August 2023 Economic & market review - Market turbulence and emerging market challenges

August 2023 Economic & market review – Market turbulence and emerging market challenges

Talking Points:

- Market Volatility in August: August witnessed significant market volatility driven by rising yields and negative developments in China. This turbulence had an impact on investor returns and raised concerns.

- Emerging Markets’ Struggles: Emerging market equities, in particular, faced substantial challenges during the month due to China’s faltering property market and its measured approach to stimulus measures. This highlighted the vulnerability of these markets.

- US Stock Performance: US stock indices, such as the S&P 500, Dow Jones, and Nasdaq Composite, experienced a roller coaster ride in August. They initially declined substantially but partially recovered by the month’s end, signalling market uncertainty.

- Bond Market Headwinds: Global bond indices encountered difficulties as a sell-off resumed, partly triggered by Fitch’s controversial downgrade of the US Government’s credit rating. Additionally, increased bond issuance by the US Treasury added to the selling pressure, impacting bond markets.

- Economic Outlook and Central Bank Actions: The economic outlook highlighted concerns about inflation, particularly in the US, where strong economic data raised the possibility of more rate hikes. The Reserve Bank of Australia (RBA) maintained a cautious stance on its cash rate, indicating its data-dependent approach and the uncertainties in the economic landscape.

Summary:

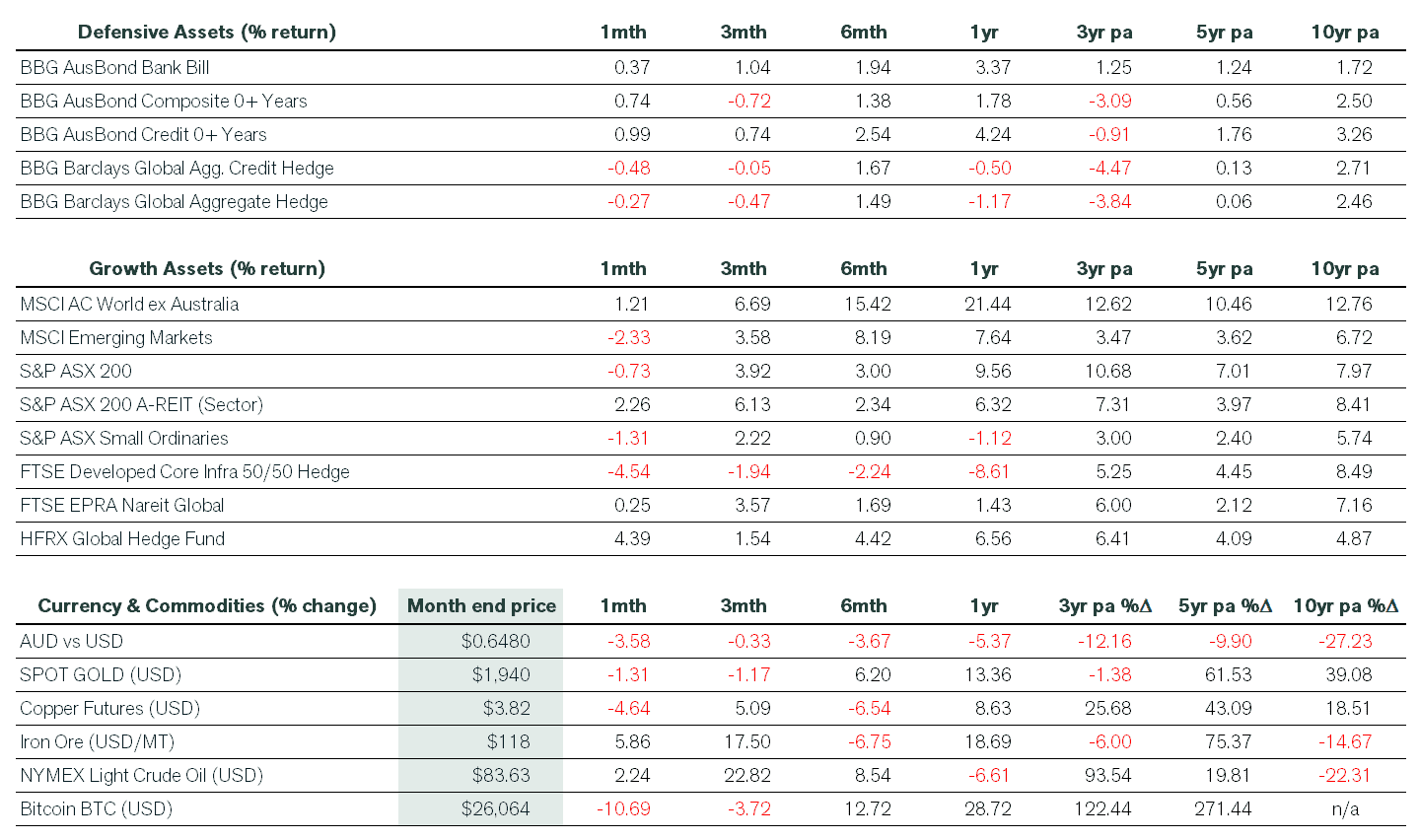

Investors endured a difficult August as a combination of rising yields and negative news flow out of China weighed on returns. Weakness in the Australian dollar also attracted increasing attention but helped insulate unhedged domestic investors from the full brunt of the sell-down.

Developed market equities were generally lower in local currency terms. However, China’s faltering property market and piecemeal approach to stimulus meant that emerging market equities fared far worse. Increased volatility also impacted small caps as investors sought the safety of many blue-chip names.

Despite a market rally at the end of August, the benchmark US S&P 500 index closed the month 1.8% lower, while the Dow Jones and Nasdaq Composite were more than 2% lower. The S&P ASX 200 finished August in the red but was well off its lows. However, Australia’s listed property sector staged a strong rebound in the latter half of the month as corporate earnings and asset valuation downgrades came in better than many had expected.

Global bond indices struggled as a sell-off recommenced following Fitch’s controversial downgrade to the US Government’s credit rating from AAA to AA+. Strong bond issuance by the US treasury added to the selling pressure as the Biden administration continued its hefty spending program. Domestic bond markets recovered throughout the month, but this was due to signs that the economy was weakening.

Market Commentary

August was a difficult month for global stocks, with the MSCI All Country World ex-Australia Index moving lower in local currency terms. However, the 3.6% decline in the Australian dollar ultimately delivered positive returns to domestic investors with no (or minimal) currency hedging. The first three weeks of the month were particularly brutal for sharemarkets, with the S&P 500 down more than 3% before a partial recovery in the final week. It was a similar story for the Dow Jones Industrial Average and the Nasdaq Composite, with the latter more than 5% lower before the late upswing. These pullbacks are in stark contrast to the market rally seen earlier this year, as the Nasdaq Composite delivered its best first-half performance in forty years.

On domestic markets, disappointing China data and numerous earnings downgrades announced during the August reporting season led to widespread weakness. On a brighter note, the consumer discretionary sector bucked the trend, as retailers often printed much stronger-than-expected profits. Over the first eight months of the year, most sectors remain in the green, with Technology leading the way. Gold has also been a strong performer, but small resources stay firmly in the red.

In fixed interest markets, the sell-off in US Treasurys saw 10-year bond yields briefly exceed 4.36% (its highest level since 2007) before ending August at 4.11%. The yield curve remains inverted across large segments, with 2-year Treasury Notes briefly exceeding 5.10% and ended the month at 4.86%. The key driver behind these moves was US economic data strength, leading to concerns that the Federal Reserve (the Fed) would keep its benchmark lending rates higher for longer than anticipated.

Economic Commentary

Despite weakening inflation data in the US, Fed Minutes from the July meeting noted that central bank officials still see “upside risks” to inflation, which could lead to more rate hikes. Specifically, the Fed expressed concern about the tight labour market and the impact solid wage growth could have on spending. July retail sales were robust (almost double expectations), and a measure of personal spending also printed stronger than expected. And despite 30-year mortgage rates exceeding 7%, US house prices continued to rise due to severely constrained supply. Many Americans have previously borrowed at ultra-low fixed rates and prefer to retain and renovate their homes rather than purchase another home and incur much higher financing costs.

On the domestic front, the RBA again paused the official cash rate in August, with the economy breathing a further sigh of relief. The RBA’s cash rate is now 4.10%. The base case is that they raise rates once more, but the RBA is highly data-dependent and taking small steps to the edge as they can’t quite see where they are yet.

NAB business confidence improved to its highest level since January, as leading indicators strengthened slightly. There was more positive news in late August when the monthly CPI indicator increased by 4.9% in the year to July 2023, below the market consensus of a 5.2% rise. This was the lowest inflation rate since February 2022, mainly due to a slowdown in housing costs and food prices. However, investor attention in August was laser-focused on China, which reported much weaker-than-expected retail sales and industrial production growth. Concerns over another real estate crisis continued to rise as the heavily indebted Country Garden Holdings fell to a record low and was removed from the Hang Seng stock index in Hong Kong. Meanwhile, Evergrande (another Chinese real estate giant) filed for bankruptcy protection in the US.

We now focus on the path for 2024 and the likely easing cycle. We estimate this commences in mid-2024, but there are myriad speedbumps along the way.

How can we help

Our experienced financial planners provide tailored investment strategies and guidance to suit your unique needs and financial goals. If you’re seeking expert investment advice, book a chat with a Pekada financial planner today.

Pete is the Co-Founder, Principal Adviser and oversees the investment committee for Pekada. He has over 18 years of experience as a financial planner. Based in Melbourne, Pete is on a mission to help everyday Australians achieve financial independence and the lifestyle they dream of. Pete has been featured in Australian Financial Review, Money Magazine, Super Guide, Domain, American Express and Nest Egg. His qualifications include a Masters of Commerce (Financial Planning), SMSF Association SMSF Specialist Advisor™ (SSA) and Certified Investment Management Analyst® (CIMA®).