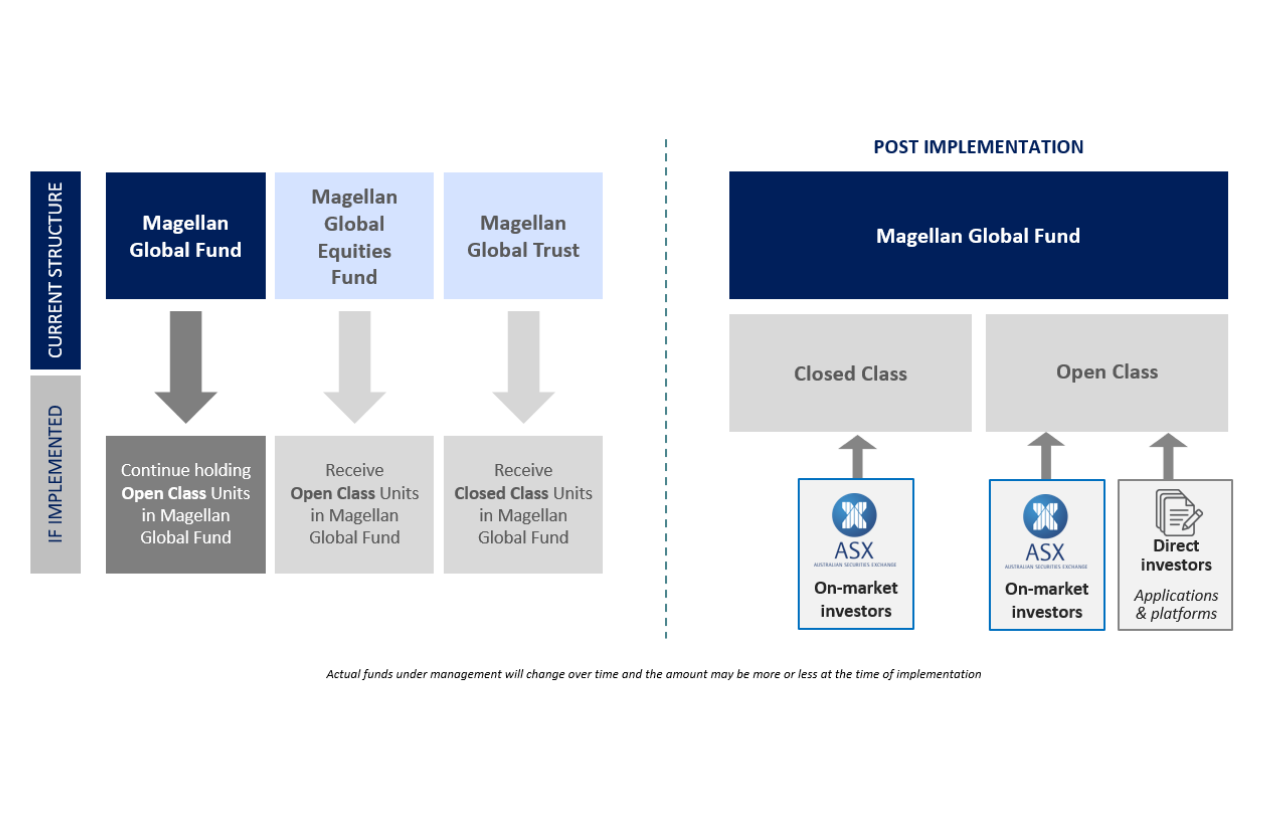

The Restructure is a proposed series of transactions which will have the effect of consolidating three of Magellan’s existing global equities retail funds, being the Magellan Global Fund, MGE and MGG into a single trust (the Magellan Global Fund) which has two unit classes: an Open Class and a Closed Class.

Post-Restructure MGF Partnership Offer and Bonus MGF Options Issue

Should the Restructure proceed, and subject to the necessary regulatory approvals, Magellan intends to undertake a $1 for $4 offer to subscribe for Closed Class Units and issue of bonus options. As part of Magellan Financial Group’s partnership approach with investors in Closed Class Units and to minimise dilution, Magellan Financial Group will fund both the 7.5% additional Closed Class Unit partnership benefit and the 7.5% MGF Option exercise price discount.

Product disclosure statements for the MGF Partnership Offer and Bonus MGF Option Issue are expected to be lodged with ASIC in January 2021.

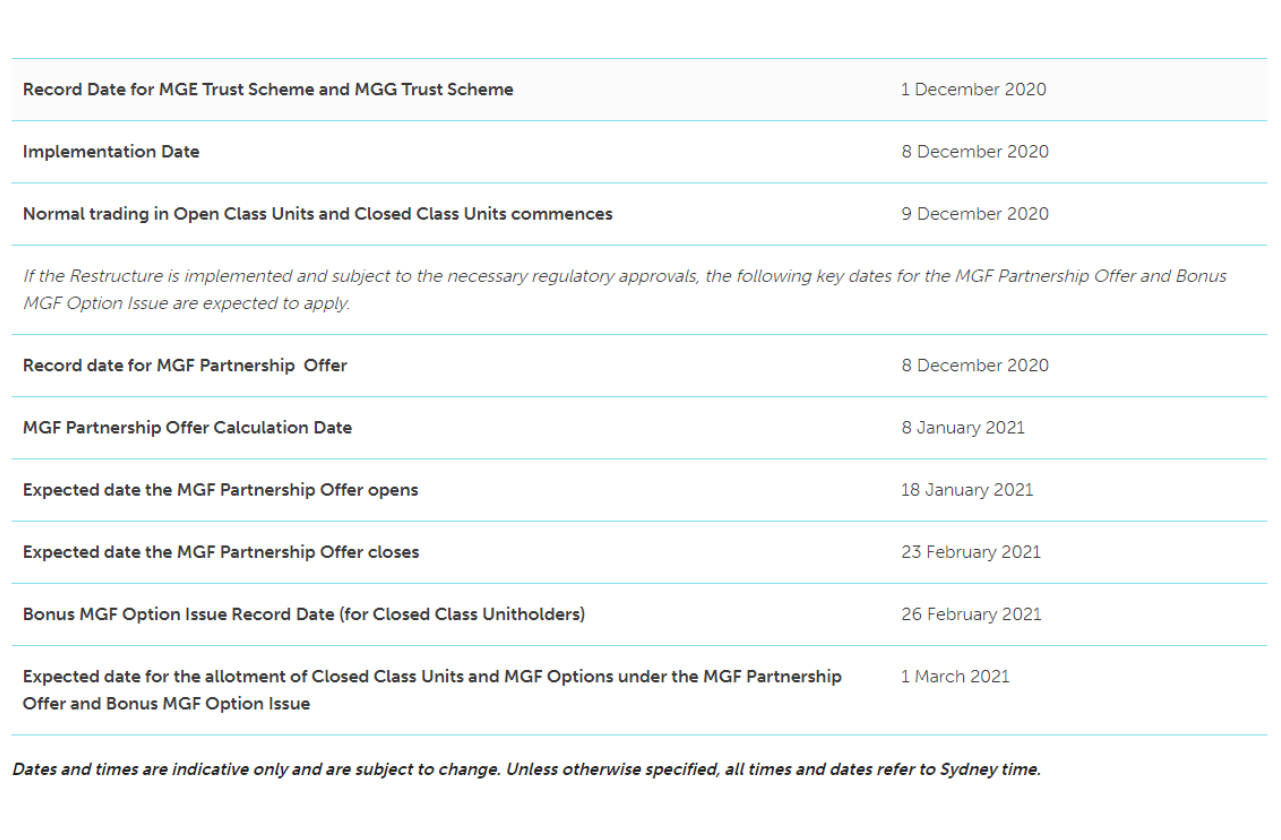

To be eligible to participate in the MGF Partnership Offer, you must be a unitholder in Magellan Global Fund on the record date of 8 December 2020. Entitlements under the MGF Partnership Offer will be determined on the Calculation Date which is expected to be 8 January 2021. To be eligible to participate in the proposed Bonus MGF Option Issue, you must be a Closed Class Unitholder in Magellan Global Fund on the Bonus MGF Option Issue Record Date, expected to be 26 February 2021.

The Bonus MGF Option Issue is only available to eligible Closed Class Unitholders and will not be offered to Open Class Unitholders.

Key dates:

Full details can be found at Magellan’s website, however if you have any queries you can also contact your financial adviser.

Pete is the Co-Founder, Principal Adviser and oversees the investment committee for Pekada. He has over 18 years of experience as a financial planner. Based in Melbourne, Pete is on a mission to help everyday Australians achieve financial independence and the lifestyle they dream of. Pete has been featured in Australian Financial Review, Money Magazine, Super Guide, Domain, American Express and Nest Egg. His qualifications include a Masters of Commerce (Financial Planning), SMSF Association SMSF Specialist Advisor™ (SSA) and Certified Investment Management Analyst® (CIMA®).