2023-24 Federal Budget summary

2023-24 Federal Budget summary

In what is always an exciting night to settle down in front of the TV, Treasurer Jim Chalmers handed down the 2023-24 Federal Budget and we have summarised what we feel are the key measures announced from a financial planning point of view.

For our ongoing service package clients, your adviser will be in contact to provide guidance on changes which may impact your strategy.

Cost of living measures

Relief on power bills

The government has put forward a comprehensive $14.6 billion relief package to ease the cost of living. This includes $3 billion to help with the cost of energy, which will be provided in the form of credits of up to $500 and offered to approximately 5 million eligible households and targeted to pensioners, Commonwealth Seniors Health Card holders, and family tax benefit recipients.

Super changes

Minimum pension payments set to revert

The minimum amount that was required to be paid to a member from their pension was halved in 2019-20. This was legislated to revert to the full amount from 1 July 2023. There was no announcement of an extension to the reduced minimum in the Budget, so the amount is likely to revert to 100 per cent of the standard minimum from 1 July 2023 unless an extension is announced. This means the payments you receive from your pension may need to increase from 1 July this year.

Increase to Transfer Balance Cap

In February 2023, it was announced the Transfer Balance Cap would increase by $200,000 to $1.9 million on 1 July this year due to indexation. This is the amount you can transfer from super to start a tax-free super pension, such as an account-based pension. Although there has been some speculation as to whether this would remain at its current level, the fact that it wasn’t announced in the Budget suggests it will increase as expected.

Pay day super

From 1 July 2026, employers will be required to pay super at the same time they pay salary and wages. Many employers have already adopted this approach even though, currently, super is only required to be paid quarterly.

Additional funding will also be provided to the ATO in 2023-24 to improve its ability to identify and act on any cases of Super Guarantee underpayment by employers.

$3 million super cap

As recently proposed, the government reinforced its plan to increase the tax on earnings on super balances over $3 million by 15%. The tax would only be payable on earnings over this threshold.

The additional 15% will apply regardless of whether they are in the accumulation phase of super or have retired and commenced a super pension.

Personal taxation

‘Stage 3’ tax cuts

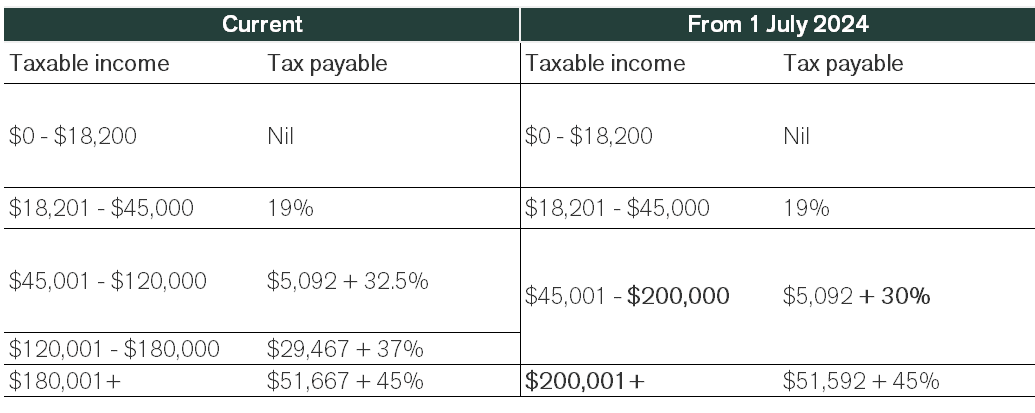

There were no new announcements regarding stage 3 tax cuts which remain legislated to take effect 1 July 2024.

As a reminder, the stage 3 tax cuts will change the income tax rates and thresholds (for resident taxpayers) as follows:

Medicare levy low-income thresholds

The Medicare levy low-income thresholds for singles, families and seniors and pensioners

will be increased from 1 July 2022.

- The threshold for singles will be increased from $23,365 to $24,276.

- The family threshold will be increased from $39,402 to $40,939.

- For single seniors and pensioners, the threshold will be increased from $36,925 to

$38,365. - The family threshold for seniors and pensioners will be increased from $51,401 to

$53,406. - For each dependent child or student, the family income thresholds will increase by a

further $3,760 instead of the previous amount of $3,619.

How can we help?

If you have any questions or would like further clarification in regards to any of the above measures outlined in the 2023-24 Federal Budget, please feel free to book a chat with your adviser.

Until next time.

—Pete

Pete is the Co-Founder, Principal Adviser and oversees the investment committee for Pekada. He has over 18 years of experience as a financial planner. Based in Melbourne, Pete is on a mission to help everyday Australians achieve financial independence and the lifestyle they dream of. Pete has been featured in Australian Financial Review, Money Magazine, Super Guide, Domain, American Express and Nest Egg. His qualifications include a Masters of Commerce (Financial Planning), SMSF Association SMSF Specialist Advisor™ (SSA) and Certified Investment Management Analyst® (CIMA®).