Financial Planning Services

At Pekada our financial planning solutions provide the clarity, confidence and resources you need to live a rich life that is free of financial stress and ensure you feel money confident.

Our Expertise

If taking full control over your superannuation and retirement plans is important to you then a self managed superannuation fund gives you the flexibility to manage your retirement savings the way you want.

Find out more about our self-managed super fund (SMSF) services.

We take a tailored approach to constructing your portfolio based on your needs and preferences so that you have a portfolio that reflects you and delivers what you need.

Find out more about our investment management services.

Once you are no longer working you will need an ongoing income so that you can maintain your lifestyle in retirement

Find out more about our retirement planning services.

Often referred to as your “nest egg” your superannuation is an important piece of your lifestyle flexibility and retirement puzzle.

Find out more about our superannuation services.

Your income is the foundation upon which your lifestyle and financial goals are built. It’s important to identify, quantify, and track all your income and expenses.

Find out more about our cashflow and budgeting services.

We understand that while talking about ‘worst case’ scenarios might not be the most exciting topic of conversation, it is a vital part of a sound plan.

Find out more about our insurance advice services.

Leverage is about boosting potential returns. Borrowing to invest or gearing provides a tax effective solution to increase the scale of investments for growth minded investors.

Find out more about our gearing strategies.

We assist our clients to build, preserve and ultimately pass on their wealth to the next generation.

Find out more about our estate planning services.

Our financial planning process

Real financial planning is about more than just your money. Real financial planning is about aligning your use of capital (time, money, energy, and attention) with what is truly important to you.

Our financial advice process is designed to deliver you financial independence and success. This isn’t transactional. We are not here to sell you some product and move on. It’s a relationship.

The first step in our financial planning process is to define the purpose of financial planning for you. Just as no two people are the same, no two financial planning strategies are (or should be) the same. We like to think of this as understanding your Why. Being clear on this is the foundation of real financial planning and ensures we are on the same page with your current reality, what is important to you and your goals.

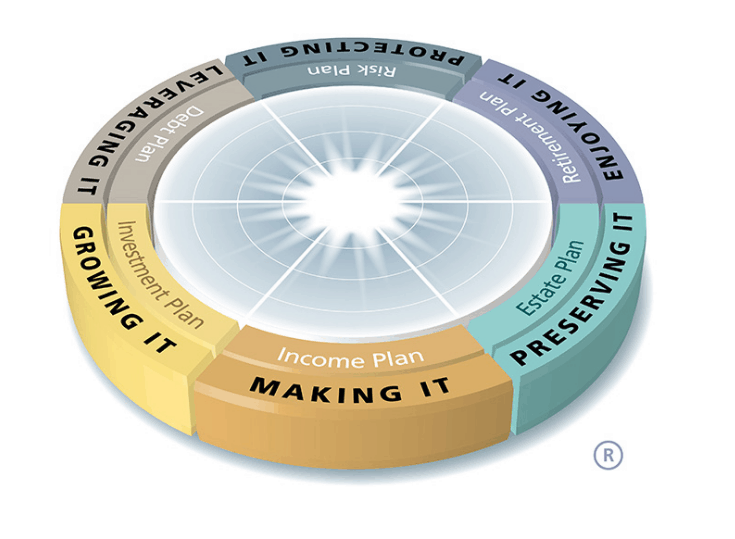

Once the foundations are in place, you are guided through our proven process that brings together your goals and purpose with our technical expertise in areas such as:

- making it (income plan),

- growing it (investment plan),

- leveraging it (debt plan),

- protecting it (risk plan),

- enjoying it (retirement plan), and

- preserving it (estate plan).

And don’t worry that you will then have to be a financial expert to manage everything yourself going forward. Financial planning is not a one-time event, and we know that the most significant value of financial planning comes from the ongoing and iterative process of planning. You will have the ongoing support and relationship from our advice team that knows you personally.

Our fees

In this meeting, we will:

- Determine any burning issues

- Define what success looks like

- Uncover the values that drive you in life

- Set initial financial goals aligned to your values to start living your best life

We charge a flat fee for our Goals and Values Session of $440.

This covers the cost of researching, preparing and implementing your financial plan (Statement of Advice) and is based on a set dollar amount ranging from $4,400 – $9,900 for couples and $3,300 – $7,425 for singles.

This will vary depending upon the scope and complexity of the advice. Should your circumstances be particularly unique or complex, our fees may vary from this range.

The fee for this service varies and is dependent on the level of support you require and the complexity of your personal situation. We are happy to discuss this aspect of our service with you during the advice process.

We have a tiered structure for our fees which are based on a combination of the scope of your advice strategy and the investment funds under our advice. It may be charged as a set dollar amount (starting from $5,500pa) or a percentage of your investments (up to 1.1%).

Financial Planning Resources

-

MoneySmart superannuation calculator

This calculator helps you work out how much super you’ll have when you retire and how fees affect your final payout.Read more -

Simple tax calculator

This calculator will help you to calculate the tax you owe on your taxable income for the previous five income years.Read more -

Retirement drawdown calculator

This calculator will help you to get an idea of how long your portfolio will last after you retire. Obviously the outcome will depend on the actual returns theRead more -

MoneySmart budget calculator

This budget template enables you to work out where your money is going, create your own custom items and save your results online.Read more