April 2025 Economic & Market Review – Tariff Turmoil, Rate Cut Talk, and Growth Worries

Talking points

- Tariffs Go Up, Markets Get Jittery: When tariffs rise fast, confidence drops faster. Trump’s “Liberation Day” tariffs rewrote the trade script and kicked off a wave of uncertainty. The market’s reaction showed how quickly a single policy shift can ripple through the global system. Investors scrambled for safety while uncertainty took the spotlight.

- Temporary Calm, Then More Chaos: Just a week after announcing broad tariffs, most were paused—except those on China, which hit a staggering 145%. Markets tried to recover, but the whiplash was real. The only clear message—nothing is clear.

- Stocks Stumble, Then Steady: Markets fell hard early in the month. The S&P 500 flirted with bear territory before bouncing. Gold was the safe bet, while falling bond yields hinted the Fed might step in with rate cuts soon.

- Australia Finds Its Footing: While US markets struggled, Australian shares quietly ended the month strong. Big investors saw Aussie stocks as a safe haven. Tech, telcos, and REITs led the way as talk of lower rates helped boost optimism.

- Growth Over Value (Again): In the US, growth stocks beat value stocks—mostly because energy names had a rough ride. Companies lowered guidance left and right. Uncertainty wasn’t just a headline; it hit earnings calls too.

- Inflation’s Cooling, But Not Everywhere: In the US, core inflation slowed to its lowest pace in nine months. Australia’s inflation also dipped under 3%—a first in over three years. Lower price growth gave central banks more breathing room.

- Central Banks Are Tapping the Brakes: The European Central Bank cut rates, and Australia’s RBA hinted it may follow after the next election. Markets are betting on a series of cuts in both the US and Australia in 2025. The message is that slower growth is the bigger concern now.

Market commentary

It was an extraordinary start to April, with Trump formally announcing reciprocal tariffs in what he declared “Liberation Day” for US trade policy. Trump set a base 10% tariff on all US imports. Canada and Mexico were exempt from the 10%, but were subject to a 25% tariff on goods not covered by their existing free trade agreement. Higher rates were announced for a host of countries based on a combination of their tariffs, consumption taxes, government support and trade surpluses with the US.

A tit-for-tat escalation of tariffs proceeded to take place between the US and China. Trump then announced that he had suspended the reciprocal tariffs for most countries for 90 days, to allow for a period of ‘negotiation’. However, the tariffs on China were subsequently increased to a total of 145%.

The period between the 2nd and 9th of April (between Liberation Day and the announcement of a suspension) was tumultuous. Financial markets found few havens outside of gold, with Trump finally yielding to pressure from the bond market, where the long-term cost of debt was escalating. A relief rally was then followed by a steady rise in equities and decline in bond yields, with traders increasing expectations that the US Federal Reserve (the Fed) would recommence its rate-cutting cycle.

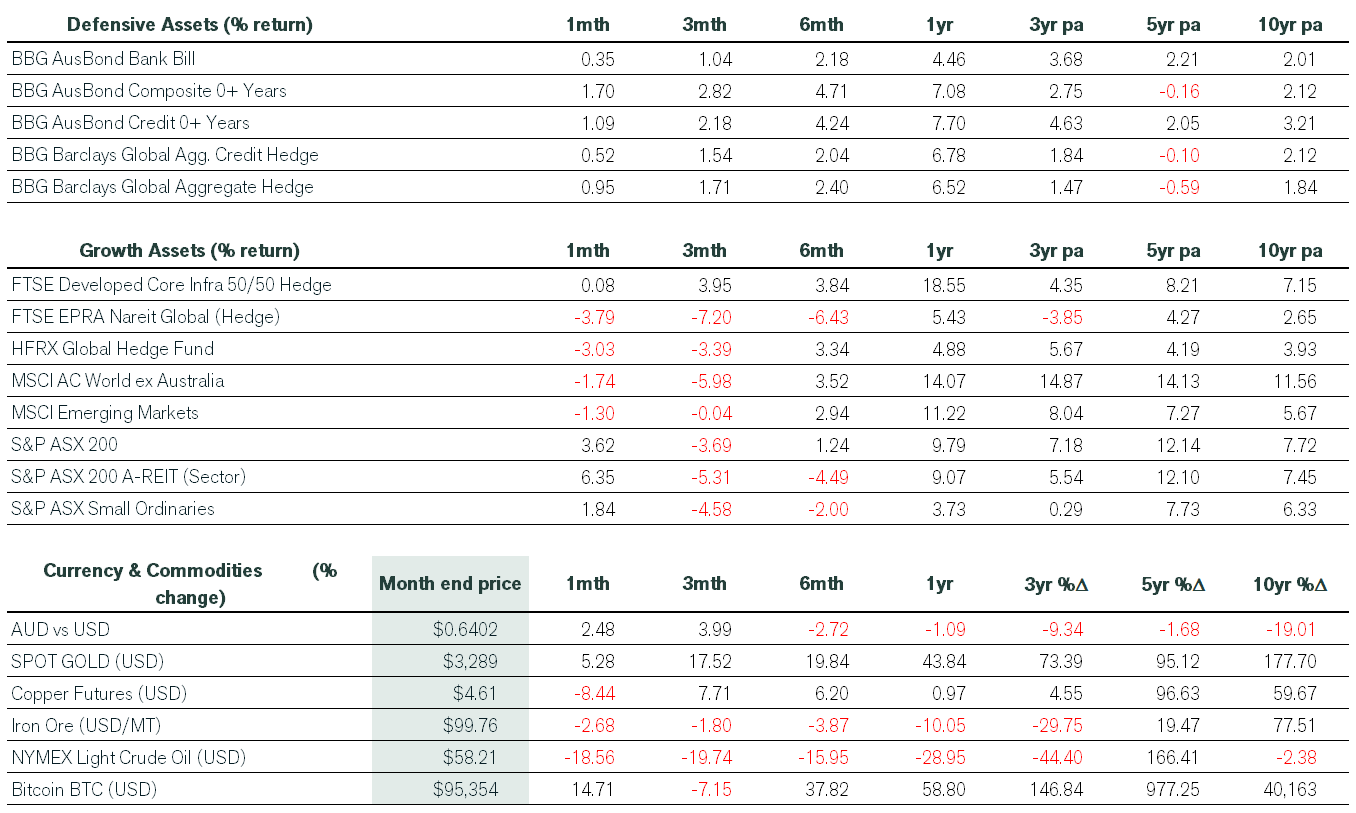

The MSCI ACWI ex-Australia index delivered a total return of -1.7% to unhedged domestic investors in April, as a 2.5% appreciation in the Australian dollar weighed on global equity returns.

The S&P 500 declined for a third consecutive month, down 0.8% as stunning tariff policy announcements added to market volatility. The S&P 500 briefly entered bear territory (-20%) on an intraday basis on April 7th after reaching an all-time high on February 19th. The S&P MidCap 400 decreased 2.3% in April, while the S&P SmallCap 600 lost 4.3%. Meanwhile, the Dow Jones Industrial Average declined 3.2% in April. Finally, the Nasdaq 100 gained 1.5% for the month, while the broader Nasdaq Composite index improved 0.9%.

Throughout April, the dramatic changes to trade policy led to several companies lowering or withdrawing guidance due to elevated uncertainty. Overall, US markets underperformed global peers. Growth stocks outperformed their value counterparts, mainly due to a slump in energy stocks.

Emerging markets performed in line with the broader global MCSI index, as Mexico and Brazil delivered positive returns.

ASX shares ultimately finished strongly in April, with the XJO price index trading in a 13.3% range during the month. There were strong performances across most sectors, with energy and resources being key exceptions. Some investors viewed the domestic market as being relatively shielded from changes in US trade policy, with big pension funds said to be seeking the safety of Australian blue chips. In terms of sectors, Telcos, Info Tech and A-REITs were the best performers, buoyed by falling yields and from rising market expectations that interest rate cuts were in the offing. The Gold sub-sector also posted another strong month, thanks to the uncertain environment.

Fixed interest markets also experienced higher-than-average volatility during the month. Investor fears of stagflation ultimately gave way to a greater focus on the likelihood of recession. The potential for a growth slowdown saw Fed funds rate traders positioning for four rate cuts in 2025 and a fifth cut early in the new year, with a similar outlook for Australian interest rates. Credit spreads moved in line with changes in sentiment throughout April, with higher quality credit markets remaining resilient.

Finally, commodity prices weakened late in the month, with oil prices slumping amid rising recession fears and a decision from OPEC+ members to increase output. Copper prices also finished lower. The gold price marked a new all-time high, exceeding US$3,500 on April 22nd.

Economic commentary

Australia

In domestic economic news, another strong jobs report kept the unemployment rate at 4.1% in March. At the beginning of the month, the RBA held the cash rate at 4.1%, just before the Trump announcement on reciprocal tariffs that disappointed markets. Minutes from the RBA’s April board meeting released later in the month revealed the board was open to cutting interest rates after the federal election, once it had the latest information on inflation and trade policy. Indeed, March quarter CPI data revealed that the RBA’s preferred measure of underlying inflation dipped below 3% for the first time in more than three years.

United States

On the economic front, the US posted a stronger-than-expected jobs report for March, but the unemployment rate ticked up to 4.2% on increased workforce participation. Workers’ average hourly earnings rose by 3.8% over the year, a bit lower than the 4% forecast and nearing the 3.5% gains seen as consistent with the Fed’s 2% inflation target. Elsewhere, underlying US inflation cooled broadly in March, indicating some relief for consumers before widespread tariffs that risk contributing to price pressures. The core CPI, which excludes food and energy, increased by the least in nine months to be up by 2.8% over the year. The overall CPI posted a small decline from a month earlier, the first decrease in nearly five years, and rose 2.4% over the year.

In early April, during a sharp sell-off in financial markets, Fed Chairman Jerome Powell noted, “While uncertainty remains elevated, it is now becoming clear that the tariff increases will be significantly larger than expected. The same is likely to be true of the economic effects, which will include higher inflation and slower growth.”

Rest of the world

Elsewhere, on the Continent, the European Central Bank cut interest rates by 0.25%, bringing the deposit rate to 2.25%. The monetary policy statement viewed the disinflationary process as “well on track” and noted that the “outlook for growth has deteriorated owing to rising trade tensions.” Finally, increasing confidence about the prospect of lower interest rates provided support for European government bond markets throughout April.

Want to chat about your personal investment strategy or have some questions?

If you want to discuss any of the above information or your personal investment strategy, then book a chat with your financial adviser here.

Pete is the Co-Founder, Principal Adviser and oversees the investment committee for Pekada. He has over 18 years of experience as a financial planner. Based in Melbourne, Pete is on a mission to help everyday Australians achieve financial independence and the lifestyle they dream of. Pete has been featured in Australian Financial Review, Money Magazine, Super Guide, Domain, American Express and Nest Egg. His qualifications include a Masters of Commerce (Financial Planning), SMSF Association SMSF Specialist Advisor™ (SSA) and Certified Investment Management Analyst® (CIMA®).