January 2026 Economic & Market Review – Geopolitics Escalate, Currencies Swing and Equity Leadership Broadens

Talking points

- Geopolitical tensions spiked, then eased: Escalation involving Venezuela, Iran and renewed tariff threats tied to Greenland unsettled markets early, before softer rhetoric restored investor confidence.

- Currency moves dominated investor outcomes: US dollar weakness lifted local-currency global equity returns, but a stronger Australian dollar pushed unhedged returns into negative territory for domestic investors.

- Emerging markets surged on cyclical recovery: A weaker US dollar and improving global growth expectations drove strong gains across Asian technology markets and key commodity producers.

- US equity leadership broadened: Investor confidence in economic momentum shifted returns away from mega-cap growth toward small and mid-caps, cyclicals and equal-weight indices.

- Resources outperformed as real assets rallied: Energy and materials led equity markets, supported by sharp gains in oil and metals amid geopolitical risk and inflation concerns.

- Australian markets advanced, but rate fears weighed: Strength in resources lifted local equities and small caps, while A-REITs declined on renewed concerns over domestic interest rates.

- Policy and inflation shaped asset allocation: The Fed paused after late-2025 cuts as US growth stayed strong, while elevated Australian inflation lifted rate hike risks, supporting cash over bonds.

Market commentary

A sharp increase in geopolitical tensions added to what was an already intriguing start to 2026. The US staged a daring raid on Venezuela, capturing its president and asserting de facto control over Venezuelan oil and security policy. This was followed by an escalation of tensions between the US and Iran, after Iranian authorities cracked down violently on anti-government protestors. Elsewhere, President Trump also made further threats to acquire or otherwise control Greenland, announcing he would impose a 10% tariff starting February 1st (rising to 25% by June) on goods from eight European nations due to their opposing stance on the matter. Subsequently, Trump eased his rhetoric on Greenland, and investors breathed a collective sigh of relief.

Global equities

A surge in the Australian dollar throughout January impacted global returns for unhedged domestic investors. US dollar weakness was a key driver of outcomes across financial markets, with the “Aussie” appreciating above US$0.70 in late January before ending the month just below this level.

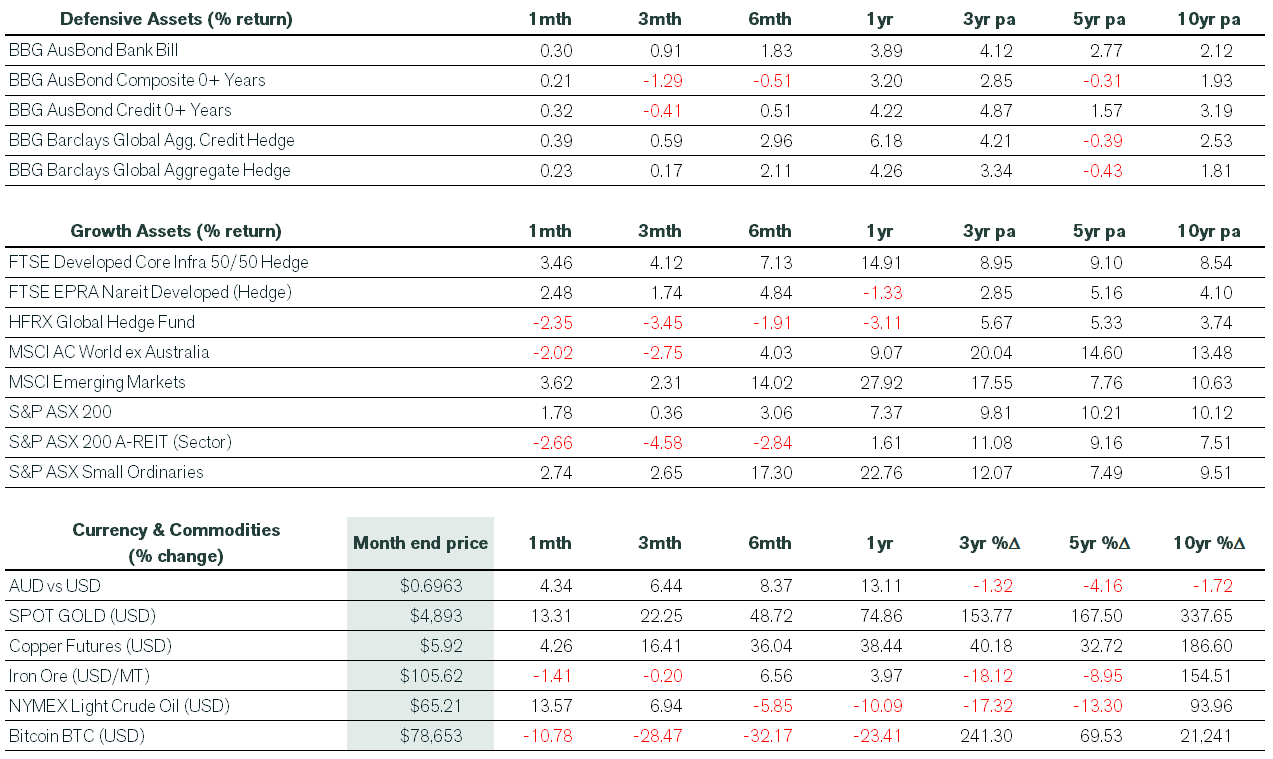

Global equity markets rallied in January when measured in local currency terms, with the MSCI ACWI ex-Australian index up 2.5%. However, the appreciation of the Australian dollar during this period pushed returns for unhedged domestic investors well into the red (-2.0%). The same effect could be seen for global hedge fund performance, where exchange rate movements saw a 2.2% local currency gain morph into a 2.4% loss in Australian dollar terms. Meanwhile, the weak US dollar and more signs of a sustained global cyclical recovery combined with bullish investor sentiment led to another searing rally in emerging market equities (+8.8% in local currency and +3.6% in Australian dollar terms). Performance was again driven by tech-heavy Asian markets (Korea, Taiwan) and key commodity producers (Brazil, Chile), while Mexico revelled on previous policy easing and the weaker US dollar.

US equity markets began 2026 on a positive note, extending the gains seen since mid-November. Returns were characterised by broader participation and underpinned by buoyant earnings growth expectations. A surge in investor interest among small and mid-cap stocks saw equal-weight indices outperform cap-weighted peers, while cyclicals outpaced defensives. This rotation is likely a reflection of investors’ confidence in the strength of the US economy and a search for value away from last year’s winners in the mega-tech and high growth space.

The benchmark S&P 500 index briefly traded above 7,000 in late January and delivered a US dollar-denominated total return of 1.4% for the month. The Dow Jones Industrial Average posted a record high in January, as it delivered a total return of 1.8%. The tech-heavy Nasdaq 100 underperformed peers, posting a 1.2% total return, led by a more modest 0.6% gain for the Magnificent Seven. Among S&P 500 GICS sectors, Energy was the clear winner, producing a 14.4% total return. Materials was the next best performer in the month, up 8.7%.

Australian equities

Australian shares pushed higher and small caps continued to outperform their large cap peers, with a similar pattern observed across key US benchmarks.

Also, further strength in the Resources sector drove the ASX 200 to a 1.8% total return, albeit underperforming the 2.7% outcome seen in the Small Ordinaries. A-REITs finished January in the red, as a modest fall in sector-behemoth Goodman Group was exacerbated by a broad-based sell-off on the back of renewed interest rate fears.

Fixed interest, currencies, commodities, crypto

The impact of global macroeconomic events were felt across financial markets, with searing rallies in crude oil and gold. Meanwhile, crypto took another leg down to begin the year, as speculative demand switched into a host of precious metals.

On the economic front, the US Federal Reserve hit the policy pause button after three rate cuts in late 2025, to add fuel to what could already be a strengthening economy. Domestic fixed interest returns were able to return to positive territory, although, cash continued to outperform the composite bond index as disappointing December CPI data increased the probability of an increase in the RBA cash rate.

Economic commentary

Australia

In domestic economic news, a strong December jobs report quickly unwound the weakness seen in the prior month as the unemployment rate fell to 4.1%. The focus, however, was on the December CPI figures. Annual headline CPI of 3.6% and trimmed mean CPI of 3.4% in the RBA’s closely-watched quarterly data series again exceeded expectations. In the monthly data series, a key contributor was electricity, which rose 21.5% in the year to December. Notably, in the absence of any rebate program, the rise would have been just 4.6%. Annual services inflation was also strong, up 4.1% from 3.6% in November, driven by rents and domestic holiday travel.

United States

In the US, GDP expanded at an annualised rate of 4.4% in the third quarter, with robust growth driven by consumer spending, a rebound in exports and higher government outlays. Notably, the US personal saving rate fell to 3.5% in November 2025, with real personal consumption expenditure per capita growing by 2% from a year ago. Meanwhile, President Trump said he will nominate Kevin Warsh to be the next chairman of the Federal Reserve, prompting mixed views about how readily the incoming central bank leader will shake off his hawkish past and push the board to lower borrowing costs. The announcement on the final trading day of the month resulted in Gold slumping 10%, while Silver plummeted nearly 30%.

Rest of the world

The International Monetary Fund (IMF) upgraded its 2026 global growth forecast to 3.3% as businesses and economies adapt to US tariffs and a continued AI investment boom that has fuelled asset markets and expectations of steep productivity gains. The IMF sees technology investment as boosting activity in the US, Spain and the UK. Among other major economies, the IMF expects China’s 2026 growth to reach 4.5%, down from a stronger-than-expected 5% outcome in 2025. Notably, it also upgraded growth for Japan due to the new government’s fiscal stimulus package. The IMF also said that global inflation was forecast to continue to decline, from 4.1% in 2025 to 3.8% in 2026.

Elsewhere, India’s industrial production accelerated to 6.7% y/y in November, to mark the sharpest pace of expansion since October 2023. The robust outcome pushed back against concerns that aggressive tariff hikes by the US government would drive a sustained slowdown in the Indian economy. However, in early February, Trump agreed on a deal to slash tariffs on India to 18% from the current level of 50% after Modi claimed that India would stop buying Russian oil. The rupee reached a record low in late January as the rebound in oil prices increased domestic US dollar demand for major energy importers. This was then magnified by the record-setting INR 17.2 trillion in borrowing outlined in the new federal budget.

Pete is the Co-Founder, Principal Adviser and oversees the investment committee for Pekada. He has over 18 years of experience as a financial planner. Based in Melbourne, Pete is on a mission to help everyday Australians achieve financial independence and the lifestyle they dream of. Pete has been featured in Australian Financial Review, Money Magazine, Super Guide, Domain, American Express and Nest Egg. His qualifications include a Masters of Commerce (Financial Planning), SMSF Association SMSF Specialist Advisor™ (SSA) and Certified Investment Management Analyst® (CIMA®).