July 2023 Economic & market review - Market resilience thanks to tech strength and central bank moves

July 2023 Economic & market review – Market resilience thanks to tech strength and central bank moves

Talking Points:

- Market Rebound After Initial Weakness: Despite a weak start to the month, the markets regained their composure and staged a strong rally in July.

- Tech Sector Dominance in US Markets: The tech sector in the US continued its strong performance, with the Nasdaq Composite posting its fifth straight monthly gain.

- Global Economic Data and Bond Market Reactions: Resilient GDP prints and improved inflationary data were well received by bond markets following a sharp sell-off in the first half of July. The US Fed’s rate hike and the expectation of limited additional tightening provided investors with increased comfort, leading to relatively flat global bond performance.

- Recovery in Global Stocks and Commodity Prices: Global stocks rebounded in the second half of July, with emerging market equities and small caps leading the way. Commodity prices also saw a recovery, with the Bloomberg Commodity Index lifting by 6.3% over the month.

- Central Bank Actions and Interest Rate Expectations: Central bank actions played a significant role in market dynamics. The RBA paused its official cash rate after consecutive rate hikes, citing concerns about low labour productivity. The European Central Bank (ECB) raised rates in July, but weak economic activity in Europe led to expectations of a pause in September. In the UK, strong wage data fueled expectations of further interest rate hikes by the Bank of England.

Summary:

Despite a weak start to the month as bond yields surged and equities sold off, markets regained their composure and staged a strong rally in July. Emerging market equities led the way, as China’s authorities gave the strongest indication yet that stimulatory measures would be implemented to ensure this year’s growth target would not be missed. Oil markets were a beneficiary of the news, as previously announced production cuts also took effect. Elsewhere, global and domestic shares were led higher by small caps and property stocks – areas of the market that have underperformed over the last year.

Meanwhile, in the US, it was more of the same as the tech sector went from strength to strength. The Nasdaq Composite posted its fifth straight monthly gain, with artificial intelligence once again the primary driver. The benchmark S&P 500 and Dow Jones Industrial indices also performed strongly but failed to match their tech counterparts.

Bond markets welcomed resilient GDP prints and improved inflationary data following a sharp sell-off in the first half of July. Along with a further hike in the US Fed Funds Rate to 5.5%, in line with expectations, investors gained increased comfort that additional tightening would be unlikely. Global bonds finished the month broadly flat, while credit markets held firm as signs of distress were contained to known areas, such as commercial real estate.

Market Commentary

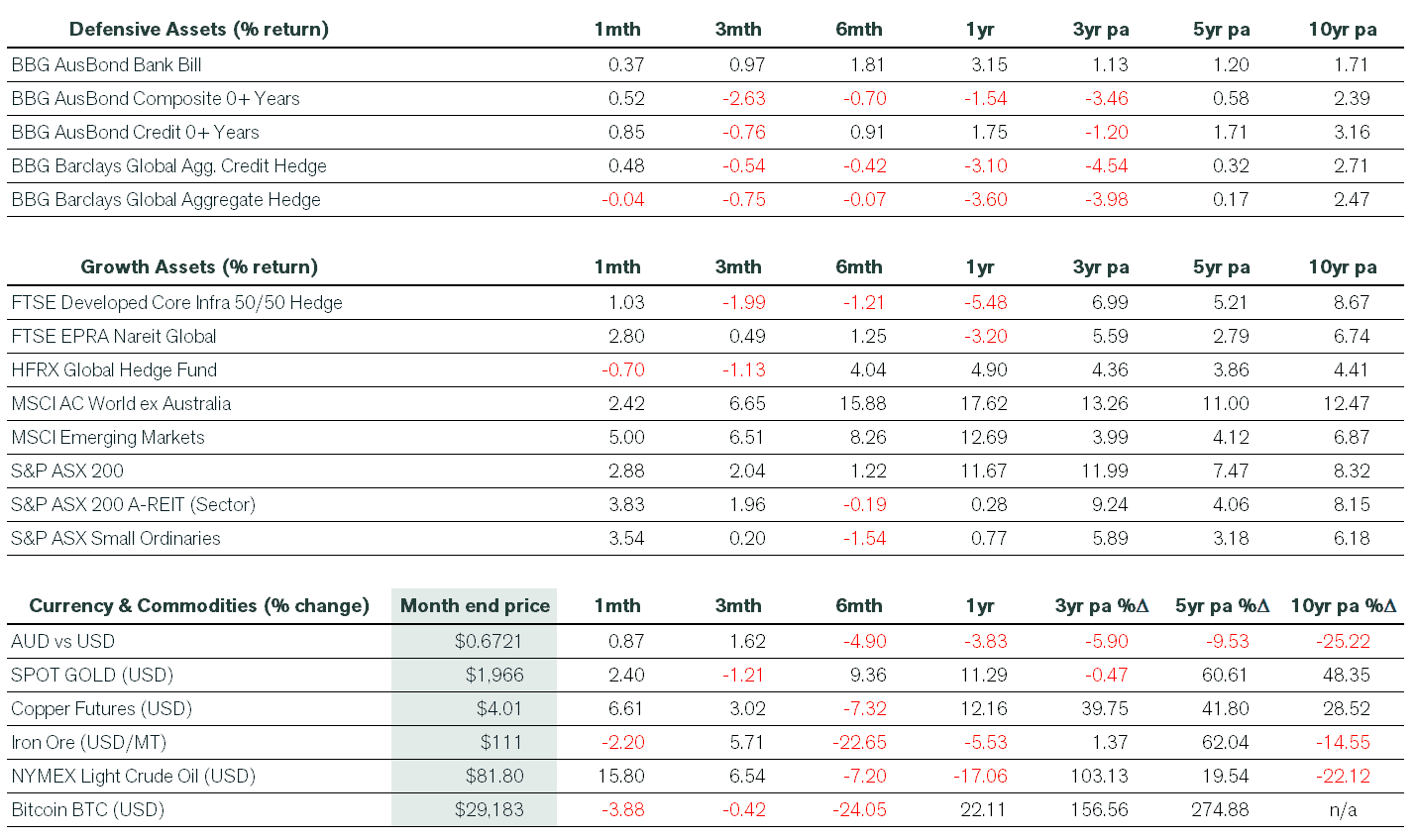

Global stocks rebounded in the second half of July, with the MSCI All Country World ex Australia Index up 2.4% in Australian dollar terms. While the US led developed markets higher, small caps and emerging market equities stole the show, with the latter finishing up 5% over the month. Australian investors enjoyed a 10% return from China, partly reversing double-digit losses that have been incurred in the first half of 2023. Some policy easing by China’s authorities and hopes for significant new stimulus were behind the gains.

Japanese equities remain the top-performing regional market in 2023 but underperformed in July. The TOPIX gained a more modest 1.5% in local currency terms as the Bank of Japan loosened its yield curve control framework. Some investors fear that the stage is now set for further adjustments that would push discount rates higher. On the ASX, a broad-based rally was underpinned by a rebound in the banks and consumer-facing sectors as interest rates remained on pause at the RBA’s July Board Meeting. Utilities performed strongly, while Healthcare was again weaker.

Global fixed income was volatile throughout July but finished the month largely unchanged as weakness in US Treasuries and European government bonds was offset by upward moves in most other regions, including Australia. Credit spreads tightened on improved economic data, thereby boosting returns and reducing losses incurred over the previous three-month period. It was a similar story for commodity prices, with some year-to-date losses being reversed in July. The broad Bloomberg Commodity Index lifted by 6.3% over the month. Higher oil prices and Russia’s cancellation of the Black Sea grain export deal buoyed the prices of certain soft commodities.

The Australian Dollar rallied against the US Dollar in early July, rising 3.8% due to momentum and lower-than-expected US CPI data. This rally faded in the second half of July to finish the month up 0.8%.

Economic Commentary

Despite data that showed US manufacturing was continuing to contract, the world’s largest economy strengthened on a booming services sector. First quarter growth was revised upward and slightly faster growth was revealed in the advanced estimate for second quarter GDP. This came despite the signs of slowing in the jobs market as June nonfarm payrolls missed expectations for the first time in over a year. The key data print for the month was the June CPI, which fell by more than expected. While core CPI remained stickier downward, US Fed Chair Powell’s current preferred inflation measure (core services ex housing) fell to just below 4% over the year.

On the domestic front, the RBA paused the official cash rate in July, having raised rates in May and June. The move came hot on the heels of weaker monthly inflation data. The RBA reiterated its concerns around low levels of labour productivity, but noted that wage growth currently remained consistent with its long term inflation target. A stronger than expected jobs market report for June led to expectations of further rate hikes by markets and economists alike. However, markets reversed course when the June quarter consumer inflation figures came in below consensus.

Finally, the European Central Bank (ECB) raised rates in July to 3.75%, in line with its guidance. Weak economic activity throughout key parts of Europe saw markets increase bets that the ECB would pause in September. Meanwhile, UK wage data remained strong and further interest rate hikes by the Bank of England were priced in by money markets. The peak is now expected to reach 6% in 2023.

How can we help

We hope you find the information useful, and if you want to discuss any details further or discuss your personal investment strategy, then please book a chat here.

Pete is the Co-Founder, Principal Adviser and oversees the investment committee for Pekada. He has over 18 years of experience as a financial planner. Based in Melbourne, Pete is on a mission to help everyday Australians achieve financial independence and the lifestyle they dream of. Pete has been featured in Australian Financial Review, Money Magazine, Super Guide, Domain, American Express and Nest Egg. His qualifications include a Masters of Commerce (Financial Planning), SMSF Association SMSF Specialist Advisor™ (SSA) and Certified Investment Management Analyst® (CIMA®).