August 2025 Economic & Market Review – Small Caps Surge, Earnings Shine, and Policy Paths Diverge

Talking points

- Markets climbed even through political drama: Despite weak US labour data, Trump’s firing of the Bureau of Labour Statistics chief, and tariff tensions—equity markets posted strong returns.

- Small caps stole the spotlight: In the US, the S&P 600 surged 6.9% on strong earnings, outpacing large-cap benchmarks. In Australia, the Small Ordinaries index jumped 8.4%.

- Reporting seasons rewarded performance: Investors rewarded companies that delivered strong results and punished those that missed expectations. On the ASX, better-than-expected earnings drove a 3.1% return, with listed property adding 4.5% after RBA rate cuts.

- Earnings growth underpinned global markets: US Q2 earnings grew 10.6%, with sales up 5.1%. Companies have largely absorbed tariff costs so far but warned that higher consumer prices are coming.

- Global policy paths diverged: The Fed faced political pressure to cut rates, while Chair Powell signaled caution at Jackson Hole. The US yield curve steepened, Japan looked set for more hikes, and the RBA cut again.

- Inflation pressures persisted, but varied: US Core PCE rose 2.9%, the fastest since February. Australia’s CPI ticked up to 2.8% on higher electricity costs, while Japan’s core inflation held at 3.4%. India benefited from weaker inflation.

- India’s growth stood out, but risks loom: India’s GDP rose 7.8% in Q2, beating expectations. Trump’s 50% tariffs on Indian imports could cut nearly 1% off annual GDP if prolonged.

Market commentary

Investors again enjoyed strong returns in August despite several negative data surprises throughout the month.

In early August, US non-farm payrolls revealed a slowing labour market, prompting Trump to fire the head of the Bureau of Labour Statistics. Weaker employment data also increased speculation about when interest rate cuts would recommence in the US, even though a sharp slowdown in migration (and hence population growth) was the key driver behind the result.

Growth and inflation reports released later in the month showed that the economy remained solid and that consumer prices were starting to be impacted by higher tariffs. Ongoing pressure from the Trump administration for the Federal Reserve (the Fed) to drastically cut rates was largely interpreted as a threat to the US central bank’s independence. Also of note, a majority ruling by the Court of Appeals upheld a finding that invalidated Trump’s tariffs.

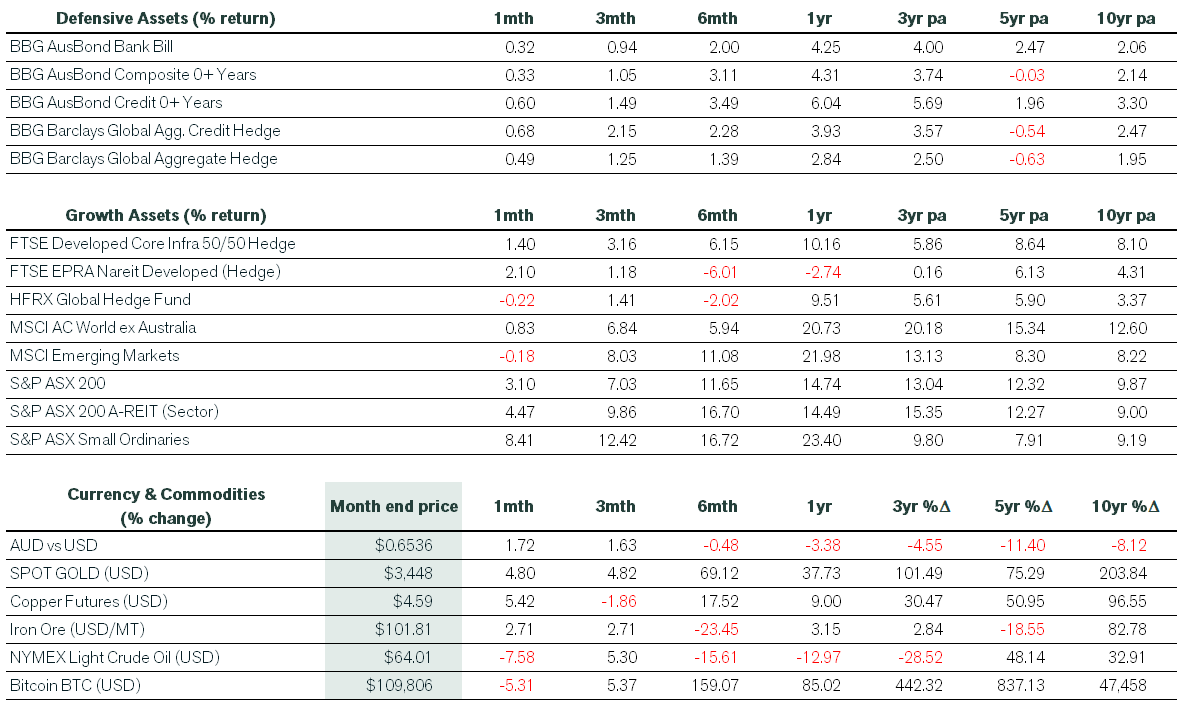

Global equity markets continued to move higher in the month, with the unhedged MSCI ACWI ex-Australian index up 0.8% in Australian dollar terms (+2.0% in local currency as the Australian dollar appreciated against most currency crosses). The stronger Australian dollar also impacted emerging market equities and hedge fund returns, resulting in small losses in August.

An uplift in corporate earnings largely validated the strength of equity market returns globally. In the US, 2nd quarter earnings data revealed annual growth of 10.6%, featuring a 5.1% jump in sales. Corporations have so far absorbed the lion’s share of the tariff costs but gave notice that consumers will need to bear more of the burden via future price increases.

The benchmark US S&P 500 reached five new closing highs in August, gaining 1.9%. Nine of the eleven S&P 500 GICS sectors finished higher in August, led by Materials. Meanwhile, Utilities performed the worst, losing the momentum gained in the recovery that followed the Liberation Day sell-off in early April. Analysts are projecting further earnings growth through to Christmas as household income and spending growth remain solid.

Meanwhile, the Dow Jones Industrial Average also reached a new high during the month, adding 3.2%. The S&P Mid-Cap 400 increased 3.3%, but the best performer was the S&P SmallCap 600, which jumped 6.9% after a strong second quarter earnings season was well received by investors.

The same was true for domestic investors, where a better-than-expected full year reporting season led to another boost to local shares. The ASX 200 enjoyed a 3.1% return, including dividends. Listed property responded to the RBA’s third cut to the cash rate this year, gaining 4.5%. However, the Small Ordinaries posted the best monthly return, adding 8.4% in August. The August financial reporting season was broadly positive, with investors rewarding strong results and heavily punishing stocks that missed expectations or provided disappointing outlooks (e.g., CSL). Ominously, Trump announced that pharmaceutical tariffs were in train (likely to be phased in by the end of 2026), hoping companies would move manufacturing to the US. Domestic gold stocks had a strong month, with the index adding 20% and over 50% this calendar year.

Elsewhere, fixed interest markets were broadly higher, as tighter spreads boosted returns in the credit space. The Australian dollar and commodity prices also had a strong month, but oil prices moved lower on the prospect of higher output.

Finally, US Treasuries ended the month in the black, helped by Fed Chair Jay Powell’s Jackson Hole speech that suggested the balance of economic risks had shifted following downward revisions in the latest jobs report. The US yield curve steepened as rate cut expectations weighed on near-term yields, but investors demanded more compensation for holding longer-dated Treasurys on uncertainty around the inflation outlook.

Economic commentary

Australia

In domestic economic news, the unemployment rate edged down to 4.2% in July, as employment increased by 24,500 over the month. Elsewhere, the Reserve Bank cut the cash rate to 3.6% at its August board meeting, in line with expectations. Governor Michele Bullock at the press conference did not push back on market pricing for another couple of rate cuts this easing cycle.

At the end of August, monthly CPI data revealed that inflation rose to 2.8% in the year to July as electricity costs rose following the end of energy rebates. The spike in power prices arose largely because households in NSW do not receive the Commonwealth energy rebate until August.

United States

US growth accelerated in the June quarter to an annualised rate of 3.3%, following the 0.5% contraction in the previous quarter. A big increase in net exports was largely driven by a collapse in imports, as businesses had increased inventories earlier in the year. Investment and consumer spending were solid, while government spending contracted slightly.

Meanwhile, the Fed’s preferred inflation gauge, Core PCE (ex-food and energy) rose 2.9% over the year to July. This matched expectations and marked the fastest increase since February.

Rest of the world

In Japan, annual headline inflation slowed less than expected in July to 3.1%. A measure of core inflation that strips out fresh food and energy – a focus of the Bank of Japan (BoJ) – remained elevated at 3.4%. The BoJ’s July summary of opinions showed confidence that the economy had risen. This suggested a further rate hike was likely this year, thereby raising Japanese government bond yields.

Finally, India’s June quarter GDP grew 7.8% from the previous year to mark the sharpest growth rate in five quarters and beat market expectations of a 6.6% increase. The result was driven by stronger consumer spending, as weaker inflation improved household purchasing power. Meanwhile, Trump’s 50% tariffs on India (as punishment for buying Russian oil) came into effect in late August. Prolonged 50% tariffs could shave nearly 1% off India’s annual GDP, according to some estimates.

Pete is the Co-Founder, Principal Adviser and oversees the investment committee for Pekada. He has over 18 years of experience as a financial planner. Based in Melbourne, Pete is on a mission to help everyday Australians achieve financial independence and the lifestyle they dream of. Pete has been featured in Australian Financial Review, Money Magazine, Super Guide, Domain, American Express and Nest Egg. His qualifications include a Masters of Commerce (Financial Planning), SMSF Association SMSF Specialist Advisor™ (SSA) and Certified Investment Management Analyst® (CIMA®).