December 2025 Economic & Market Review – Fed Cuts Again, Currencies Shift Returns, and Policy Paths Diverge

Talking points

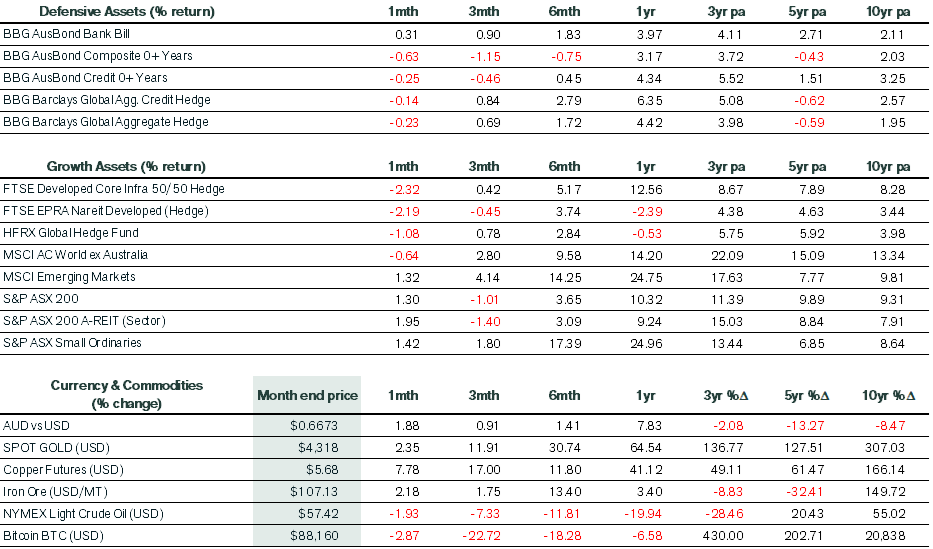

- Markets delivered mixed outcomes in December: Risk assets were mostly higher in local currency terms, while yield-sensitive and long-duration assets fell as interest rate and currency dynamics dominated returns.

- The Fed cut rates amid internal division: The US Federal Reserve lowered the funds rate by 0.25% in a 9–3 decision, citing labour market uncertainty. However, most non-voting officials favoured an unchanged policy rate as the appropriate year-end target for 2025.

- Balance sheet expansion returned: The Fed announced it would recommence bond purchases, expanding its balance sheet just six weeks after confirming the end of quantitative tightening.

- Currency movements weighed on global returns: Global equities rose in local currency terms, but appreciation in the Australian dollar pushed unhedged global equity and hedge fund returns into negative territory for domestic investors.

- Emerging markets outperformed: Emerging market equities recorded solid gains, supported by technology-heavy Asian markets and select commodity producers.

- Australian equities ended the year on a strong note: The ASX 200 rose 1.3% in December and delivered a third consecutive double-digit annual return, driven by strength in banks, resources and a rebound in domestic listed property.

- Bond markets faced renewed pressure: Global and domestic fixed interest returns were challenged as Japan raised rates, real yields rose and the RBA ruled out further near-term easing, keeping upward pressure on yields.

Market Commentary

Financial markets were mixed in December, with yield-sensitive and long-duration assets falling, while risk assets were mostly higher in local currency terms. A divided US Federal Reserve cut interest rates by 0.25% as expected. The decision was 9-3 in favour of the move due to uncertainty in the jobs market. However, most non-voting Fed officials indicated they didn’t support the reduction, preferring an unchanged funds rate as the appropriate year-end target for 2025. Notably, the Fed also announced that it would recommence bond buying, once again expanding the size of its balance sheet. This came just six weeks after it said it would end quantitative tightening (QT) commencing in December.

Global equities

Global equity markets rallied (for the most part) in December when measured in local currency terms, with the MSCI ACWI ex-Australian index up 0.8%. However, the Australian dollar’s appreciation throughout the month pushed returns for unhedged domestic investors into the red by 0.6%. It was a similar story for global hedge fund performance, where currency movements flipped returns for the asset class into negative territory.

Emerging market equities enjoyed a strong December, rising 2.6% in local currency terms and 1.3% in Australian dollars. Returns were driven by tech-heavy Asian markets (Korea, Taiwan) and select commodity producers (South Africa, Chile).

From a total return perspective, the US S&P 500 rose 0.1% in local currency terms in December. The benchmark S&P 500 index posted three new monthly closing highs during the month, closing above 6,900 for the first time. US mid-caps performed similarly, while small-caps ended the month 0.1% in the red. Meanwhile, the Dow Jones Industrial Average gained 0.9% and the tech-laden Nasdaq lost 0.7% in the final month of 2025. Financials were the strongest sector within the S&P 500, while Utilities sold off on profit-taking.

As an aside, in January, the S&P 500 has historically posted gains 63% of the time. The Dow Jones Industrial Average posted two new closing highs, but fell short of reaching 49,000.

Australian equities

On the domestic front, a differing outlook on the likely interest rate trajectories between Australia and the US led domestic equities to endure a wave of selling in the final week of the year. Even so, the ASX 200 posted its third consecutive double-digit annual return in 2025—up 10.3% for the calendar year.

The ASX 200 outperformed peers, finishing up 1.3% for the month. Returns were driven by strong performances across the resources and banking sectors. Domestic listed property also performed well, as Goodman Group staged a solid rebound, offsetting negative performances by Stockland and Mirvac. Retail property outperformed on hopes of a sustained recovery. The same could not be said for global listed property and infrastructure, which posted heavy falls on rising real yields.

Fixed interest, currencies, commodities and crypto

Performance across fixed interest markets was disappointing in December, despite investor expectations being met for policy changes by the Fed (mentioned above) and the Bank of Japan (where a hike was anticipated). The BoJ is concerned that accommodative financial conditions are adding to inflationary pressures and raised rates by 0.25% to 0.75%, taking them to the highest level since 1995. Furthermore, the promotion of expansionary fiscal policies by Prime Minister Takaichi helped to push the 10yr Japanese Government Bond yield to as high as 2.1%—a level not seen since 1999.

Meanwhile, metals prices continued to impress, with gold, silver and copper reaching all-time highs in December. Finally, the Australian dollar finished the year on a positive note, up 1.9%, while crypto and energy prices declined further.

Economic Commentary

Australia

In domestic economic news, the RBA again held rates at 3.6% and announced that additional cuts are “not needed”. Governor Bullock ruled out any rate reductions in the “foreseeable future”, citing solid private demand. Meanwhile, the November jobs report was headlined by a slump in full-time employment. But with workers dropping out of the labour force, the participation rate also fell, thereby keeping the unemployment rate at 4.3%. The September quarter national accounts revealed that growth had again stalled on a per capita basis, despite a 0.4% expansion in the quarter. Domestic final demand—which excludes exports and inventory changes—roared 1.1% higher. This was driven by household spending and by the build-out of data centres.

United States

As delayed, if not stale, economic data was released in the US (following the reopening of government agencies), markets were warned to expect distortions. US job growth rebounded in November after nonfarm payrolls were depressed in October, suggesting no material deterioration in labour market conditions. Since March 2025, job creation has halved to an average of 35,000 a month, compared to the twelve months prior to March. Fed Chair Jerome Powell has said that he suspects these numbers will be revised even lower.

A week later, the unemployment rate printed at a more than four-year high of 4.6%. However, the annual CPI inflation rate for November came in at 2.7%, well below consensus, and annual core CPI inflation of 2.6% was the lowest since March 2021. No data was collected for October 2025 due to the government shutdown. Initial estimates revealed that the US economy expanded at a 4.3% annualised rate in the third quarter as consumer spending, exports and government spending grew faster than expected. Growth in the quarter relative to the same quarter a year ago was 2.3% higher.

Rest of World

Elsewhere, the European Central Bank left interest rates unchanged at 2% for a fourth straight meeting as inflation hovers around target and the eurozone continues to weather global shocks. In contrast, the Bank of England cut interest rates to take them to the lowest level in almost three years, while suggesting future decisions on policy easing will be a “closer call”.

How can we help?

Pete is the Co-Founder, Principal Adviser and oversees the investment committee for Pekada. He has over 18 years of experience as a financial planner. Based in Melbourne, Pete is on a mission to help everyday Australians achieve financial independence and the lifestyle they dream of. Pete has been featured in Australian Financial Review, Money Magazine, Super Guide, Domain, American Express and Nest Egg. His qualifications include a Masters of Commerce (Financial Planning), SMSF Association SMSF Specialist Advisor™ (SSA) and Certified Investment Management Analyst® (CIMA®).