April 2023 Economic & market review - Markets rebound in April with positive returns across major asset classes

April 2023 Economic & market review – Markets rebound in April with positive returns across major asset classes

Talking points

- Markets rebounded in April as volatility faded and all major asset classes delivered positive returns.

- First-quarter earnings in the US were strong, with 80% of S&P 500 companies beating lowered analyst expectations.

- Falling risk-free rates helped lagging sectors such as listed property and small caps lead the way higher on the ASX 200.

- The RBA held the cash rate at 3.6% but suggested that “some further tightening of monetary policy may well be needed to ensure that inflation returns to target.”

- Inflation remained a concern in the US, with the Fed’s preferred gauge and employment costs increasing in the March quarter.

Summary

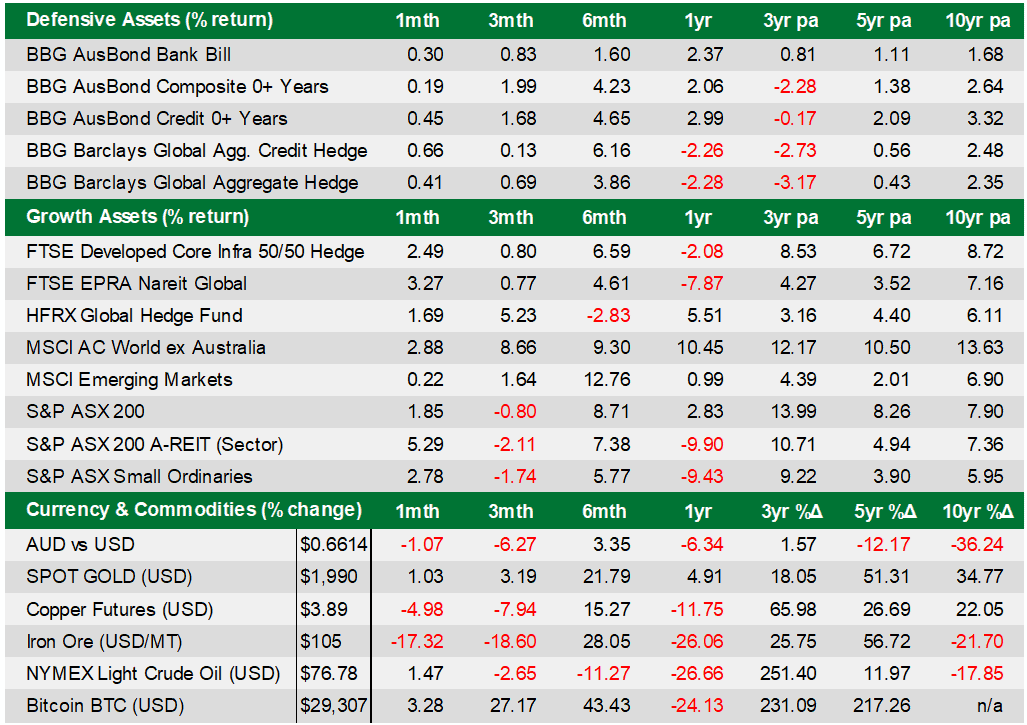

Markets quickly put the regional banking crisis behind them in April, with volatility fading into the background and all major asset classes delivering positive returns in Australian dollar terms. Indeed, the Reserve Banks’ decision not to raise the cash rate in April contributed to further weakness in the domestic currency, thereby boosting unhedged global returns in the hands of Australian investors. Only the MSCI Emerging Markets index finished lower in local currency terms.

The US benchmark S&P 500 closed 1.5% higher, the Dow rose 2.5%, while the Nasdaq ended only marginally higher following its stellar performance in March. There was a strong focus on first quarter (Q1) earnings in the US, where just over half of S&P 500 companies had reported by month’s end. Of those companies, 80% beat analyst expectations, which had been sharply lowered in recent months.

Local shares also enjoyed smoother market conditions in April as falling risk-free rates helped lagging sectors such as listed property and small caps, which lead the way higher. The ASX 200 posted a total return of 1.9%, despite the resources sector finishing in the red on sinking bulk commodity prices. For example, iron ore prices have fallen 10% year-to-date. Against this backdrop, gold stocks added 7.5%, while the tech sector gained 4.8%. Elsewhere, fixed interest continued to recover some of its longer-term losses. Finally, Bitcoin’s 2023 rally moved to a lower trajectory, but its year-to-date return exceeded 76%.

Market Commentary

The US regional banking crisis took a back seat throughout much of April as investors focused on company earnings, economic data and comments from Federal Reserve (Fed) officials. Shares extended a bear market rally that began in October as signs of an impending recession remained elusive beyond the inverted US yield curve. Global value-style stocks outperformed higher-growth counterparts in April. This followed a six-month period of dominance by growth stocks, helped by an easing in financial conditions.

Domestic shares were also stronger, with A-REITs rebounding on lower risk-free rates. In traditional fixed interest, falling yields meant US Treasurys outperformed other sovereign bonds, though positive returns were posted across developed markets.

In the quarterly earnings season, over half of S&P 500 companies reported Q1 results in April, with 80% beating expectations. Nevertheless, analysts savaged earnings estimates at the end of 2022 and continued to lower the bar throughout the start of this year. As a result, Q1 earnings were projected to decline by more than 6.5% at the end of March. However, economic resilience in 2023 has cushioned the blow, and by 30 April earnings were on track for a much smaller quarterly decline. Strong performances among the large banks and mega tech stocks were behind the improvement.

In relation to the banking crisis, the Fed blamed the collapse of Silicon Valley Bank on poor management, watered-down regulations and lax internal oversight. The Fed called for stricter policing on multiple fronts to prevent future bank failures. The beleaguered First Republic Bank traded in a narrow range for much of the month before taking a significant leg down during the final trading week. By 30 April, the stock had lost more than 97% of its value since the start of the year (and failed in early May, with JPMorgan Chase & Co. absorbing the remains).

Economic Commentary

On the domestic front, mortgage holders breathed a sigh of relief in April as the RBA held the cash rate at 3.6%. Its decision to pause official interest rates followed 350 basis points (3.5%) of increases since May last year. The accompanying statement suggested it wanted to take more time to examine the lagged economic impact of monetary policy. It stated that “some further tightening of monetary policy may well be needed to ensure that inflation returns to target.”

Elsewhere, labour market data for March again printed stronger than consensus, providing further evidence that conditions remained tight. Meanwhile, the March quarter CPI revealed that annual headline inflation had cooled to 7% from 7.8% in 2022. The underlying CPI measures also slowed, with the impetus in goods prices fading as supply constraints continued to resolve. However, services inflation was still running hot as domestic demand conditions remained strong.

In the US, the Fed’s preferred inflation gauge remained 4.6% higher over the year to March. Core PCE, which excludes food and energy costs, has been slow to fall. Furthermore, the Labor Department’s measure of employment costs — also closely watched by the Fed — increased 1.2% in the March quarter, exceeding forecasts. Markets are positioned for a final increase to the Funds Rate at the upcoming Fed meeting in early May but continue to expect rate cuts in the second half of 2023.

Finally, in Europe, the ECB is also expected to hike rates at its upcoming policy meeting.

For further information or expert investment advice, reach out to a Pekada financial planner today.

Pete is the Co-Founder, Principal Adviser and oversees the investment committee for Pekada. He has over 18 years of experience as a financial planner. Based in Melbourne, Pete is on a mission to help everyday Australians achieve financial independence and the lifestyle they dream of. Pete has been featured in Australian Financial Review, Money Magazine, Super Guide, Domain, American Express and Nest Egg. His qualifications include a Masters of Commerce (Financial Planning), SMSF Association SMSF Specialist Advisor™ (SSA) and Certified Investment Management Analyst® (CIMA®).